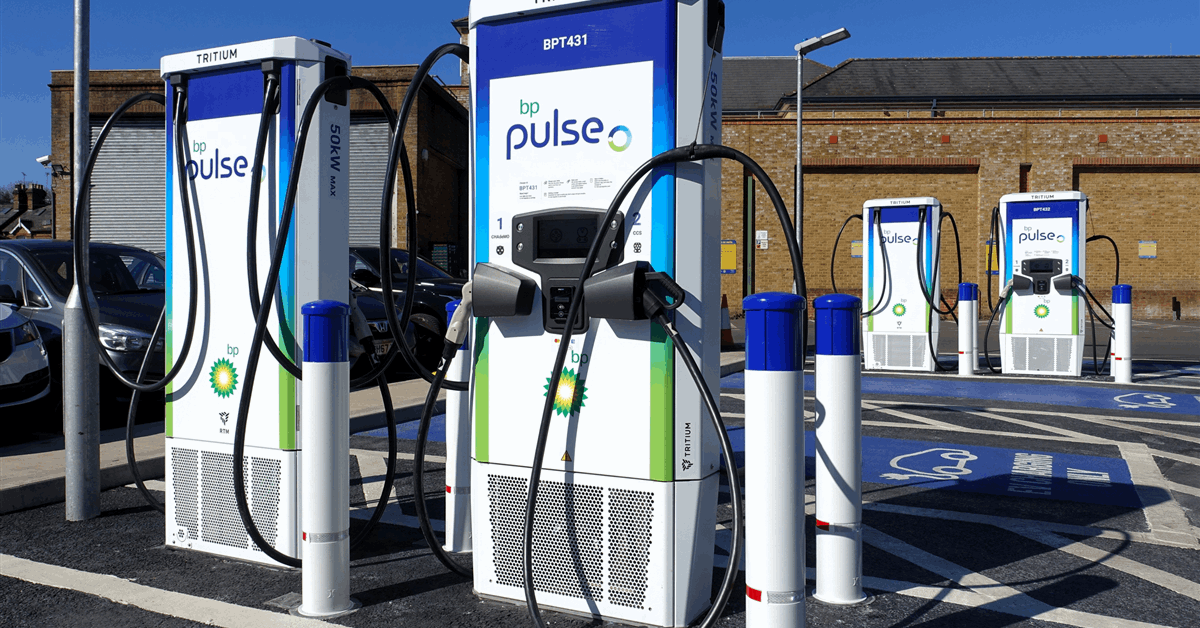

BP PLC said Wednesday it had signed a deal to divest its convenience, mobility and BP Pulse businesses in the Netherlands to local fuels distributor Catom BV.

“The transaction includes around 300 bp-owned or branded retail sites – some with on-site EV charging infrastructure – as well as 15 operational bp pulse EV charging hubs, eight under development and the associated Dutch fleet business”, a joint statement said. BP Pulse is BP’s multinational electric vehicle charging business.

The parties did not disclose the price of the transaction, expected to be completed by year-end subject to regulatory approvals.

The assets will grow Catom’s retail network to over 400 sites across the Netherlands. Catom sells conventional and renewable fuels and lubricants under the OK brand.

“With this acquisition, we’re on our way to becoming the number one brand in our industry in the Netherlands”, commented Catom chief executive Jan Willem Westerhuis.

“Catom was ultimately selected as the successful bidder as they presented the best overall offer, including future plans for the business and protection of terms and conditions of employees”, the statement said.

Emma Delaney, BP executive vice president for customers and products, said, “We have built a high-quality retail and convenience business in the Netherlands but as we look to focus our downstream as part of a reset bp, we believe a new owner is best placed to take our Dutch business forward”.

BP expects to sell $3-4 billion worth of assets this year, including $1.5 billion signed or completed in the first quarter.

“Further progress on divestment proceeds will be provided as part of 2Q25 results”, Wednesday’s announcement said.

Under a “reset” plan announced February, which involves scaling down renewables investment and cutting costs, BP targets $20 billion in divestment proceeds by 2027, including from solar developer Lightsource BP Renewable Energy Investments Ltd.

Separately at the time, BP said it was considering “all options” for its global lubricants brand Castrol.

Earlier in February it announced a marketing process for the potential sale of Ruhr Oel GmbH-BP Gelsenkirchen (ROG), which operates in Germany and the Netherlands. Sale completion is targeted 2025.

ROG’s German presence includes two plants in Horst and Scholven in Gelsenkirchen that form a refining and petrochemical site. The refinery can process up to about 12 million metric tons of petroleum a year.

ROG also owns the Bottrop tank farm, DHC Solvent Chemie GmbH and Nord-West Oelleitung GmbH, which operates pipelines, crude tanks, tank farms and unloading points.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR