Extreme Networks: AI management over AI hardware

Extreme deliberately prioritizes AI-powered network management over building specialized hyperscale AI infrastructure, a pragmatic positioning for a vendor targeting enterprise and mid-market.Named a Leader in IDC MarketScape: Worldwide Enterprise Wireless LAN 2025 (October 2025) for AI-powered automation, flexible deployment options and expertise in high-density environments. The company specializes in challenging wireless environments including stadiums, airports and historic venues (Fenway Park, Lambeau Field, Dubai World Trade Center, Liverpool FC’s Anfield Stadium).

Key AI networking hardware

8730 Switch: 32×400GbE QSFP-DD fixed configuration delivering 12.8 Tbps throughput in 2RU for IP fabric spine/leaf designs. Designed for AI and HPC workloads with low latency, robust traffic management and power efficiency. Runs Extreme ONE OS (microservices architecture). Supports integrated application hosting with dedicated CPU for VM-based apps. Available Q3 2025.

7830 Switch: High-density 100G/400G fixed-modular core switch delivering 32×100Gb QSFP28 + 8×400Gb QSFP-DD ports with two VIM expansion slots. VIM modules enable up to 64×100Gb or 24×400Gb total capacity with 12.8 Tbps throughput in 2RU. Powered by Fabric Engine OS. Announced May 2025, available Q3 2025.

Wi-Fi 7 access points: AP4020 (indoor) and AP4060 (outdoor with external antenna support, GA September 2025) completing premium Wi-Fi 7 portfolio.

Extreme Platform ONE:Generally available Q3 2025 with 265+ customers. Integrates conversational, multimodal and agentic AI with three agents (AI Expert, AI Canvas, Service AI Agent) cutting resolution times 98%. Includes embedded Universal ZTNA and two-tier simplified licensing.

ExtremeCloud IQ: Cloud-based network management integrating wireless, wired and SD-WAN with AI/ML capabilities and digital twin support for testing configurations before deployment.

Extreme Fabric: Native SPB-based Layer 2 fabric with sub-second convergence, automated macro and micro-segmentation and free licensing (no controllers required). Multi-area fabric architecture solves traditional SPB scaling limitations.

Analyst Rankings: Market leadership in AI networking

Foundry

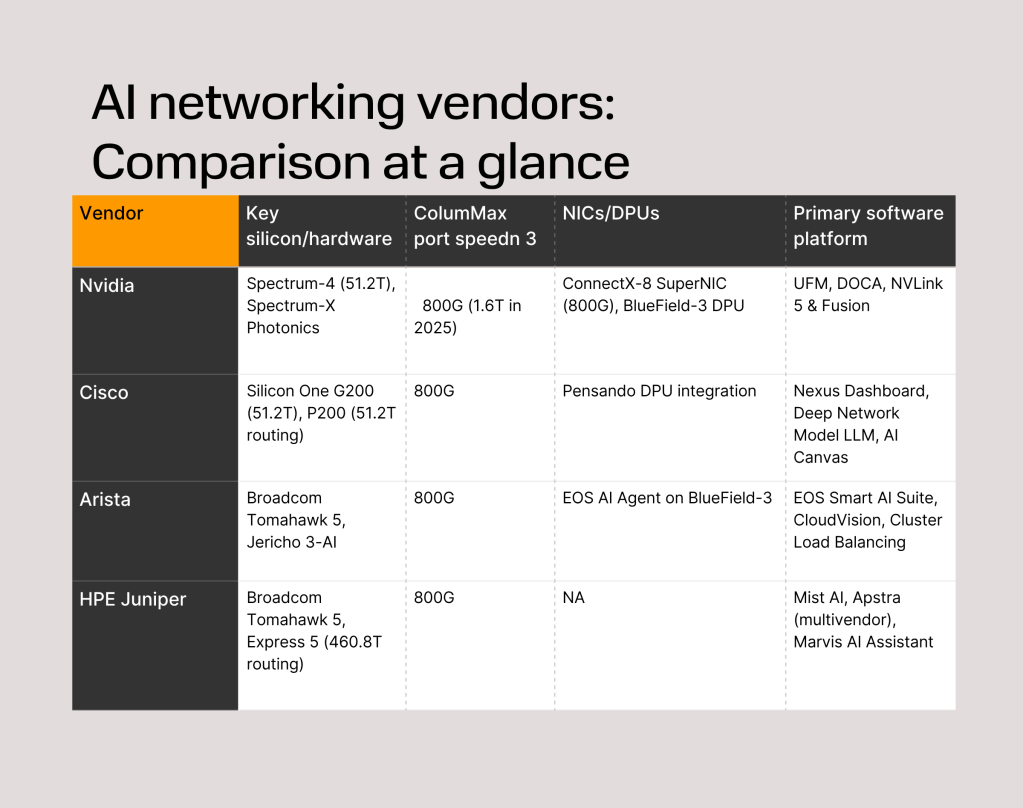

Each of the vendors has its own strengths and weaknesses. Analyst reports on the market don’t necessarily show a clear winner but rather a diverse market where enterprises have multiple options.

In theGartner Data Center Switching Reports (March-April 2025): Magic Quadrant, Cisco, Juniper and Arista Networks occupy the Leaders quadrant, withArista showing the highest “ability to execute.” HPE ranks as a Challenger alongside Nvidia andExtreme Networks in the Niche Players quadrant.Juniper scored highest in Enterprise Data Center Network Build-out, second highest in AI Ethernet Fabric Build-out and second highest in SONiC-Based Data Center Network Build-out use cases.

According to IDC Datacenter Ethernet Market Share (Q2 2025),Nvidia surpassed both Arista and Cisco in the datacenter segment with 25.9% share ($2.3B), up 647% YoY. Arista holds 18.9% share ($1.83B), while Cisco maintains 27.3% of the total Ethernet market.This marks a dramatic shift from Q1 2025 when Arista led at 21.3% ($1.48B) and Nvidia trailed at 21.1% ($1.46B), demonstrating Nvidia’s Spectrum-X momentum in AI workloads.

While traditional leaders (Cisco, Arista, Juniper) maintain strong positions in enterprise data centers, the AI-specific networking market shows Nvidia rapidly gaining ground through vertical integration and Spectrum-X adoption. The 2025 competitive landscape is fragmenting as organizations hedge bets across multiple vendors for both compute and networking.