Alberta, Canada’s top oil-producing province, is projecting its first budget deficit after four years of surpluses as the prospect of a trade war with the US weighs on the outlook for economic growth and oil revenue.

The shortfall of C$5.2 billion ($3.6 billion) in the fiscal year starting in April would be driven largely by a C$4 billion drop in bitumen royalties and a C$1.2 billion drop in personal and corporate income taxes, according to forecasts released Thursday.

Expenses are expected to rise 3.3% to C$75.3 billion.

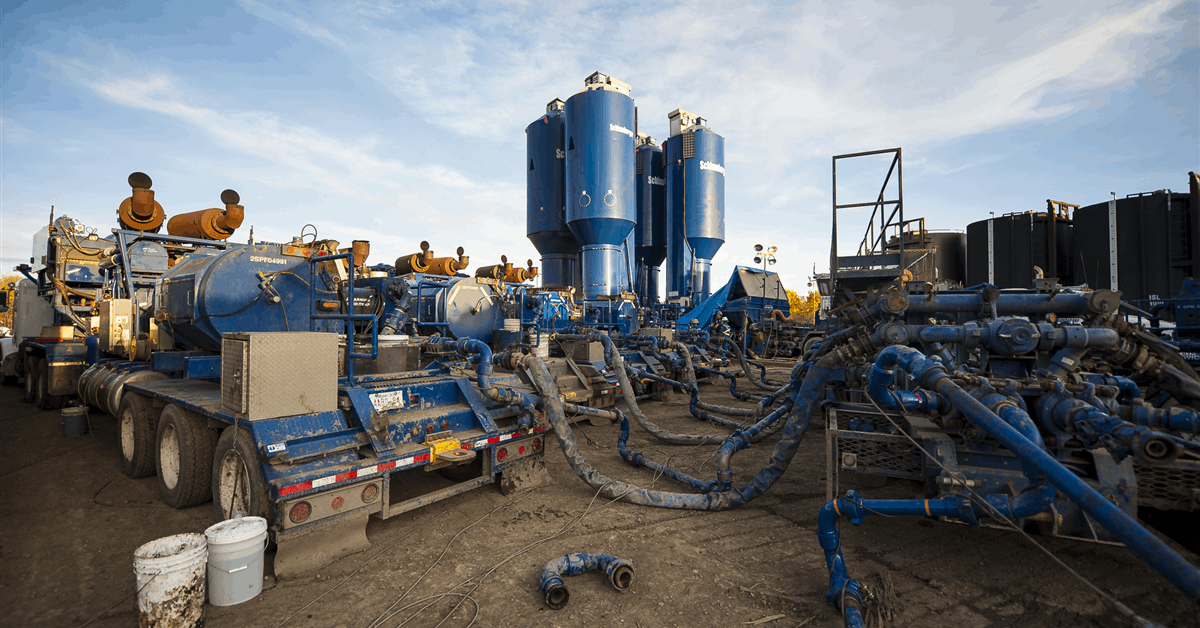

Alberta stands to be among the Canadian provinces hardest hit by President Donald Trump’s planned tariffs as it provides the vast majority of the roughly 4 million barrels a day of crude the US imports from its northern neighbor. While US imports of Canadian energy products are facing a 10% levy — less than half the proposed duty on other goods — a potential trade war still threatens to lower Alberta oil prices and volumes, reducing the resource revenue that accounts for about a quarter of the province’s inflows.

“While we work closely with partners to find solutions to a possible trade conflict, we will continue our work to make sure Alberta’s economy is strong — in and outside of the energy sector — so that we can manage any turbulence that comes our way,” Finance Minister Nate Horner said in a statement.

Trump’s 25% tariffs on most US imports from Canada and Mexico were set to take effect Feb. 4, then pushed back by a month after those countries’ leaders announced new border security measures. Trump said in a social media post Thursday that the levies are on track to go into place on March 4, saying drugs from the US’s North American neighbors are still entering “at very high and unacceptable levels.”

In January, US authorities seized 0.03 pounds of fentanyl at the northern border, according to figures from US Customs and Border Protection. Longer-range data on drug seizures from CBP also suggest the amount of fentanyl coming from Canada is small — about 70 pounds since October 2021, compared with 67,000 pounds at the Mexico-US border.

With the trade threat looming, Alberta’s government said it’s taking a cautious approach to economic projections for this year, including a forecast that real gross domestic product growth will decelerate to 1.8% from about 3% in 2024.

Alberta projects population growth will slow to 2.5% this year, down from a record 4.4% in 2024. The province’s population has boomed in recent years amid an influx of Canadians from Ontario and British Columbia in search of more affordable housing.

US benchmark West Texas Intermediate oil, which has a significant effect on the price of Canadian crude exports, is projected to average $68 a barrel for the next fiscal year, down from $74 in the current fiscal cycle, the province said.

The government also said it will introduce a lower personal income bracket of 8% on Albertans’ first C$60,000 of income, saving Albertans as much as C$750 in 2025.

The government expects total borrowing requirements to rise 0.8% to C$11.4 billion next year, with further increases to C$13.9 billion in the 2026 to 2027 fiscal year and $20.8 billion in the year after that.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg