The U.S. data center market is entering 2026 with fundamentals that remain unmatched across commercial real estate, but the nature of the dominant constraint has shifted. Demand is no longer gated by capital, connectivity, or even land. It is gated by the ability to deliver very large blocks of power, on aggressive timelines, at a predictable cost.

According to the CBRE 2026 U.S. Real Estate Market Outlook as overseen by Gordon Dolven and Pat Lynch, the sector is on track to post another record year for leasing activity, even as vacancy remains at historic lows and pricing reaches all-time highs. What has changed is the scale at which demand now presents itself, and the difficulty of meeting it.

Large-Block Leasing Rewrites the Economics

AI-driven workloads are reshaping leasing dynamics in ways that break from prior hyperscale norms. Where 10-MW-plus deployments once commanded pricing concessions, CBRE now observes the opposite behavior: large, contiguous blocks of capacity are commanding premiums.

Neocloud providers, GPU-as-a-service platforms and AI startups, many backed by aggressive capital deployment strategies, are actively competing for full-building and campus-scale capacity.

For operators, this is altering development and merchandising strategies. Rather than subdividing shells for flexibility, owners increasingly face a strategic choice: hold buildings intact to preserve optionality for single-tenant, high-density users who are willing to pay for scale.

In effect, scale itself has become the scarce asset.

Behind-the-Meter Power Moves to the Foreground

For data centers, power availability meaning not just access, but certainty of delivery, is now the defining variable in the market.

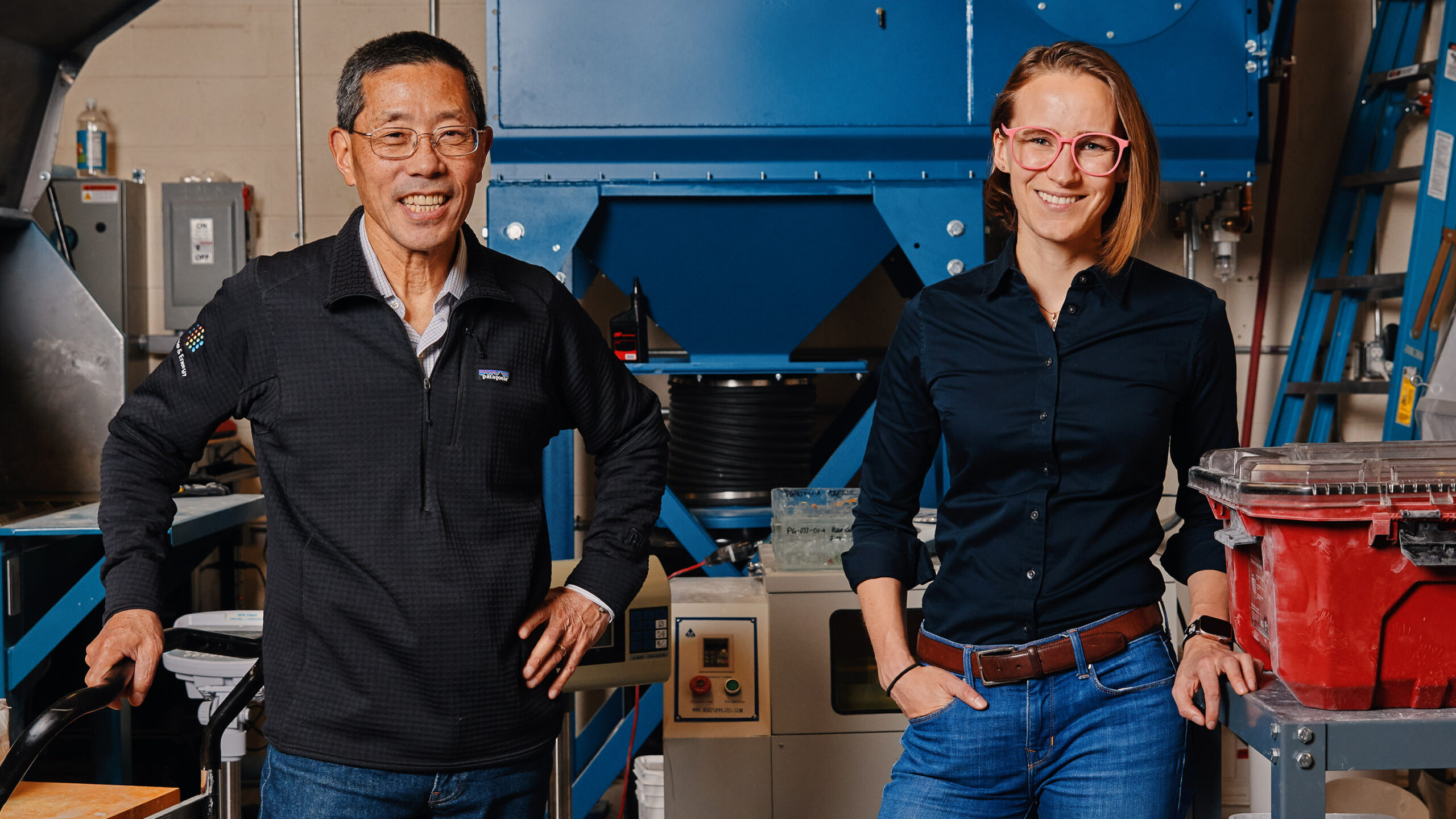

CBRE notes accelerating adoption of behind-the-meter strategies as operators seek to bypass increasingly constrained utility timelines. On-site generation using natural gas, solar, wind, and battery storage is gaining traction, particularly in deregulated electricity markets where operators have more latitude to structure BYOP (bring your own power) solutions.

This dynamic is reinforcing a shift toward greenfield development, where power strategies can be engineered from the outset rather than retrofitted into legacy campuses.

The implication is clear. Gone are the days when power strategy was an operational consideration layered onto site selection. It now is site selection.

AI Inference Enters the Demand Conversation

While AI training workloads have dominated headlines, CBRE highlights inference as an emerging demand driver that bears watching in 2026.

Publicly traded data center operators reported that AI-related workloads accounted for a meaningful share of new leasing activity in 2025, signaling that AI demand is already broadening beyond model training clusters.

The open question is where inference ultimately lands. If inference workloads scale into more latency-sensitive, distributed architectures, edge data centers could see renewed relevance.

For now, inference remains tethered largely to large-scale facilities, but the next phase of AI commercialization may test the boundaries between core and edge deployment models.

Power Cost and Speed Supersede Connectivity

Perhaps the most telling shift in CBRE’s outlook is the reprioritization of site selection criteria. Fiber availability and network redundancy, long the top of the checklist, are now secondary to power cost and delivery timelines.

As power consumption grows non-linearly with AI density, developers and occupiers are prioritizing sites capable of supporting 300-MW-plus deliveries within 36 months or less. In many cases, the ability to meet that threshold now outweighs traditional connectivity advantages.

This does not diminish the importance of network infrastructure, but it does reframe it: connectivity is assumed, while power is contested.

Construction Timelines Stretch Into Multi-Year Territory

The supply side of the equation is becoming increasingly complex. CBRE emphasizes that traditional 12- to 18-month delivery timelines for sub-50-MW facilities are no longer representative of the market.

The industry’s pivot toward 500-MW-plus AI campuses has pushed construction schedules into multi-year territory, driven by the need for multiple on-site substations and, in many cases, new high-voltage transmission infrastructure.

Where incremental generation or transmission upgrades are required, interconnection timelines can extend to 24, 36, or even 48 months and beyond.

This structural friction may explain why vacancy remains compressed even as inventory expands.

Preleasing Becomes the New Normal

Preleasing activity underscores the imbalance. CBRE expects preleasing rates to remain in the mid-70% range in 2026, well above the historical norm of 40% to 50%. Even with a 43% year-over-year expansion in primary-market inventory, demand shows little sign of cooling.

Figures included in the CBRE outlook illustrate both rising rental rates for 250- to 500-kW requirements and sustained preleasing intensity across primary markets.

The takeaway is not simply that demand is strong, but that it is arriving earlier in the development cycle, absorbing capacity years before delivery.

Geography Follows Power and Gas

Looking ahead, CBRE anticipates continued greenfield development across emerging U.S. markets, particularly along the Interstate 20 corridor and in deregulated electricity markets.

Regions with abundant natural gas resources are especially attractive, with current commodity pricing well below prior peak cycles.

States including Alabama, Mississippi, Louisiana, Georgia, Florida, South Carolina, North Carolina, Virginia, and Pennsylvania remain priority development zones; not because they are new to data centers, but because they offer a combination of power economics, regulatory flexibility, and physical scale that the AI era now demands.

A Market Defined by Execution Risk

Despite fears of a bubble, CBRE’s data shows how the 2026 data center outlook is not defined by demand uncertainty. It is defined by execution risk. Power procurement, interconnection timing, and construction sequencing now determine who can deliver, and who cannot, in a market where tenants are ready to commit capital years in advance.

For operators and developers, the message from CBRE is direct: success in this cycle will hinge less on chasing demand and more on mastering the mechanics of delivery at unprecedented scale.

In the AI era, the market’s appetite for capacity is clear. What remains uncertain is how quickly that capacity can be built, and powered, at scale.