This story originally appeared in The Algorithm, our weekly newsletter on AI. To get stories like this in your inbox first, sign up here.

I decided to go to CES kind of at the last minute. Over the holiday break, contacts from China kept messaging me about their travel plans. After the umpteenth “See you in Vegas?” I caved. As a China tech writer based in the US, I have one week a year when my entire beat seems to come to me—no 20-hour flights required.

CES, the Consumer Electronics Show, is the world’s biggest tech show, where companies launch new gadgets and announce new developments, and it happens every January. This year, it attracted over 148,000 attendees and over 4,100 exhibitors. It sprawls across the Las Vegas Convention Center, the city’s biggest exhibition space, and spills over into adjacent hotels.

China has long had a presence at CES, but this year it showed up in a big way. Chinese exhibitors accounted for nearly a quarter of all companies at the show, and in pockets like AI hardware and robotics, China’s presence felt especially dominant. On the floor, I saw tons of Chinese industry attendees roaming around, plus a notable number of Chinese VCs. Multiple experienced CES attendees told me this is the first post-covid CES where China was present in a way you couldn’t miss. Last year might have been trending that way too, but a lot of Chinese attendees reportedly ran into visa denials. Now AI has become the universal excuse, and reason, to make the trip.

As expected, AI was the biggest theme this year, seen on every booth wall. It’s both the biggest thing everyone is talking about and a deeply confusing marketing gimmick. “We added AI” is slapped onto everything from the reasonable (PCs, phones, TVs, security systems) to the deranged (slippers, hair dryers, bed frames).

Consumer AI gadgets still feel early and of very uneven quality. The most common categories are educational devices and emotional support toys—which, as I’ve written about recently, are all the rage in China. There are some memorable ones: Luka AI makes a robotic panda that scuttles around and keeps a watchful eye on your baby. Fuzozo, a fluffy keychain-size AI robot, is basically a digital pet in physical form. It comes with a built-in personality and reacts to how you treat it. The companies selling these just hope you won’t think too hard about the privacy implications.

Ian Goh, an investor at 01.VC, told me China’s manufacturing advantage gives it a unique edge in AI consumer electronics, because a lot of Western companies feel they simply cannot fight and win in the arena of hardware.

Another area where Chinese companies seem to be at the head of the pack is household electronics. The products they make are becoming impressively sophisticated. Home robots, 360 cams, security systems, drones, lawn-mowing machines, pool heat pumps … Did you know two Chinese brands basically dominate the market for home cleaning robots in the US and are eating the lunch of Dyson and Shark? Did you know almost all the suburban yard tech you can buy in the West comes from Shenzhen, even though that whole backyard-obsessed lifestyle barely exists in China? This stuff is so sleek that you wouldn’t clock it as Chinese unless you went looking. The old “cheap and repetitive” stereotype doesn’t explain what I saw. I walked away from CES feeling that I needed a major home appliance upgrade.

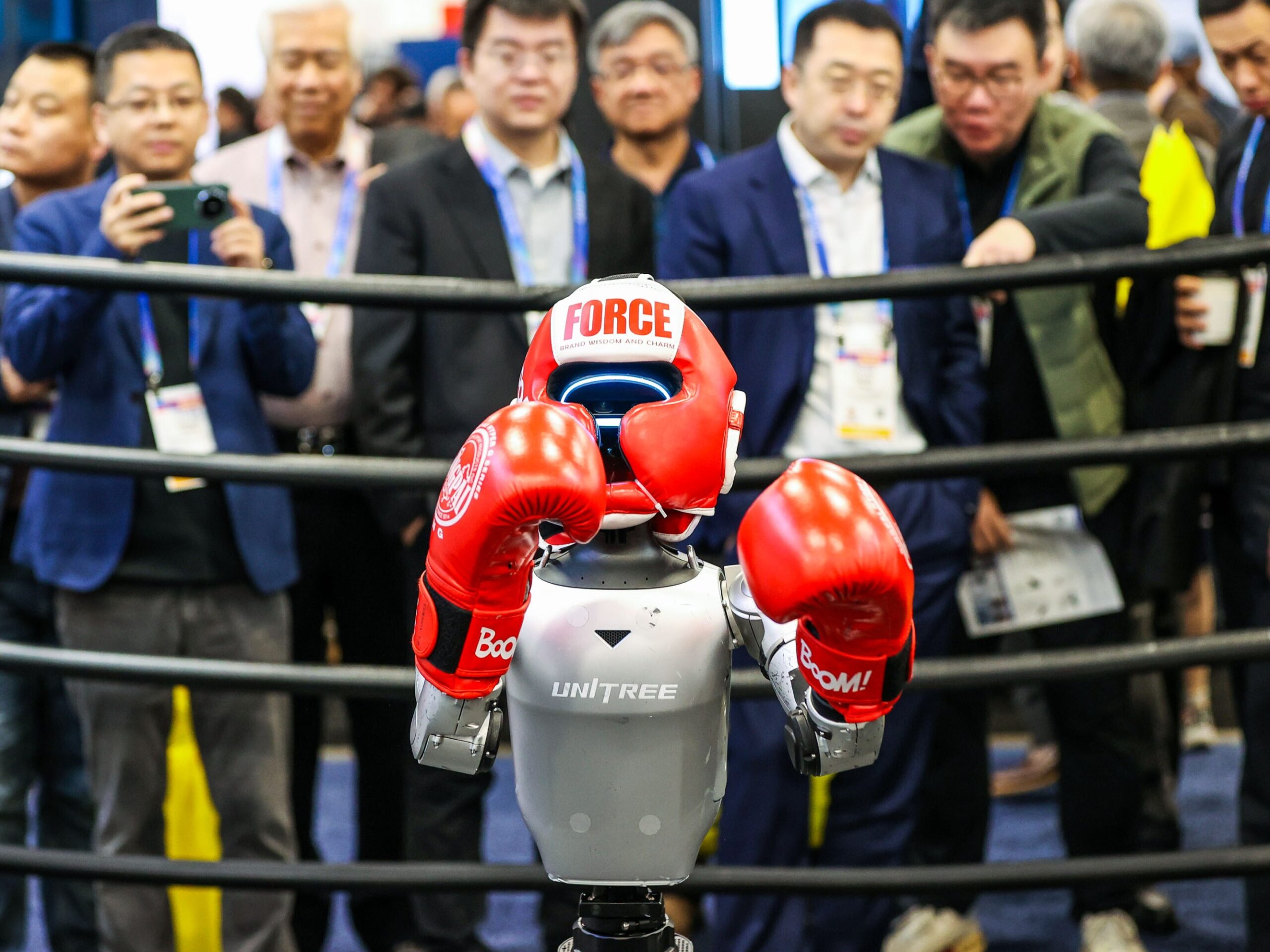

Of course, appliances are a safe, mature market. On the more experiential front, humanoid robots were a giant magnet for crowds, and Chinese companies put on a great show. Every robot seemed to be dancing, in styles from Michael Jackson to K-pop to lion dancing, some even doing back flips. Hangzhou-based Unitree even set up a boxing ring where people could “challenge” its robots. The robot fighters were about half the size of an adult human and the matches often ended in a robot knockout, but that’s not really the point. What Unitree was actually showing off was its robots’ stability and balance: they got shoved, stumbled across the ring, and stayed upright, recovering mid-motion. Beyond flexing dynamic movements like these there were also impressive showcases of dexterity: Robots could be seen folding paper pinwheels, doing laundry, playing piano, and even making latte art.

However, most of these robots, even the good ones, are one-trick ponies. They’re optimized for a specific task on the show floor. I tried to make one fold a T-shirt after I’d flipped the garment around, and it got confused very quickly.

Still, they’re getting a lot of hype as an important next frontier because they could help drag AI out of text boxes and into the physical world. As LLMs mature, vision-language models feel like the logical next step. But then you run into the big problem: There’s far less physical-world data than text data to train AI on. Humanoid robots become both applications and roaming data-collection terminals. China is uniquely positioned here because of supply chains, manufacturing depth, and spillover from adjacent industries (EVs, batteries, motors, sensors), and it’s already developing a humanoid training industry, as Rest of World reported recently.

Most Chinese companies believe that if you can manufacture at scale, you can innovate, and they’re not wrong. A lot of the confidence in China’s nascent humanoid robot industry and beyond is less about a single breakthrough and more about “We can iterate faster than the West.”

Chinese companies are not just selling gadgets, though—they’re working on every layer of the tech stack. Not just on end products but frameworks, tooling, IoT enablement, spatial data. Open-source culture feels deeply embedded; engineers from Hangzhou tell me there are AI hackathons every week in the city, where China’s new “little Silicon Valley” is located.

Indeed, the headline innovations at CES 2026 were not on devices but in cloud: platforms, ecosystems, enterprise deployments, and “hybrid AI” (cloud + on-device) applications. Lenovo threw the buzziest main-stage events this year, and yes, there were PCs—but the core story was its cross-device AI agent system, Qira, and a partnership pitch with Nvidia aimed at AI cloud providers. Nvidia’s CEO, Jensen Huang, launched Vera Rubin, a new data-center platform, claiming it would dramatically lower costs for training and running AI. AMD’s CEO, Lisa Su, introduced Helios, another data-center system built to run huge AI workloads. These solutions point to the ballooning AI computing workload at data centers, and the real race of making cloud services cheap and powerful enough to keep up.

As I spoke with China-related attendees, the overall mood I felt was a cautious optimism. At a house party I went to, VCs and founders from China were mingling effortlessly with Bay Area transplants. Everyone is building something. Almost no one wants to just make money from Chinese consumers anymore. The new default is: Build in China, sell to the world, and treat the US market like the proving ground.