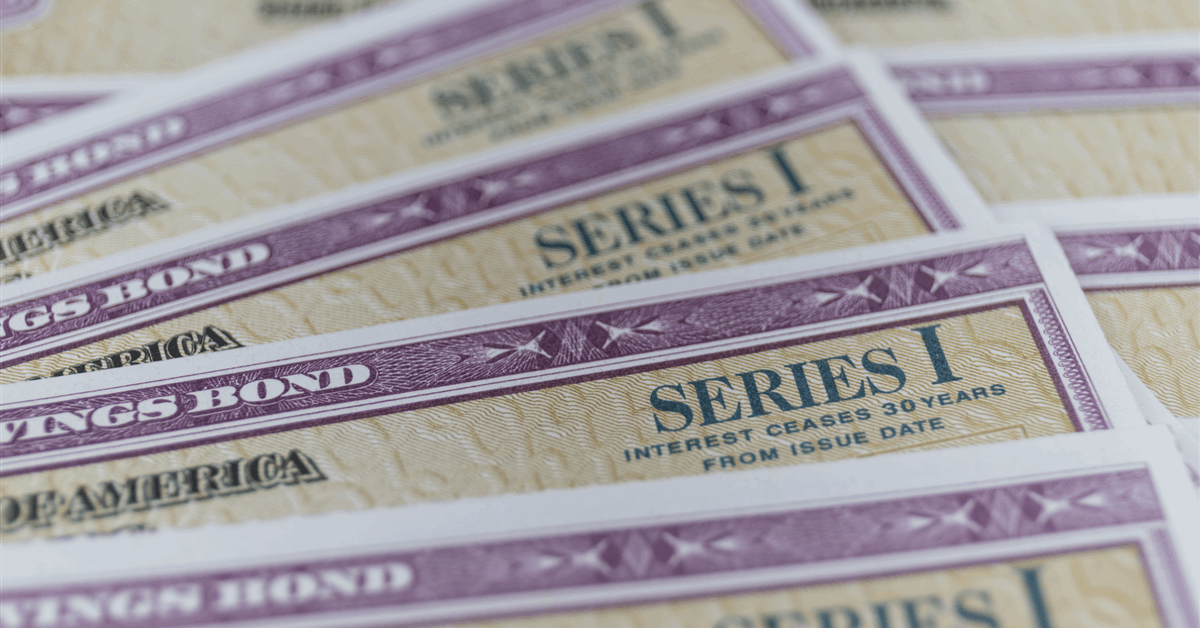

Cheniere Energy Partners LP (CQP), part of Cheniere Energy Inc. (Cheniere), is offering $1 billion of senior notes due 2035 with a yearly interest of 5.55 percent.

“The CQP 2035 Notes will be issued at a price equal to 99.731 percent of par”, CQP said in a press release. Cheniere Partners expects to close the offering July 10.

“Cheniere Partners intends to contribute the proceeds from the offering to its subsidiary, Sabine Pass Liquefaction, LLC, to be used to redeem a portion of the outstanding aggregate principal amount of its senior secured notes due 2026”, the statement added.

“The CQP 2035 Notes will rank pari passu in right of payment with the existing senior notes at Cheniere Partners, including the senior notes due 2029, the senior notes due 2031, the senior notes due 2032, the senior notes due 2033 and the senior notes due 2034”, it said.

Cheniere Partners owns the Sabine Pass LNG terminal in Cameron Parish, Louisiana. The terminal has a production capacity of about 30 million metric tons per annum (MMtpa). It also has regasification facilities that include five LNG storage tanks, vaporizers and three marine berths.

Cheniere Partners also owns the Creole Trail Pipeline, which interconnects Sabine Pass LNG with several interstate and intrastate pipelines.

Houston, Texas-based Cheniere, which owns 100 percent of the general partner stake and 48.6 percent of the limited partner interest in CQP, reported $10.55 billion in available liquidity at the end of the first quarter.

On June 24 Cheniere announced a positive FID (final investment decision) to add two “midscale” trains to the Corpus Christi LNG facility in South Texas. The two trains will raise the terminal’s capacity by over 3 MMtpa.

In July 2023 the United States Department of Energy (DOE) granted CCL Midscale Trains 8 & 9 authorization to export to countries with a free trade agreement (FTA) with the U.S.

The DOE has yet to grant the project a non-FTA permit. However, the agency has resumed issuing final orders on pending decisions paused by the previous administration last year, in support of President Donald Trump’s “unleashing American energy” agenda.

Trains 8 and 9 will rise next to CCL Stage 3, which is also under construction.

Stage 3 will have seven midscale trains with a total capacity of more than 10 MMtpa, raising the terminal’s capacity to over 25 MMtpa. Midscale trains 1-7 are permitted to export the equivalent of 582.14 billion cubic feet a year of natural gas to both FTA and non-FTA countries on a non-additive basis.

In March Cheniere said train 1 of Stage 3 had been commissioned. Train 1 had already started production December 2024 and dispatched its first cargo February 2025, the company said earlier in a quarterly report.

Cheniere said in the June 24 announcement that Stage 3’s train 2 had begun production earlier in June.

Currently Corpus Christi LNG has a production capacity of around 16.5 MMtpa from four trains. It has dispatched about 1,140 cargoes since 2018, Cheniere says on its website.

The company said, “In addition, Cheniere is developing further brownfield liquefaction capacity expansions at both the Corpus Christi and Sabine Pass terminals. The Company expects these expansions to be executed in a phased approach, starting with initial single-train expansions at each site which, if completed, would grow Cheniere’s LNG platform to up to approximately 75 mtpa [million metric tons per annum] of capacity by the early 2030s”.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR