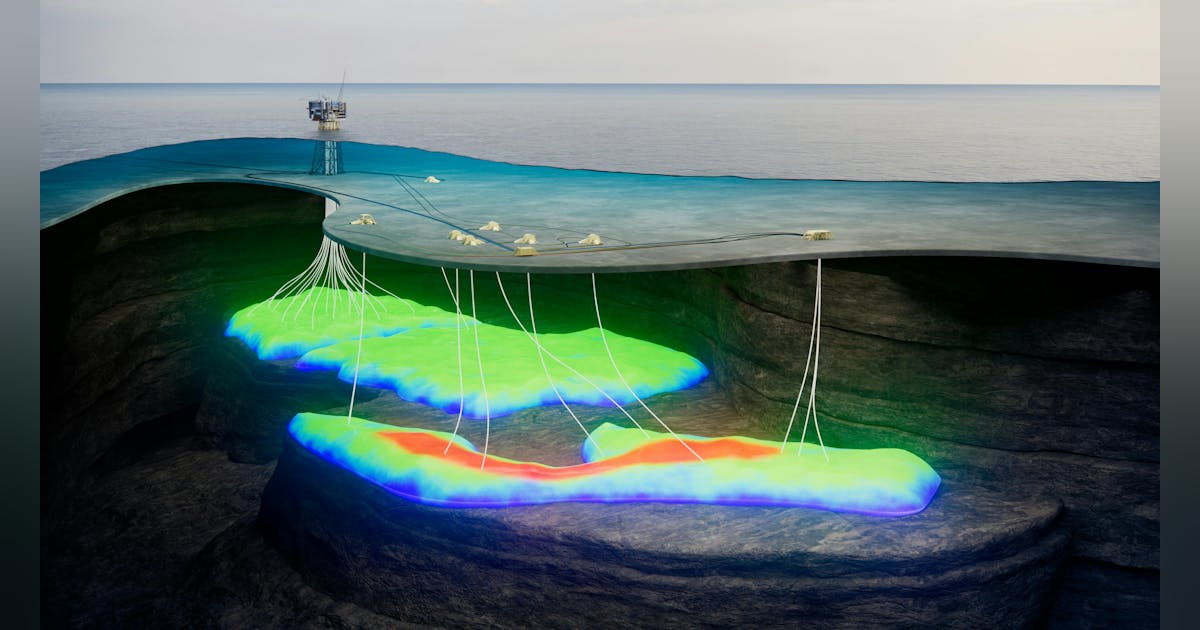

Offshore holdings drive growth in 2026. Wirth noted that 2025 acquisitions and project startups are the main drivers of an expected rise of about 200,000 boe/d. Roughly 125,000 boe/d of that is forecast to come from Guyana while the Gulf of Mexico should provide 60,000 boe/d more than in 2025 and Eastern Mediterranean projects will add roughly 20,000 boe/d. Based on Chevron’s 2025 average total production of 3.72 MMboe/d and the 7-10% growth target, the company’s 2026 output is estimated at 3.98-4.1 MMboe/d.

Venezuela possibilities, fourth-quarter numbers

Given Chevron’s track record of remaining active in Venezuela over the past decade, its operations and plans were a regular topic of conversation on the conference call. Wirth said the company’s teams now produce about 250,000 b/d there and added that they “see the potential” to push that number to 375,000 b/d in the next 2 years if they’re authorized to do so.

On the downstream side, Wirth said, Chevron today brings about 50,000 bbl to its Pascagoula, Miss., refinery. That number could triple, Wirth said, as Chevron has capacity in Pascagoula and at its West Coast refineries.

Chevron produced a fourth-quarter net profit of more than $2.84 billion on revenues of nearly $47 billion. Those numbers were down from $3.26 billion and $52.2 billion, respectively, in late 2024 because of lower commodity prices. The company’s cash flow from operations grew to $10.8 billion in the quarter from $8.7 billion a year earlier.

Shares of Chevron (Ticker: CVX) were up nearly 1% to roughly $172.50 in midday trading Jan. 30. Over the past 6 months, shares have climbed about 12%, growing the company’s market value to $348 billion.