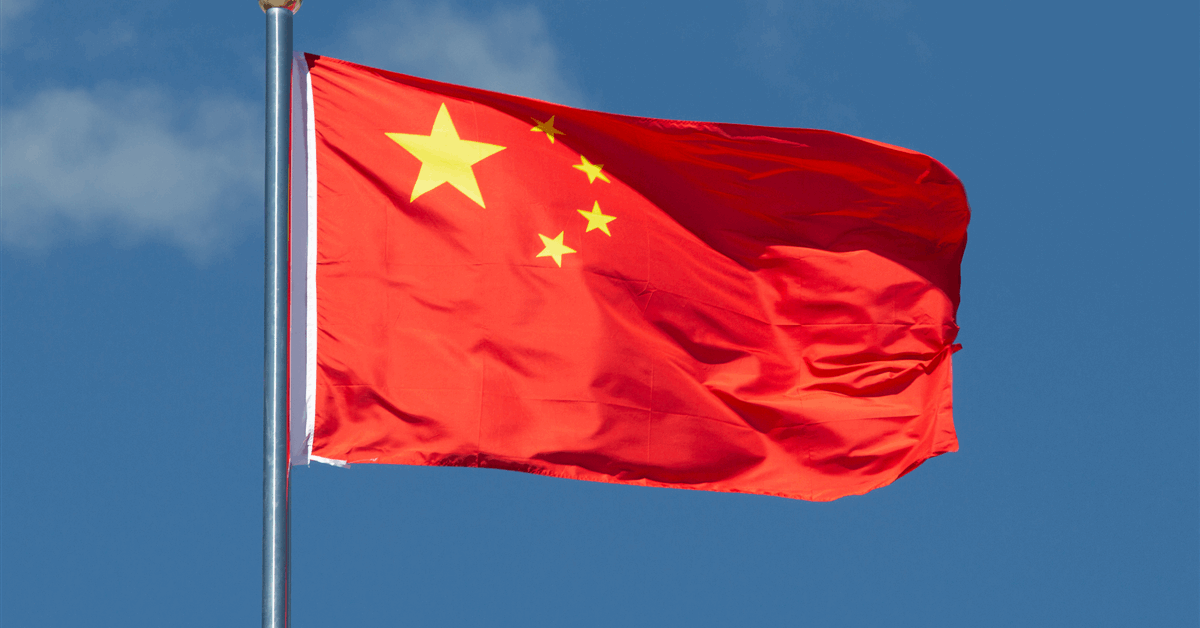

Leading Chinese oil companies with interests in Venezuela have asked Beijing for guidance on how to protect their investments as Washington cranks up pressure on the Latin American country to increase its economic ties with the US.

State-owned firms led by China National Petroleum Corp. raised concerns this week with government agencies and sought advice from officials, in an effort to align their responses with Beijing’s diplomatic strategy and to salvage existing claims to some of the world’s largest oil reserves, according to people familiar with the situation. They asked not to be identified as the discussions are private.

The companies, closely monitoring developments even before the US seized President Nicolas Maduro at the weekend, are also conducting their own assessments of the situation on the ground, the people said. Top Beijing officials are separately reviewing events and trying to better understand corporate exposure, while planning for scenarios including a worst case where China’s investments would go to zero, they added.

While it is typical for government-backed firms to maintain close ties with officials in Beijing, the emergency consultations underscore the stakes for Chinese majors, caught off-guard by Washington’s raid and by the rapid escalation of efforts to establish a US sphere of influence in the Americas. Beyond the immediate impact of US actions, all are concerned about long-term prospects, the people said.

Chinese companies have established a significant footprint across Latin America over the past decades, including under the Belt and Road Initiative. Venezuela, with few other friends, has been among the most important beneficiaries of this largesse — in part because of its vast oil wealth.

China first extended financing for infrastructure and oil projects in 2007, under former President Hugo Chavez. Public data supports estimates that Beijing had lent upwards of $60 billion in oil-backed loans through state-run banks by 2015.

Over that time, as US sanctions tightened, China became the country’s largest oil buyer and its biggest creditor. State-owned oil producers including CNPC, the parent of PetroChina Co., and China National Offshore Oil Corp. have oil and gas developments in the Orinoco heavy crude belt and other areas, while Chinese players have also invested in refining and petrochemical facilities.

Companies became more cautious in recent years, as the Venezuelan economy deteriorated and projects operated far below design capacity. Most cut back as China’s own priorities also changed, though a few, including CNPC, still have staff on the ground to manage operations including its joint venture with Venezuelan state firm PDVSA.

But Venezuela still owes billions, and earlier this week China’s top financial regulator asked policy banks and other major lenders to report their exposure, and urged them to strengthen risk-monitoring of all related credit. China Development Bank has been a key lender through crude-backed financing arrangements.

Decades of mismanagement have eroded Venezuela’s oil infrastructure and under Maduro crude output fell sharply. Oil purchases from Venezuela accounted for just 4% of China’s total crude imports in 2025. The more significant concern for producers is the sheer extent of past spending, and the country’s potential.

China has criticized the Trump administration’s reported call for Venezuela to sever its alliances with US rivals, labeling the move a “bullying act”, adding other countries have rights which must be protected. The comments follow reports by ABC News and the New York Times that the White House has demanded Venezuela cut back its ties with China, Russia, Iran and Cuba, long its only partners.

China’s biggest oil names, CNPC, Sinopec and CNOOC, did not immediately respond to Bloomberg News queries. SASAC, which supervises state-owned companies, also did not immediately comment.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.