Chord Energy Corp., Houston, plans to run a production maintenance program this year, aiming for oil production of 150,000-155,000 b/d, dropping to four rigs from five by midyear, while expanding its 4-mile lateral drilling program in North Dakota’s Williston basin.

The company detailed plans as part of its fourth-quarter 2024 results, a quarter in which it successfully drilled its first 4-mile lateral with completion operations beginning in this year’s first quarter.

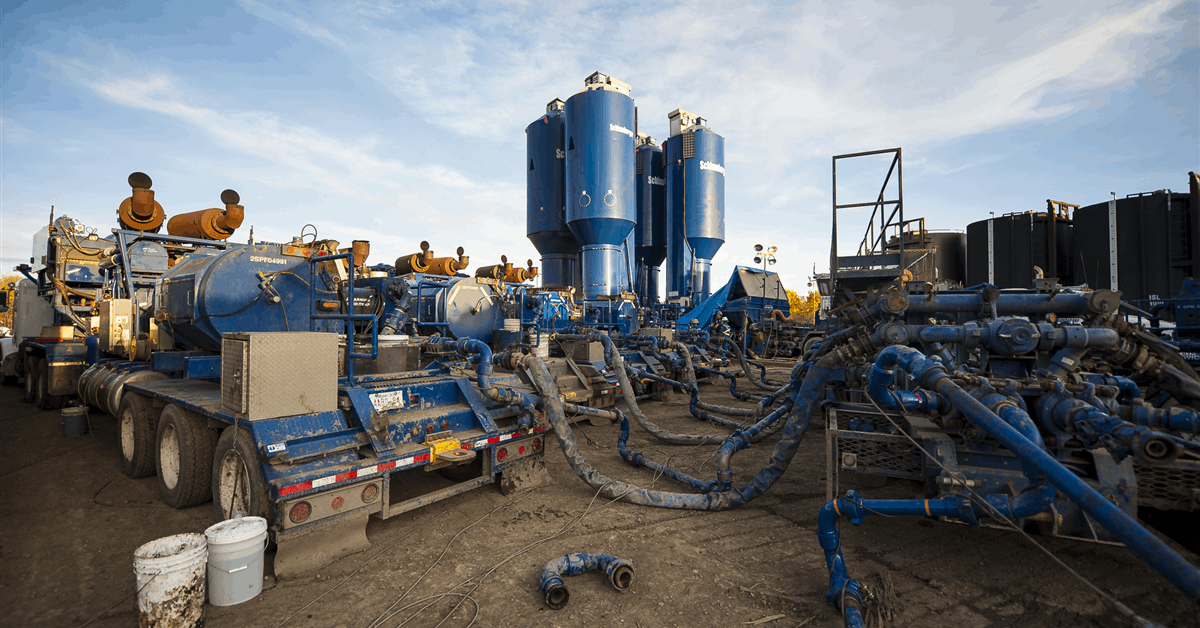

Chord is currently running one full-time frac crew and one spot crew and expects to turn in line (TIL) 130-150 gross operated wells (about 40% 3-mile laterals) in 2025. Of those, 22-32 are expected in first-quarter 2025, with the remainder to be spread out across the year.

Total 2025 capital expenditures of $1.34-1.46 billion are expected. The 2025 outlook is consistent with Chord’s 3-year outlook reported in November 2024 to deliver oil volumes of 152,000-153,000 b/d of oil for $1.4 billion of capex annually.

Longer laterals

On an earnings call, chief operating officer Darrin Henke said the company is planning “several more” 4-mile laterals this year, and that “with success, [is] likely to implement many more in 2026 and beyond.” The initial approach to 4-mile wells will be converting two, 2-mile drilling spacing units to one, 4-mile drilling spacing unit.

“However,” he said, “similar to Chord’s evolution on the 3-mile program, as we make progress on execution and drive the risk adjusted returns higher, we ultimately could look to convert some of our existing 3-mile inventory into 4-mile wells.”

Asked about any operational challenges with the 4-mile lateral, Henke said the first has “gone off without a hitch,” with spud rig release at 14.5 five days, and a frac job that went “beautifully.”

Adding to the discussion on the 4-mile lateral, chief executive officer Daniel Brown said the ‘straight’ 4-milers is the plan, but that the company is also looking at alternate well shapes.

“If we can’t go to straight, we’ll look at alternate [well shapes] because we recognize that capital efficiency of that incremental foot of lateral is almost always going to be better. But the best incremental foot is going to be a straight incremental foot.”