It’s worth pointing out the discrepancy between the largest E&P firms (defined by the Dallas Fed as producing 10,000 b/d or more) and their smaller peers. Among large-company executives responding, 36% said they plan to ramp up capex slightly this year (none said they will add “significantly” to spending) while 50% said they will decrease spending. Among small-company leaders, by contrast, 63% say they will spend more while only 15% plan to trim capex.

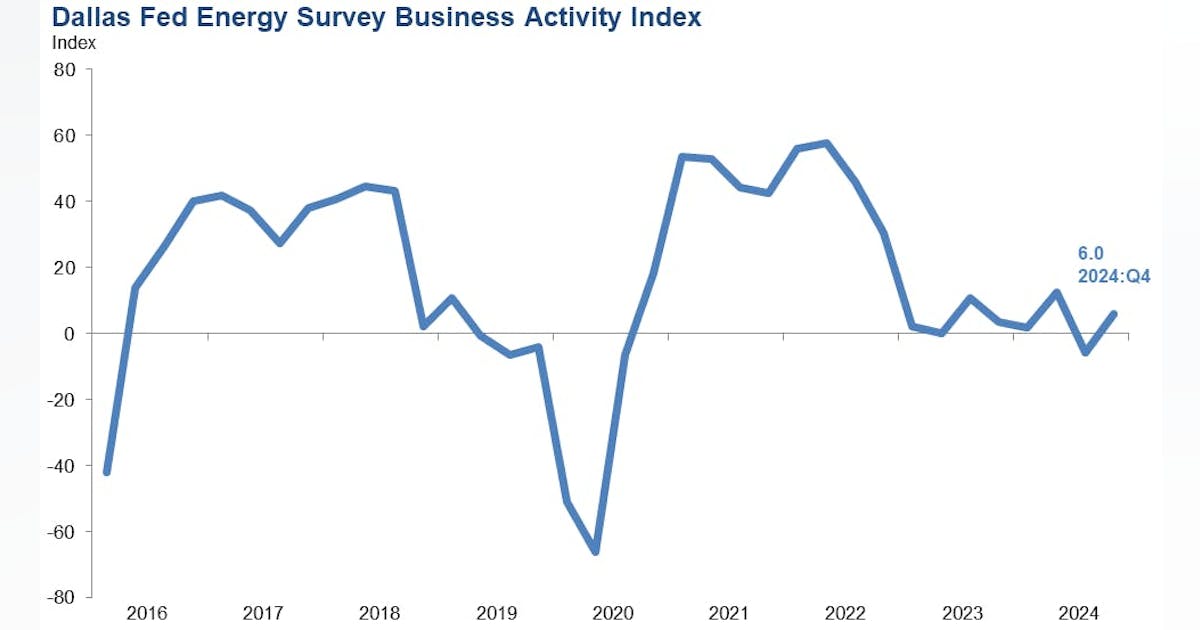

The Dallas Fed Energy Survey’s headline reading of business activity in the bank’s territory, which includes parts of New Mexico and Louisiana, improved nearly 12 points from the third quarter to a slightly positive 6.0. Similarly, its outlook indicator improved nearly 20 points to 7.1, a move that puts it back to where it spent the first half of 2024.

Moderating price expectations

Many elements of the quarterly survey—including for production and employment—held relatively steady from their fall readings. Expectations for the prices of a barrel of West Texas Intermediate crude (which was about $71 during the survey period) have grown a bit more cautious, though. Six out of 10 respondents expect that WTI’s price will be between $65 and $75/bbl at year’s end.

Three months ago, roughly 30% of executives thought WTI would top $75 by the end of 2024. Respondents’ latest forecasts have moved them closer to those of analysts at Morningstar DBRS: Late last month, those researchers said they think WTI will end 2025 priced at $65/bbl.