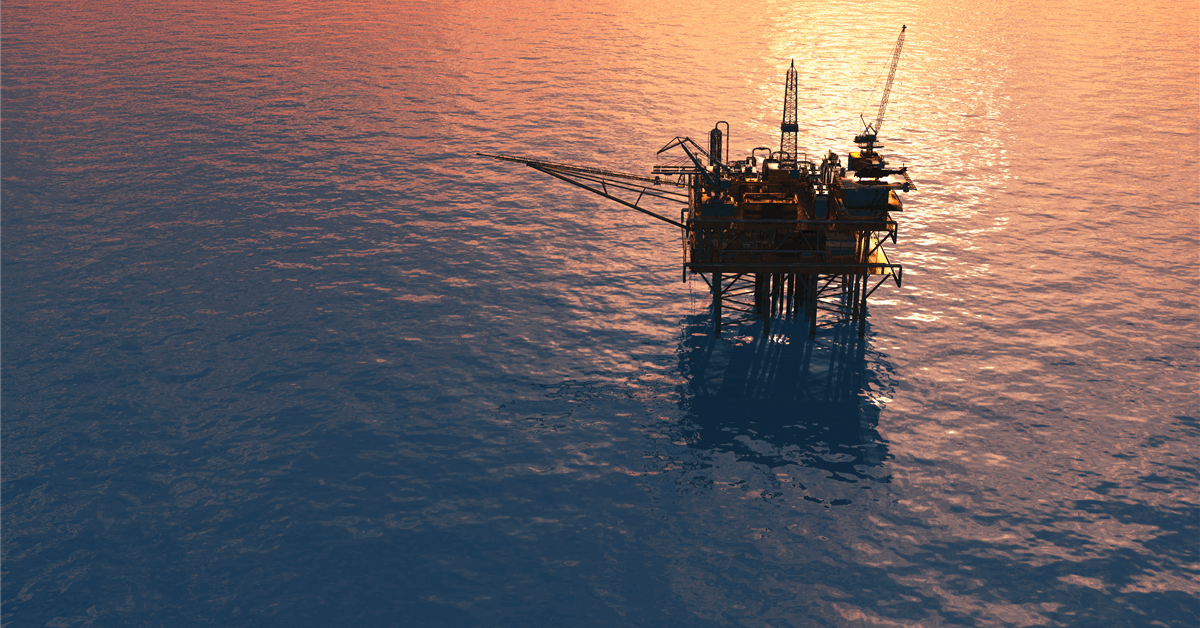

CNOOC Ltd. announced Monday a “major” discovery in the Huizhou 19-6 oilfield in the South China Sea.

Well HZ19-6-3 has raised the field’s proven in-place volumes to over 100 million metric tons of oil equivalent. During testing the discovery well produced 413 barrels of oil and 2.41 million cubic feet of natural gas a day. Drilled to 5,415 meters (17,765.75 feet), the well encountered 127 meters of oil and gas pay zones, the state-backed oil and gas exploration and production company said in a press release.

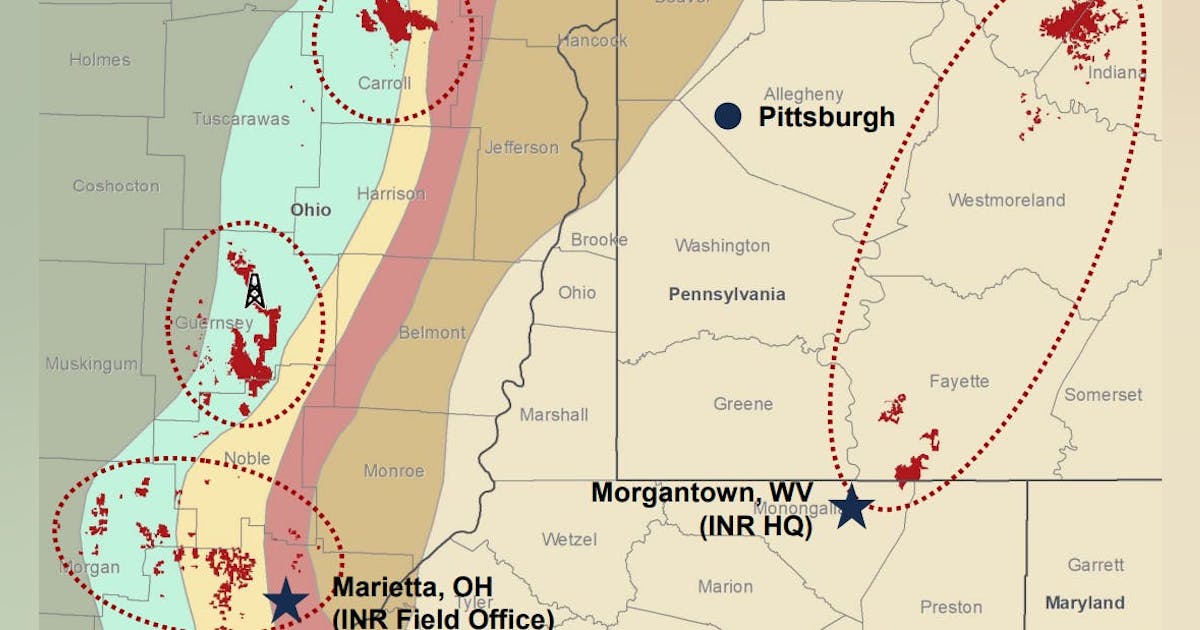

Huizhou 19-6 sits in the eastern South China Sea at an average water depth of about 100 meters. “The main oil-bearing plays are Paleogene Enping Formation and Wenchang Formation, and the oil property is light crude”, said CNOOC Ltd., majority-owned by China National Offshore Oil Corp. (CNOOC).

CNOOC Ltd. chief geologist Xu Changgui commented, “In recent years, CNOOC Limited has strengthened the research on exploration theory and technology of the deep and ultra-deep plays in the South China Sea, and breakthroughs have been achieved”.

“This discovery has confirmed the largest integrated clastic oilfield in the northern South China Sea in terms of original oil in place, breaking the traditional theoretical understanding, and demonstrating the enormous exploration potential of deep and ultra-deep plays in high-temperature and highly active basins offshore China”, Xu added.

CNOOC Ltd. chief executive Zhou Xinhuai noted, “Oilfields with hundred-million-ton oil in-place have been discovered in this area for two consecutive years, making it a new driver of the offshore oil and gas production growth”.

HZ19-6-3 is the second discovery declared by CNOOC Ltd. this year, following WZ10-5-1Sa in the Weizhou 10-5 field.

Drilled to a total depth of about 4,840 meters in an area with an average water depth of 37 meters, WZ10-5-1Sa showed a pay zone of 283 meters. During testing the well produced around 13.2 million cubic feet of gas and approximately 800 barrels of petroleum per day.

“It marks a major breakthrough in natural gas exploration in the granite buried hills in the Beibu Gulf Basin”, CNOOC Ltd. said March 6, using the local name for the Gulf of Tonkin.

Xu said, “The Weixinan Sag in the Beibu Gulf Basin is one of the most explored sags offshore China”.

“In recent years, the Company has been researching on the reservoir formation theories of the complex buried hills and the relevant technologies needed”, Xu said. “The breakthrough in the exploration of Paleozoic granite buried hills reveals the vast exploration prospects of the buried hills in the Beibu Gulf Basin. It will also provide guidance for exploration in similar fields offshore China”.

Last year CNOOC Ltd. made 11 oil and gas discoveries and appraised 30 oil and gas structures across its global portfolio. At the end of 2024 its net proven reserves reached 7.27 billion barrels of oil equivalent, up 7.2 percent year-on-year, the company said in its report of annual results Thursday.

“CNOOC Limited continued to innovate exploration theories and technologies”, the report said. “In China, multiple discoveries were made under the guidance of the exploration theories, including Longkou 7-1, Qinhuangdao 29-6, Huizhou 19-6, and Lingshui 36-1.

“Overseas, the Company expanded its global exploration footprint along the Atlantic rim and the ‘Belt and Road’ countries. This year, CNOOC Limited was awarded petroleum contracts for 10 exploration blocks in Mozambique, Brazil and Iraq”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR