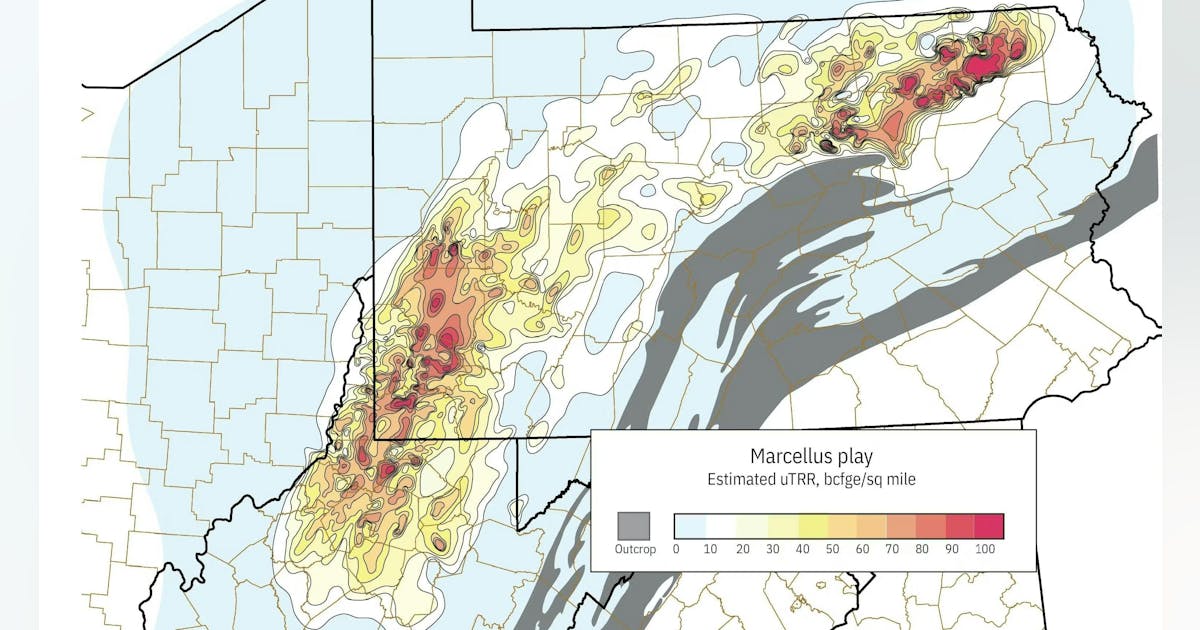

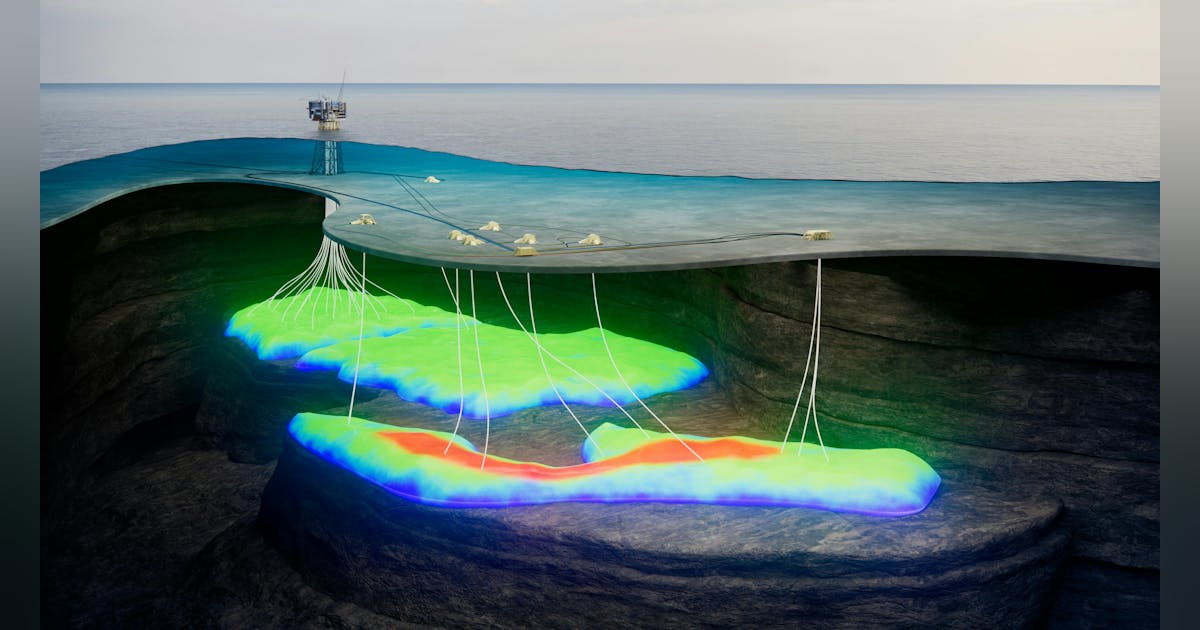

While reporting fourth-quarter earnings of more than $1.4 billion of net profits on total revenues of $14.2 billion, executives pointed out that the former Marathon assets have contributed to growing their Lower 48 reserves to more than 2 decades worth of production.

During the fourth quarter, total production in the Lower 48—which accounted for 60% of ConocoPhillips’ total segment earnings over the past 2 years—totaled nearly 1.44 MMobe/d versus 1.31 MMboe/d in late 2024. ConocoPhillips’ overall output during the fourth quarter was 2.32 MMboe/d versus 2.18 MMboe/d in the same period of the previous year.

Executives are forecasting that ConocoPhillips’ total production will rise only slightly this year to 2.33-2.36 MMboe/d. The financial focus will be on efficiency. Lance and chief financial officer Andy O’Brien said the company’s 2026 capital spending budget is about $12 billion, a reduction of nearly $600 million from 2025, while adjusted operating costs will be about $10.2 billion, $400 million less than last year.

Shares of ConocoPhillips (Ticker: COP) were down more than 2% to roughly $104.80 in afternoon trading Feb. 5. They are, however, still up more than 10% over the past 6 months, a move that has increased the company’s market capitalization to more than $130 billion.