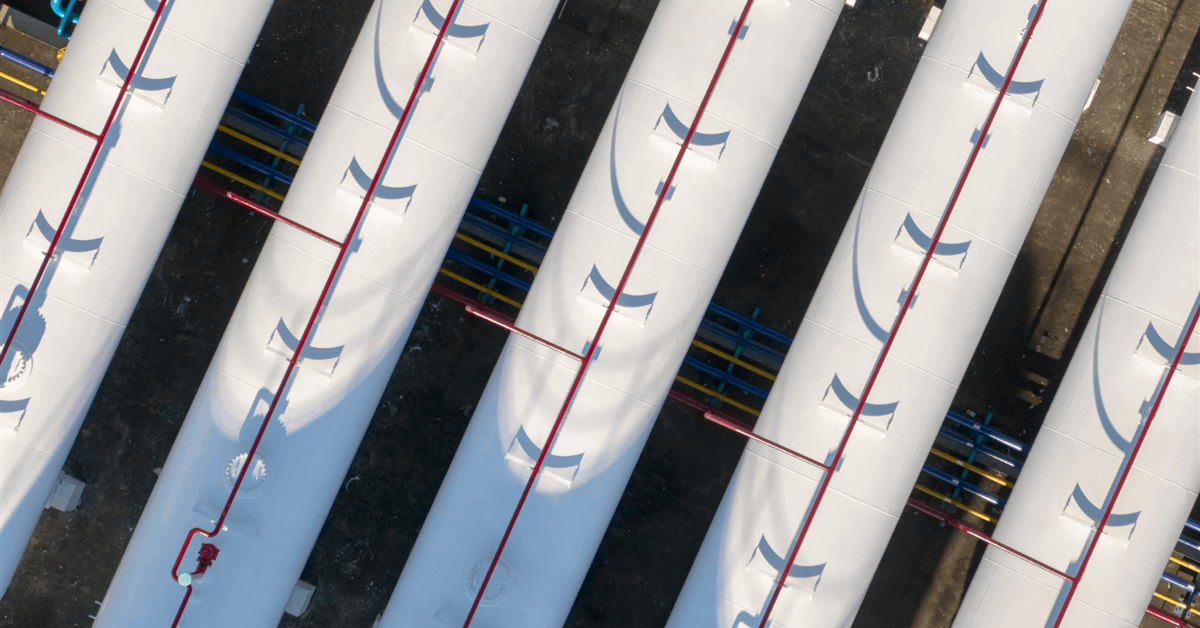

The United States Department of Energy (DOE) has granted final authorization for Venture Global Inc’s CP2 LNG project in Cameron Parish, Louisiana, to export to countries without a free trade agreement (FTA) with Washington, following a conditional permit in March.

“Under President Trump’s leadership, DOE has authorized more than 13.8 Bcfd [billion cubic feet a day] of LNG exports – greater than the volume exported today by the world’s second-largest LNG supplier”, DOE said in an online statement Wednesday. “Today, U.S. exports are approximately 15 billion Bcfd, an increase of approximately 25 percent from 2024 levels”.

The Arlington, Viriginia-based developer said separately, “The CP2 project construction is well underway and we look forward to continue advancing the project safely and quickly to bring new LNG to the global market at a record pace beginning in 2027”.

CP2 LNG already secured an FTA permit April 22, 2022. It can now export a cumulative 1.45 trillion cubic feet a year of natural gas equivalent or about 28 million metric tons per annum of liquefied natural gas (LNG) to FTA and non-FTA nations through 2050.

“Because the export volumes authorized in CP2 LNG’s FTA order and this [non-FTA] order reflect the maximum liquefaction capacity of the project as approved by FERC, the non-FTA volume in this order is not additive to CP2 LNG’s FTA order”, DOE said in the order dated October 21, 2025, referring to the Federal Energy Regulatory Commission’s (FERC) siting, construction and operation permit.

“Additionally, this final order brings DOE’s cumulative total of approved non-FTA exports of LNG from the lower-48 states to 52.81 Bcfd of natural gas (across 42 final orders, including this order)”.

On July 28, 2025, Venture Global announced a positive final investment decision and the closing of $15.1 billion in financing for phase 1 of CP2 LNG and the associated CP Express Pipeline.

“This milestone represents the largest standalone project financing ever, and the second largest project financing after the combined financings of Venture Global’s Plaquemines LNG”, Venture Global said July. “The transaction garnered enormous interest from the world’s leading banks, resulting in over $34 billion of commitments, and required no outside equity investment”.

ING and Santander served as lead arrangers for phase 1’s construction term loan and working capital facility. Bank of America and Scotiabank were lead arrangers for its equity bridge loan.

“The lender group for the construction financing is comprised of the world’s leading banks, signaling significant demand for U.S. LNG investment not only in the United States but also in Europe and Asia”, Venture Global said.

“Phase 1 has contracted long-term SPAs [sale and purchase agreements] with customers in Europe, Asia and the rest of the world”, it said.

Chief executive Mike Sabel said, “We are extremely proud to have taken FID on our third greenfield project in under six years with over $80 billion in capital markets transactions executed to date”.

“Our significant early investments and work on the project make CP2 the most advanced project at FID to date”, Sabel added.

On June 3 Venture Global said it had started site work at CP2 LNG after receiving final clearance from the Federal Energy Regulatory Commission.

On March 19 DOE conditionally granted the non-FTA portion of CP2 LNG’s authorization. The DOE said it was withholding a final order pending a review of permitting considerations launched by the previous administration.

On May 19 DOE said it was ready to proceed with issuing final orders on pending applications after ruling that the review initiated by the Biden government supports U.S. LNG expansion.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR