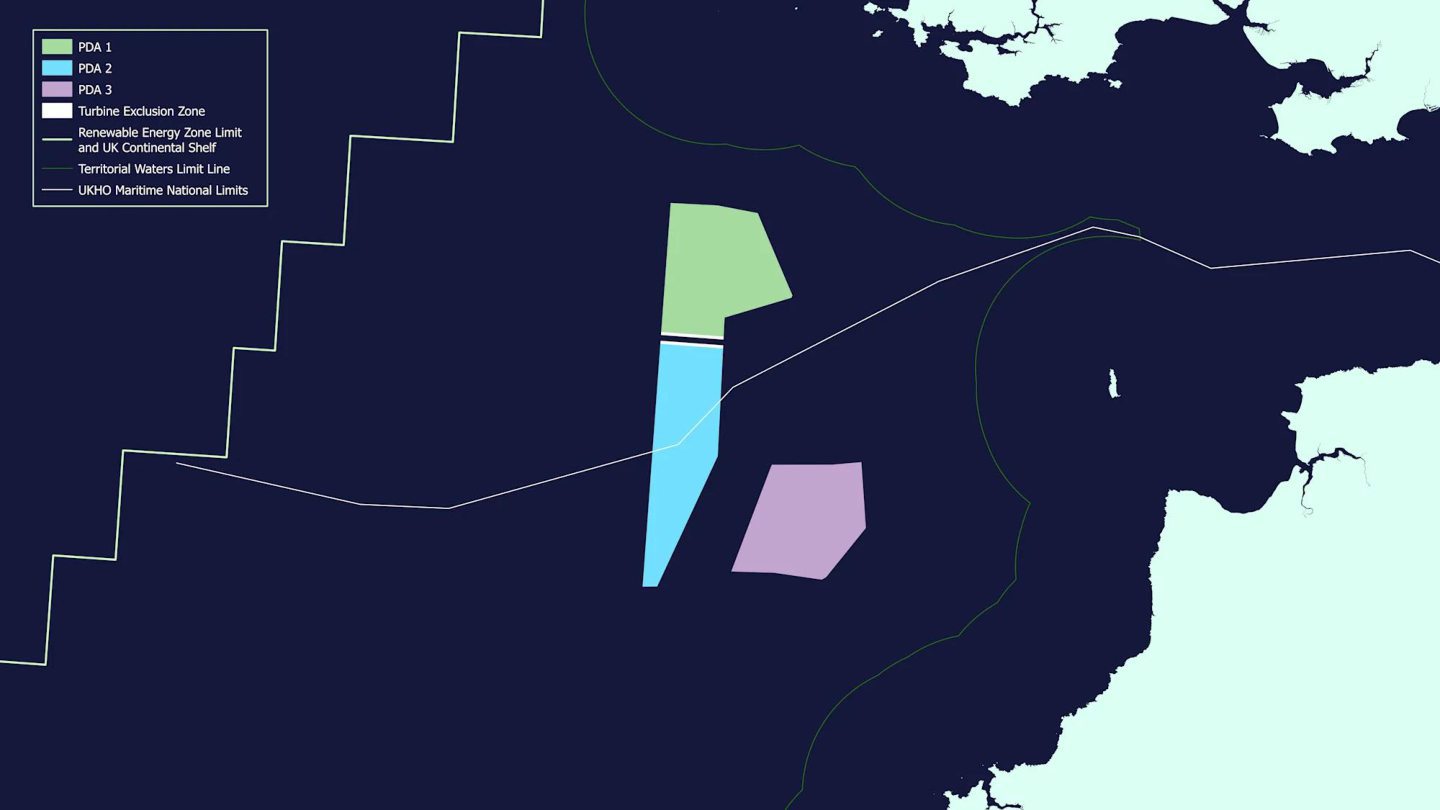

Plans to build up to 4.5 GW of floating wind capacity in the Celtic Sea have moved a step closer as The Crown Estate enters the final stages of its latest leasing round.

The Crown Estate (TCE) also announced that bidding wind developers have identified seven ports in Wales and south west England for turbine assembly and deployment.

In total, the three Celtic Sea wind farms could support the creation of an estimated 5,000 jobs and provide a £1.4 billion economic boost to the region.

TCE, a statutory corporation which manages the seabed around England, Wales and Northern Ireland, embarked on its fifth offshore wind leasing round in February 2024.

The leasing round is expected to award seabed rights for three floating wind farms in the Celtic Sea.

Altogether, the three projects will be capable of generating enough capacity to power more than four million average UK homes.

After assessing bids submitted in the first stage of the tender, TCE said it will now invite successful shortlisted developers to participate in an auction process later in the Spring.

© The Crown Estate

© The Crown EstateTCE said it then expects the winning bidders to sign agreements covering the floating wind leases later in the Summer.

Firms which have announced an interest in developing projects in the Celtic Sea include Germany’s RWE, Norway’s Equinor, and Blue Gem Wind, a joint venture between Ireland’s Simply Blue Energy and France’s TotalEnergies.

Celtic Sea floating wind

TCE managing director Gus Jaspert said the advent of floating wind offers a “generational opportunity for the UK to be a the forefront of an exciting new global industry”.

“Developing this new technology in the Celtic Sea will open up transformational opportunities for new jobs, investment and growth across Wales, South West England and beyond,” Jaspert said.

“With government backing to secure the long-term success of the UK as a global leader in floating wind, we can lay the foundations for future generations to reap the rewards of a decarbonised, energy-secure and prosperous future.”

Meanwhile, UK energy secretary Ed Miliband said the Labour government will continue its efforts to support the UK floating wind sector and unlock the “untapped potential” of the Celtic Sea.

“More floating turbines in our waters means more clean, homegrown power that we control, delivering energy security for families and businesses,” Miliband said.

Wales floating wind

Floating wind is a key focus for Labour, with the party outlining its flagship GB Energy clean energy company in Wales during the election campaign last year.

At the time, Labour leader Sir Keir Starmer said floating wind will be the “priority” for GB Energy’s first investment, potentially signalling a role for the company in the Celtic Sea.

However, GB Energy has since announced plans for a £200m rooftop solar programme as its first major project.

Welsh cabinet secretary for economy, energy and planning Rebecca Evans said the leasing round represents a significant opportunity for Wales.

“Floating offshore wind in the Celtic Sea will not only advance our clean energy goals but create valuable jobs and investment across Wales’ coastal communities,” Evans said.

“Our ports are well positioned to support this growing industry and we’re committed to ensuring such developments deliver lasting economic benefits for Wales whilst continuing to strengthen our position as a renewable energy leader.”

Floating wind ports

As part of the Celtic Sea bid process, TCE said developers have set out which ports they intend to work with to deliver their projects if they are successful.

The ports will be used for integration and assembly, where the turbines will be mounted on to large floating platforms before being towed out to sea.

Shortlisted ports include Milford Haven, Swansea, Talbot, Bristol, Plymouth, Falmouth and Brest.

Overall, TCE said bidders have indicated a “strong potential” for both Port Talbot and Port Bristol to play a key role in delivery of the Celtic Sea projects.

Ports across the UK will play a crucial role in the deployment of offshore wind, with significant investment already underway in Cromarty Firth and Ardersier in Scotland.

© Supplied by Port of Cromarty Firth

© Supplied by Port of Cromarty FirthHowever, while many ports in Scotland and northern England are well suited for handling large-scale offshore infrastructure as a result of their existing oil and gas industry, Celtic Sea ports are “effectively a greenfield site” for floating according to experts.

Professor Deborah Greaves from the University of Plymouth told Energy Voice that this means the region’s ports, infrastructure and supply chains will “all need to be adapted” for floating wind.

As in Scotland, significant investment is beginning to flow into ports across Wales and south west England.

Port Talbot forms part of the wider Celtic Freeport alongside the Port of Milford Haven, which attracted £26m in UK government investment.

Meanwhile, TCE launched a £15m fund earlier this year to accelerate the development of port infrastructure in the Celtic Sea.

Ports and jobs growth

British Ports Association chief executive Richard Ballantyne said floating wind will bring “jobs and prosperity” to the UK alongside contributing to net zero targets.

“Ports are critical to securing the social and economic benefits of the energy transition and we welcome this step forward in making floating wind a reality in UK waters,” he said.

Meanwhile, RenewableUK deputy chief executive Jane Cooper said the TCE announcement will “provide confidence for investors” in port facilities.

“By 2050, floating turbines could provide a third of the UK’s offshore wind capacity with 40 gigawatts fully operational – enough to power every home in the country,” she said.

© Supplied by Blue Gem Group

© Supplied by Blue Gem Group“By then, our analysis shows that the UK’s floating wind industry will employ 97,000 people, contributing £47 billion to our economy by building and supplying projects here as well as exporting our cutting-edge technology worldwide.

“Maximising the capacity of floating wind to be delivered in future leasing rounds would enable the UK to make the most of these exciting opportunities.”

The Crown Estate offshore wind plans

The fifth leasing round comes amid wider TCE plans to support an additional 20-30 GW of offshore wind capacity by 2030.

In addition, the organisation has identified potential for up to 12 GW of floating wind capacity in the Celtic Sea.

Offshore wind is a key focus for TCE after the UK Labour government passed legislation expanding its borrowing powers to support energy transition goals.

The Celtic Sea leasing round comes after two major floating wind leasing rounds in Scotland in recent years.

TCE’s Scottish counterpart, Crown Estate Scotland, awarded around 25 GW of floating wind capacity to developers in the ScotWind and INTOG leasing rounds.

Which developers are bidding?

TCE has not publicly announced which bidders it has shortlisted as part of the Celtic Sea leasing round.

However, several offshore wind have outlined an interest in developing projects in the region.

Alongside RWE, Equinor and Blue Gem Wind, other firms to announce potential bids include Ørsted, Corio Generation, and a joint venture between EDF, ESB and Reventus.

Elsewhere, developers are also progressing several smaller floating wind demonstration projects in the Celtic Sea.

These include Blue Gem Wind’s 100 MW Erebus and 300 MW Valorous, Floventis’s 200 MW Lyr 1 & 2, and Flotation Energy and Cobra’s 100 MW White Cross project.

Swedish firm Hexicon is also developing the innovative 32 MW TwinHub project which involves mounting two turbines on a single floating platform.