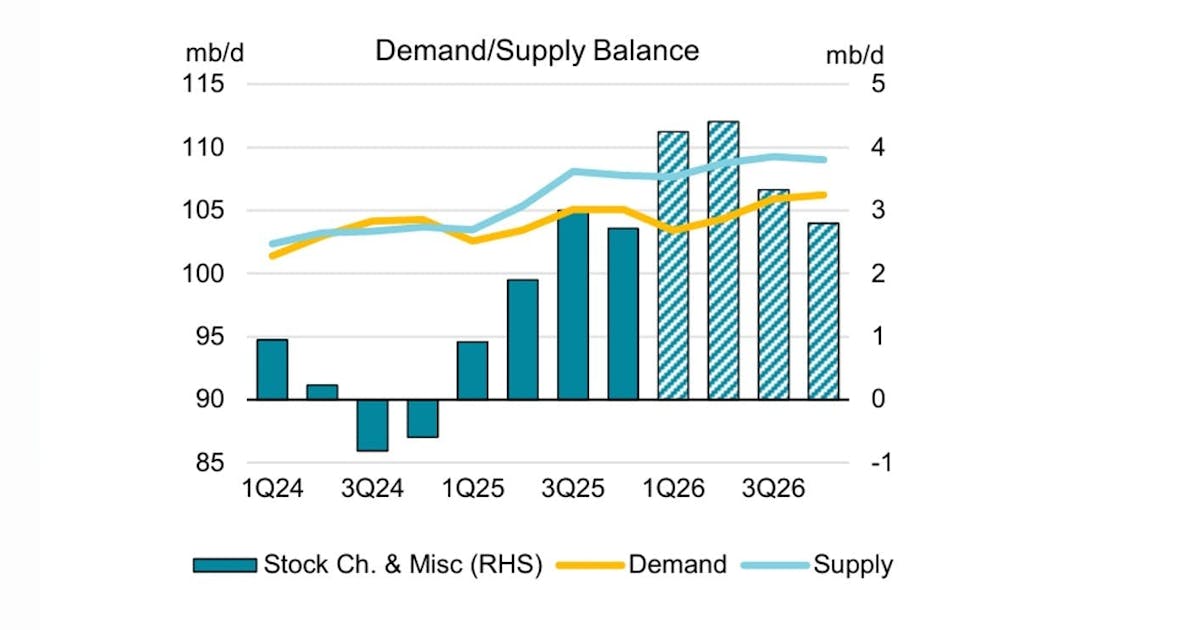

Oil edged down as an improving supply outlook out of OPEC+ member Kazakhstan overshadowed fears that a winter storm which pounded swaths of the US with snow, ice and freezing temperatures will crimp production.

West Texas Intermediate fell slightly to settle below $61 a barrel, after climbing 2.9% on Friday, the biggest gain in two weeks. Disruptions to Kazakh oil flows that had tightened the European crude market eased as a key Black Sea terminal that accounts for most of Kazakhstan’s exports was brought back into service. At the same time, output from the country’s giant Tengiz field is set to restart shortly.

The fresh injection of supply mitigated fears of shortages as investors assess the fallout from a winter storm that gripped much of the US. Several plants, including ExxonMobil Corp.’s Baytown mega refinery, curtailed operations ahead of the freeze, while diesel rallied by the most since November on higher demand for heating. The full extent of cold-related supply shut-ins remains unclear.

Meanwhile, tensions persist in the Middle East after US President Donald Trump dispatched naval assets to the region, prompting speculation he may follow through on threats to attack Iran’s regime and spurring concern over the country’s oil output.

Geopolitical turmoil and short-term supply disruptions have supported crude prices amid widespread expectations that swelling output from the Americas will create a glut. Hedge funds raised their bullish bets on crude to the highest since August in the week through Jan. 20.

“The constant stir in geopolitics is keeping risk premiums alive,” said Priyanka Sachdeva, a senior market analyst at brokerage Phillip Nova Pte in Singapore. “However, the broader market remains cautious with production growth from the US and other major exporters outpacing demand growth.”

OPEC+ delegates, meanwhile, said they are currently expecting to stick with plans to keep oil production steady next month when the group meets on Sunday. The alliance is pausing output increases this quarter during a seasonal lull in consumption.

Oil Prices

- WTI for March delivery fell 0.7% to settle at $60.63 a barrel in New York.

- Brent for March settlement declined 0.4% to settle at $65.59 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.