The UK needs to focus on decarbonising the North Sea energy industry “damn hard and damn fast”.

A panel of industry specialists at a conference discussed what Energy Industries Council (EIC) president Campbell Keir called an “urgent necessity” to “reshape industries, create new partnerships, generate sustainable jobs and secure a future where energy and environment responsibilities built together”.

In the first session of the North Sea Decarbonisation conference, RV Ahilan Ahilan, chief energy transition officer of ABL Group, admitted annoyance with UK energy policy. ABL, is headquartered in London but listed on the Oslo stock exchange which gives the global firm insight into both sectors of the North Sea.

“Even looking across the pond to Norway, we have a completely inconsistent policy about oil and gas development between the two countries.

“One is ready to have no oil and gas licenses. The other one is saying we should have more

“We have to somehow find a way to attract industry that can work on both sides of this agenda, and that’s the bit that I’m consistently having to struggle with.

“The second part is that I think it’s also very annoying that we have a decarbonisation target and yet heavy subsidies for fossil fuels and subsidies for renewables without actually redirecting those in an efficient manner across the country’s GDP.

That’s a big problem. It’s putting the foot on the accelerator and on the break at the same time and expecting decarbonisation to happen. And that’s very provocative.

Matt Abraham, head of operations for James Fisher and Sons, called for acceleration of North Sea decommissioning as a means of driving carbon reduction and industry innovation while also maintaining oil and gas production

“We could lead the world in the decommissioning of installation. Genuinely, there’s a whole lot of new different cutting technologies. If you’re going to actually support decarbonisation, make sure you have an opportunity to keep that transition funded,” he said.

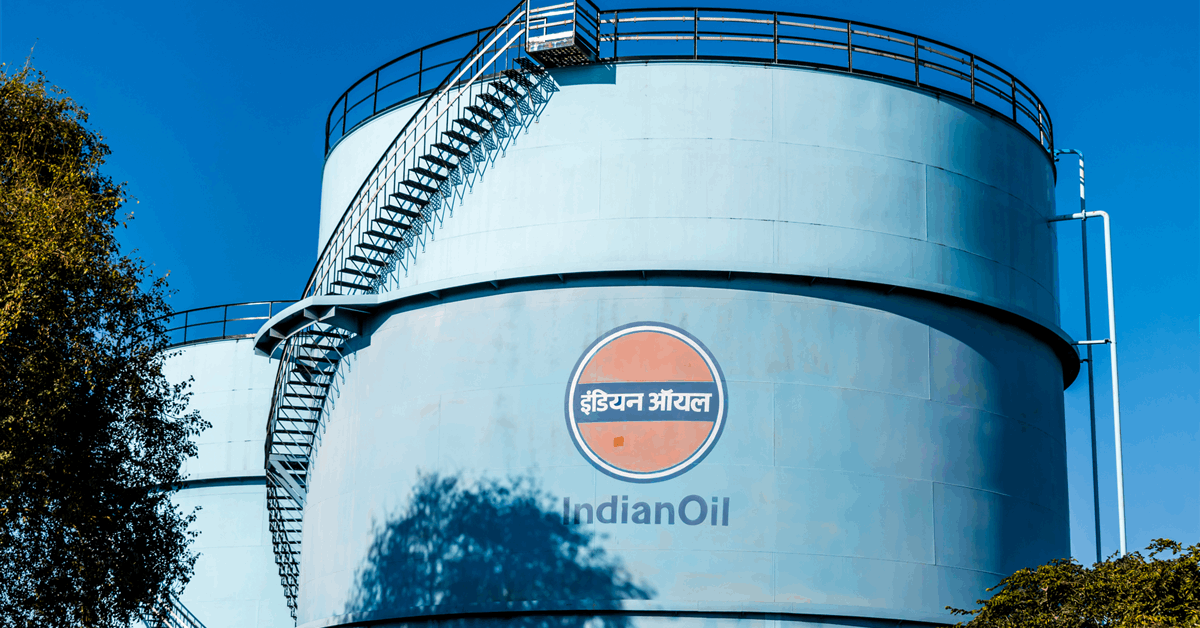

He also argued that the UK needed to maintain domestic supply of oil and gas,

“We see from our maritime businesses, there’s lots of markets and increased demand for fuel around the whole of the UK.

“If you want to talk decarbonisation source locally as well. It’s a very easy thing to say, though its seems impossible in political reality.

“It’s still a huge industry out there for us to do things with, but it just feels that we have an opportunity that we could we still can grasp, but we need to grasp it damn hard and damn fast.”

Stuart Walters, senior policy manager for the North Sea Transition Authority (NSTA) said the oil and gas industry was on track to meet its target to slash emissions in half by 2030 but that meeting more ambitious reductions in 2040 relies on delivering carbon capture and storage (CCS). “It’s great opportunity to not only capture domestic carbon, but take some of Europe’s carbon and store it as well. So there’s quite big government decisions to be made there.”

Chris Rowell head of net zero at Tees Valley Combined Authority said Teesside was leading the UK’s effort to deliver decarbonisation through the establishment of the East Coast Cluster CCS and hydrogen projects, which are backed by government through its £22 billion CCS tracking scheme, as well as hosting the UK’s largest freeport, Teesworks.

“In Tees Valley, we need to see track one expansion happen, there’s a technical reason why it hasn’t kicked off yet, but we have inward investment projects circling and waiting to land. Expansion of carbon capture will allow that,” he said.

He added track two regions which include Scotland’s Acorn project in Peterhead also need certainty but that he’s optimistic the UK’s approach is working. However, he warned the current high cost of energy risks driving out industries such as steel making and ammonia production which would make the UK reliant on imports with higher carbon pollution.

“The UK is actually doing really well in terms of developing carbon capture. When you have the Inflation Reduction Act in America, you saw everybody jumping towards American projects, but the UK model and the track process is attractive, and it has borne fruit.

“The big opportunity for it is do more. The big challenge is communicating to global businesses and to UK companies that want to decarbonise how they get involved in that, and keeping them on the hook until, until that capacity to capture their carbon is delivered.

“Because, the longer we wait, the more the more investments we might not realize, or companies we lose.

“The same goes again for cost of energy. If we drive up the cost of energy here we may end up increasing the amount of CO2 in our in our products, just by driving them abroad. If you lose steel making in the UK, you lose a unit, you’d be buying anywhere. The same has happened with ammonia. We used to produce a load of ammonia at Teesside. If you start looking at Russia and China, you do start looking at coal. The UK way of doing things may, because of the state of our energy market, be more expensive, but it could also be sort of lower carbon in the medium term.”