Deltic Energy has expressed “frustration” at what it sees as a discrepancy between the value of its assets and the price of its stock.

In an operations update, Deltic CEO Andrew Nunn said: “The magnitude of the divergence between Deltic’s share price and the company’s valuation of its stake in the Selene Gas Project is clearly a cause of frustration for both shareholders and the board, especially given the quality of the asset and commitment of the joint venture partners.”

On Tuesday, Deltic stocks opened on the AIM market at 3.25 pence per share, a significant drop-off compared to the peaks of around 43p in April 2024.

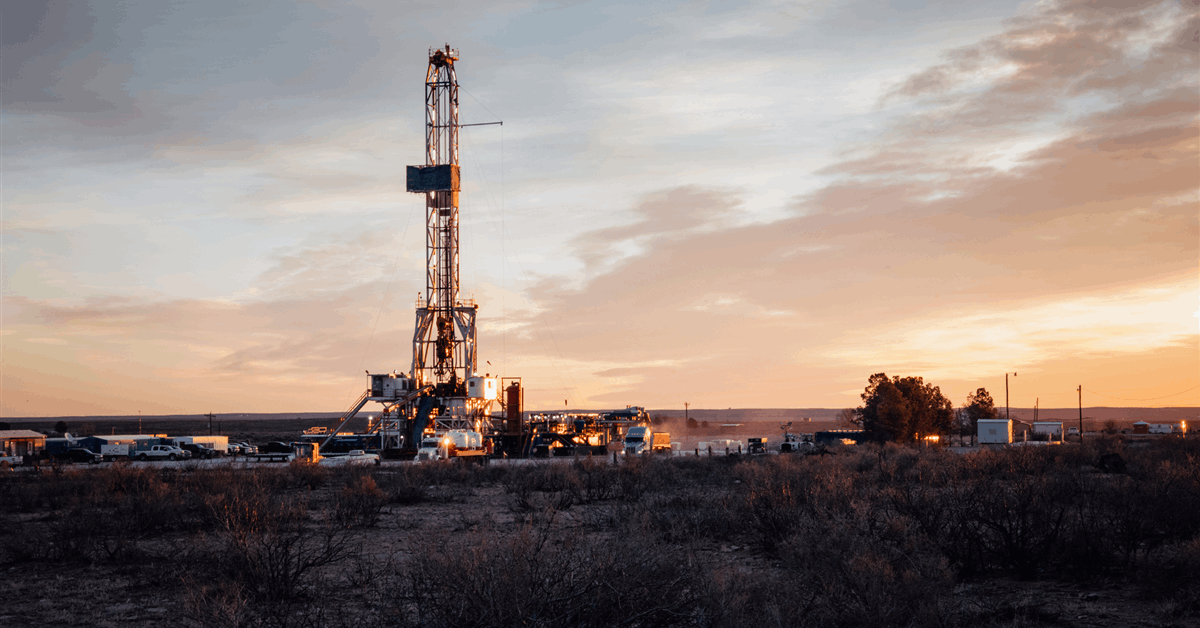

In the shareholder update, the North Sea boss reiterated his confidence in the Selene project, a development in which Deltic owns a 25% non-operated stake.

The firm forecasts a 35% return on investment in the UK gas asset and post-tax net earnings of $58 million (£44.94m).

In November, Deltic confirmed that well costs on Selene would come in under budget, with field operator Shell confirming that the partners in the joint venture would press ahead for the second term of the licence.

This news caused the firm’s share price to climb 13% on the day of the announcement.

© Supplied by Deltic Energy

© Supplied by Deltic EnergyNunn continued: “The board considers that actions taken in late 2024 to reduce ongoing G&A costs, and Deltic’s previously communicated year-end cash position of £1.4m, provides the board with sufficient flexibility to progress potential funding options to enable the business to move to Selene FID and beyond.”

Salene is yet to take final investment decision (FID), and late last year the Deltic boss told Energy Voice that in order to reach FID his firm is contemplating farming out yet more of its stake in the Southern North Sea gas project.

The North Sea explorer owns 25% of this project after South Korea’s Dana bought out a 25% share in February 2024, with London-based supermajor Shell operating the project and claiming the remaining half.

Despite the firm’s perceived undervaluation, there is confidence in the current UK market following certainty from Labour’s first budget in Autumn.

“There has now been a period of stability in the UK oil and gas industry following the UK Budget in October 2024, and while the overall environment remains extremely challenging, we believe there has been a slight improvement in sentiment towards the sector,” Nunn added.

The day following the budget, Deltic announced its joint venture Selene project would be downgrading its estimated ultimate recoverable (EUR) resources of 131 billion cubic feet (BCF) at 50% probability (P50). Previously, it was said to be around 300 BCF.

The trio of firms behind the asset expect first gas in 2029.

Recommended for you

Harbour Energy pays 108% UK tax