Devon Energy Corp., Oklahoma City, has reduced its planned capital spending by $100 million for the second consecutive quarter, with executives joining several of their peers in saying that their teams are working ever more efficiently.

Devon’s assets in the Delaware, Rockies, Eagle Ford and Anadarko basins required $932 million in capital during second-quarter 2025, which was 7% less than president and chief executive Clay Gaspar and his team had planned for. Over the past 2 years, executives pointed out, Devon’s average drilling cost in the Delaware has fallen 12% and its average completion spending is down 15%.

“We are optimizing well performance, reducing cycle times, and streamlining field operations all while delivering production performance,” Gaspar said on an Aug. 6 conference call. “These are sustainable, structural gains.”

For the year, Devon’s leaders now expect the company’s capital spending to be between $3.6 billion and $3.8 billion. When they first laid out their 2025 plans last November, the midpoint of their range was $4.1 billion.

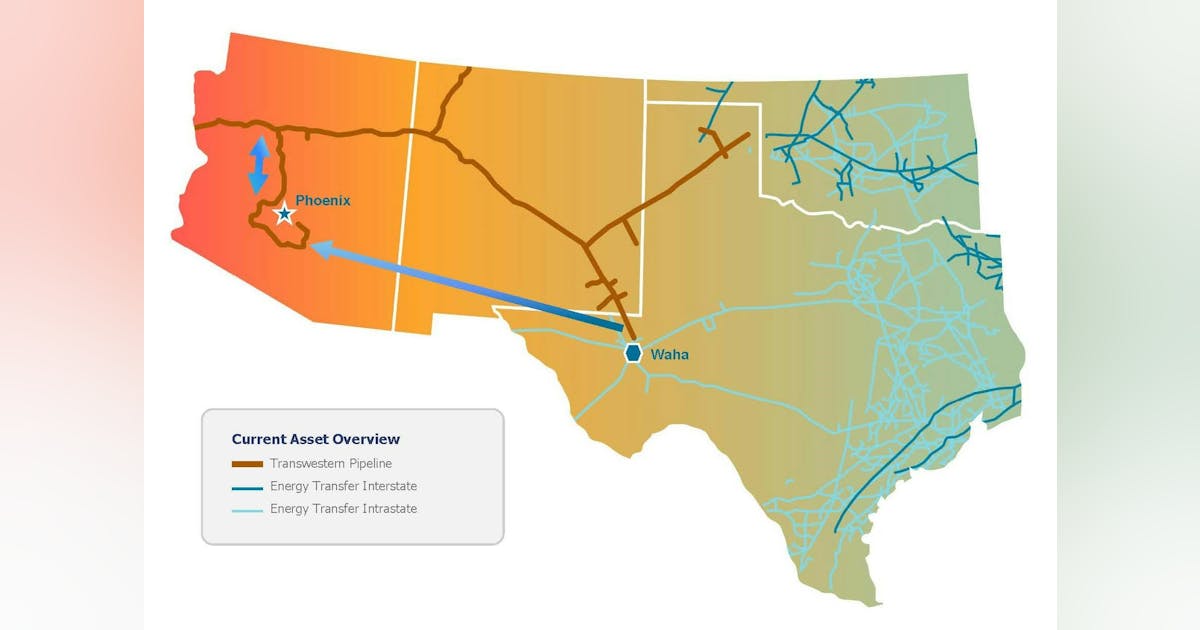

The capex reduction—which is of the same magnitude as recent moves by both Diamondback Energy Corp. and Expand Energy Corp.—comes after a second quarter in which Devon averaged 387,000 b/d of oil production and 841,000 boe/d of total production while averaging 21 rigs and six completion crews. The oil output was up 15% from last year’s spring quarter and oil-equivalent production was up 19% thanks in part to sizable natural gas and natural gas liquids increases from the company’s Permian operations.