Electricity customers of Duke Energy Corp. in Florida will see a storm-related rate increase in 2025 and 2026 after the power and gas utility filed a plan with the state regulator to recover about $1.1 billion in costs from hurricane response efforts.

The figure represents “direct costs associated with the company’s emergency activation and response to hurricanes Debby, Helene and Milton, which included mobilizing more than 27,000 workers and additional resources to restore power for approximately 2 million impacted customers”, Duke Energy said in an online statement.

“Given the severity of these three storms, the filing covers a range of costs, such as deploying hundreds of Duke Energy crews from the entire span of the company’s service territories and acquiring significant mutual assistance from across the country and even Canada; standing up staging sites, basecamps and temporary lodging, while also providing meals for thousands of lineworkers and field personnel; and repairing, rebuilding and replacing critical infrastructure, including poles, wires and transformers, that were damaged and/or destroyed by catastrophic storm surge and wind”, it said.

Charlotte, North Carolina-based Duke Energy said the category 1 (Debby), 3 (Milton) and 4 (Helene) hurricanes had damaged 2,805 poles and caused 2.15 million reported outages in total.

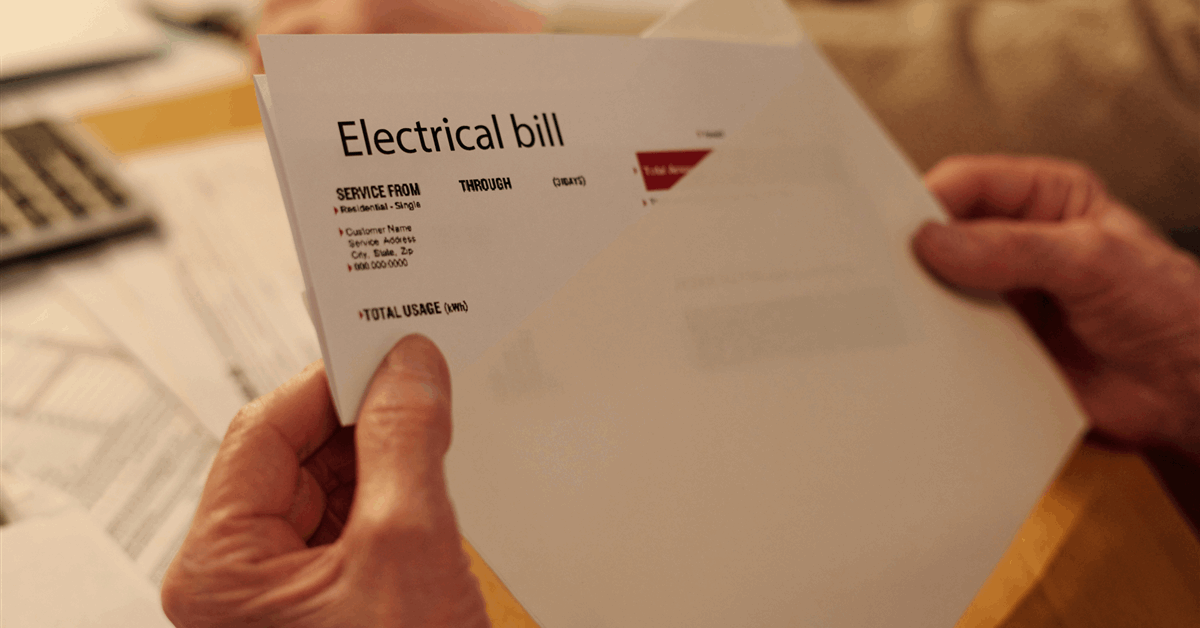

The costs will be passed onto customers starting March 2025. “Residential customers will see an increase of approximately $21 per 1,000 kilowatt-hours (kWh) of electricity on their monthly bills in March 2025 when compared to February 2025”, Duke Energy said.

“While the storm charge actually totals an approximately $31 increase, the impact on customers has been reduced because of the annual, seasonal (March-November) decrease of $10 per 1,000 kWh through November 2025.

“However, it should be noted that storm costs will remain on bills through the end of February 2026”.

It said existing financial assistance offers remain in place.

Melissa Seixas, Duke Energy Florida state president, said, “While today’s filing reflects the costs of those efforts, we want to assure our customers that, as part of our overall commitment to affordability, we strived to minimize the impact on their bills as much as possible, and moving forward, we will keep making strategic investments to strengthen the electric grid and help ensure they have the reliable power they need”.

In its third-quarter report November 7, Duke Energy said it expected to spend between $2.4 billion and $2.9 billion restoring damages caused by the hurricanes, mainly sustained by its units serving the Carolinas and Florida. “Total storm restorations costs will be recognized in the third and fourth quarter 2024”, it said.

Duke Energy Carolinas, Duke Energy Florida and Duke Energy Progress entered into term-loan facilities totaling $1.75 billion, with an option for a further $850 million, Duke Energy said then.

Duke Energy logged $1.24 billion in adjusted net income for the third quarter, down from $1.49 billion for the same three-month period last year partly due to the hurricane costs.

“Lower third-quarter 2024 adjusted results were driven by a higher effective tax rate, storm costs, interest expense and depreciation on a growing asset base”, it said. “These items were partially offset by growth from rate increases and riders”.

Duke Energy’s power segment generated $1.45 billion in income, slightly up year-on-year due to the “net impact of charges related to certain system post-implementation costs”, though adjustments render a lower figure for the third quarter of 2024.

Its gas segment logged a loss of $25 million, primarily driven by depreciation and interests.

Operating revenues totaled $8.15 billion, up from $7.99 billion for the third quarter last year. Regulated power contributed $7.78 billion while regulated gas accounted for $298 million. Operating income landed at $2.14 billion, up from $2.11 billion for the 2023 third quarter.

Duke Energy ended the third quarter of 2024 with $12.14 billion in current assets including $376 million in cash and cash equivalents. Its current liabilities stood at $17.43 billion.

To contact the author, email [email protected]