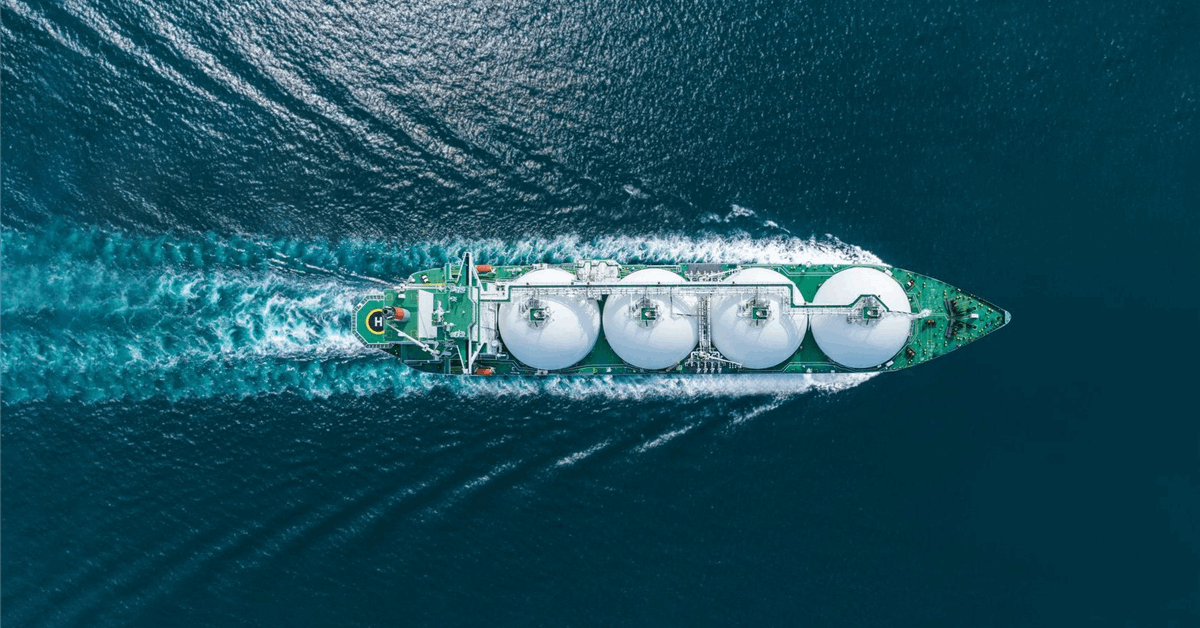

Egypt agreed to buy liquefied natural gas cargoes from Saudi Aramco, Trafigura Group, Vitol Group and others, putting the country on course to be a long-term importer as local production slows.

Egyptian Natural Gas Holding Co. also made agreements with Hartree Partners LP, BGN and Shell, according to people with knowledge of the matter who asked not to be identified.

The move to secure cargoes is aimed at cutting Egypt’s reliance on volatile spot markets, but also exemplifies the sharp turnaround in a country that until just a year ago was exporting LNG. Declining gas output from local fields at a time when an increasing population and rising temperatures are boosting demand have made Egypt a major importer and helped tighten global markets.

The move comes as the North African nation tries to reboot its economy after emerging from a foreign-currency crisis, and a shift to medium-term LNG deals leaves it less exposed to the volatility of the spot LNG market.

Still, higher gas requirements means Egypt’s energy bill is likely to rise to about $3 billion a month over the summer from July, compared with about $2 billion last year, a person familiar with the matter said last month. Bloomberg has previously reported Egypt could buy more than 160 shipments for the period through June 2026.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.