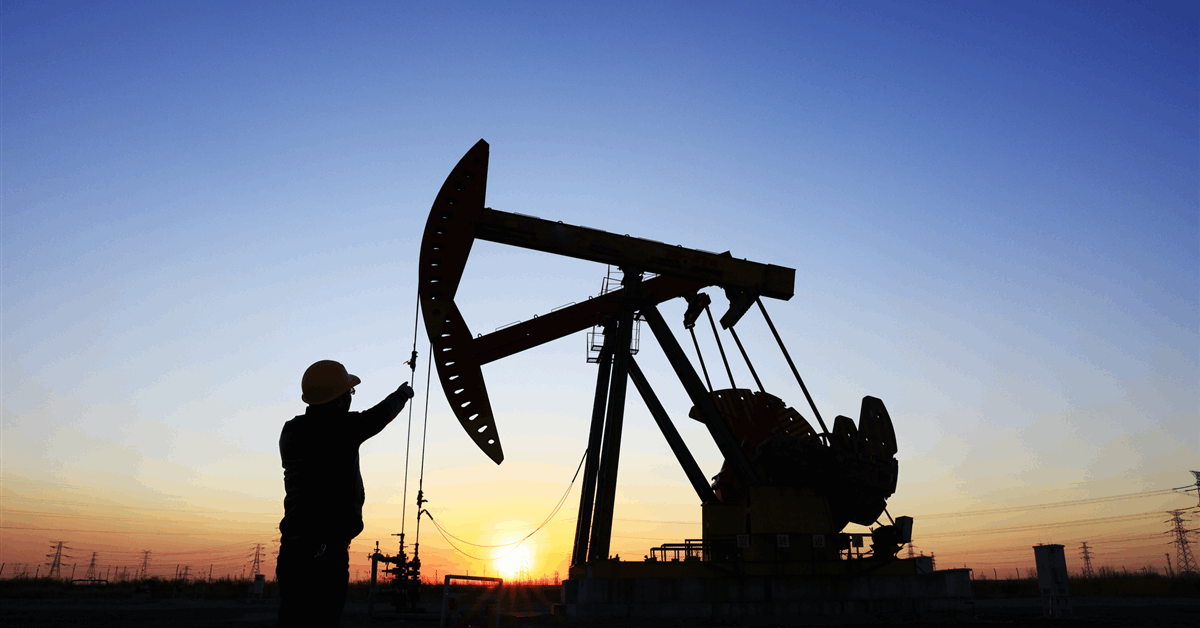

The U.S. Energy Information Administration (EIA) cut its average Brent oil spot price forecast for 2025 and 2026 in its latest short term energy outlook (STEO), which was released on May 6.

According to that STEO, the EIA sees the Brent spot price averaging $65.85 per barrel this year and $59.24 per barrel next year. In its previous STEO, which was released in April, the EIA projected that the Brent spot price would average $67.87 per barrel in 2025 and $61.48 per barrel in 2026.

The EIA’s latest STEO sees the commodity averaging $65.04 per barrel in the second quarter of this year, $62 per barrel in the third quarter, $61 per barrel in the fourth quarter, $60 per barrel across the first and second quarters of next year, $59 per barrel in the third quarter of 2026, and $58 per barrel in the fourth quarter.

In its April STEO, the EIA forecast that the Brent spot price would come in at $66.33 per barrel in the second quarter of 2025, $65.67 per barrel in the third quarter, $64 per barrel in the fourth quarter, $63 per barrel in the first quarter of next year, $62 per barrel in the second quarter, $61 per barrel in the third quarter, and $60 per barrel in the fourth quarter of 2026.

“The Brent crude oil spot price averaged $68 per barrel in April, $5 per barrel lower than in March,” the EIA highlighted in its latest STEO.

“Crude oil prices fell for the third consecutive month, driven primarily by expectations of lower global oil demand growth following the implementation of new tariffs from the United States and its largest trading partners,” it added.

“In April, OPEC+ members also reaffirmed and accelerated their planned production increases, adding to expectations that global oil inventories will grow and put additional downward pressure on oil prices,” it continued.

In its May STEO, the EIA noted that crude oil prices have been lower this year than it expected in its January 2025 STEO release, “which largely reflects lower expectations for global oil demand growth both among market participants and in our forecast”.

“Since the January release, we have reduced our expectations for global oil demand by a total of 0.5 million barrels per day throughout the forecast period, while we have lowered the Brent crude oil price forecast by $8 per barrel on average,” the EIA said in its latest STEO.

“With less oil being consumed this year, oil inventories have risen. We estimate about 0.3 million barrels per day of oil was put into inventory during the first four months of 2025,” it added.

“In our January outlook, we had expected inventories to fall by more than 0.2 million barrels per day over this period. Perceptions of oversupply among oil market participants also reflect production growth from non-OPEC producers, along with announced production increases from OPEC+,” it continued.

“In addition to our lower forecast for global oil demand compared with January, uncertainty about tariff rates and the degree to which those tariffs will affect economic growth and, in turn, oil demand growth has also led to an increase in short-term price volatility,” the EIA went on to state.

The EIA also stated in the STEO that high levels of implied volatility suggest considerable market uncertainty. It highlighted that implied volatility is “a measure of market participants’ expectations for the range of crude oil futures price changes”.

“Since early April, crude oil implied volatility has averaged more than 35 percent, based on futures and options contract data from the CME Group, with daily Brent crude oil implied volatility reaching as high as 39 percent on April 8,” the EIA noted in the May STEO.

“With the exception of periods of heightened risks of supply disruptions from geopolitical events – such as concerns over the potential for widening conflict in the Middle East that occurred last October – implied volatility has generally been less than 30 percent since the beginning of 2024,” it added.

“The recent increase in implied volatility has been mostly driven by concerns of an economic slowdown or recession, rather than any risk of supply disruption. As a result, the increased volatility has been reflected primarily in downward oil price movements over recent weeks,” it continued.

In its May STEO, the EIA said it anticipates that global oil inventories will start to increase in 2025, “growing 0.5 million barrels per day on average in the second quarter of 2025 before increasing by 0.7 million barrels per day in 4Q25”. The EIA highlighted in the report that it expects global oil inventories “to grow on average by 0.4 million barrels per day in 2025 and accelerate to 0.8 million barrels per day on average in 2026”.

“Given our expectation that oil inventories will accumulate over the next several quarters, we forecast that Brent crude oil prices will generally decline throughout the forecast period,” the EIA said in its May STEO.

“As global oil inventories begin to grow, we expect Brent crude oil prices will fall from an average of $76 per barrel in 1Q25 to an average of $61 per barrel by 4Q25 and will average $59 per barrel overall next year,” it added.

The EIA went on to warn in the STEO that significant uncertainty remains in its price forecast.

“The effect that new or additional tariffs will have on global economic activity and associated oil demand is still highly uncertain and could weigh heavily on oil prices going forward,” the EIA said.

Rigzone has contacted the White House and OPEC for comment on the EIA’s May STEO. The White House and OPEC have not responded to Rigzone at the time of writing.

To contact the author, email [email protected]