The electric utility sector’s capital expenditures “are higher than any other sector in the U.S. economy,” Edison Electric Institute President and CEO Drew Maloney said.

A composite wind blade. U.S. electric utilities brought 52 GW of total new generating capacity online in 2024, 11% more than in 2023 and 48% more than in 2022, according to a July 23, 2025, report from the Edison Electric Institute.

Scott Olson via Getty Images

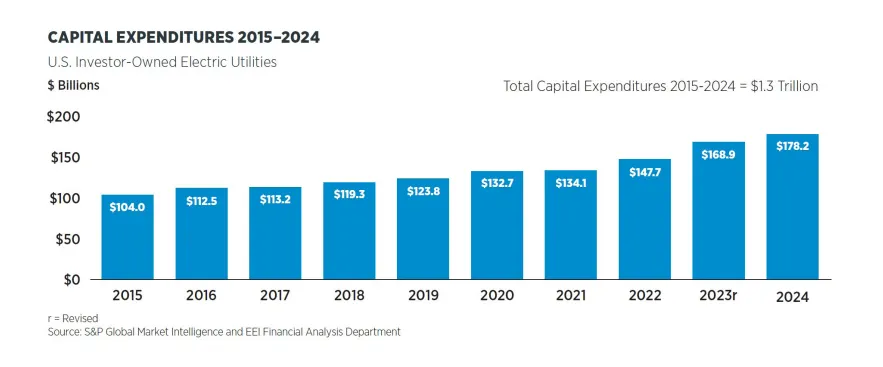

Investor-owned U.S. electric utilities will invest more than $1.1 trillion in the 2025-2029 period, marking a rapid increase in capital expenditures as the sector rushes to meet growing power demand, according to a Wednesday report from the Edison Electric Institute.

Capital expenditures from 2015 to 2024 totaled $1.3 trillion, the trade group noted.

Permission granted by Edison Electric Institute

The electric utility sector’s capital expenditures “are higher than any other sector in the U.S. economy, outpacing transportation, retail, and other capital-intensive industries,” EEI President and CEO Drew Maloney said in a statement. “As demand for electricity continues to grow, we remain committed to making the investments needed to strengthen America’s energy security while ensuring that our customers receive reliable, affordable energy.”

Much of the investment is going to meet rising demand from data centers. While predictions for AI-related load growth vary, EEI’s financial review cited a McKinsey study predicting data center demand will rise about 20% annually from 2023 to 2030, from 60 GW today to 170-220 GW. Depending on factors, demand could even reach 300 GW, the McKinsey analysis said.

But not all proposed data centers will ultimately be built, experts agree. A Schneider Electric 2030 AI power demand estimate put scenario ranges from 16.5 GW to 65.3 GW.

“Of course, prospects for higher demand growth come from more than AI and data centers,” EEI’s report noted. “Increased electrification of transportation, manufacturing reshoring, and strong economic development across many service territories are positive factors as well.”

“The longer-term bias for electric company growth is on the upside,” the report concluded.

Utilities are working to quickly bring new generation online, with the bulk of it being renewable. But in recent months there has been a shift towards proposing new gas capacity to power data centers.

The sector brought 52 GW of new generating capacity online in 2024, 11% more than the 46.8 GW in 2023 and 48% more than the 35 GW in 2022, according to the report.

“The increase from 2023 to 2024 was primarily due to additional solar and storage capacity,” EEI said. “Solar capacity installations increased 63% to 32,486 MW in 2024, the fastest annual growth since 2020.”

Energy storage additions increased 54% to 11,534 MW in 2024, EEI said. New gas capacity brought online decreased 79% to 2,428 MW in 2024, “marking natural gas’s lowest increase since 2020,” the report said. “Wind capacity additions also decreased,” from 6,343 MW in 2023 to 4,132 MW in 2024, “indicating a maturing technology after decades of rapid growth.”

<!– –>