Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More

This is how smart your smartphone is getting. Now it will be able to analyze your saliva and do a real-time hormone test.

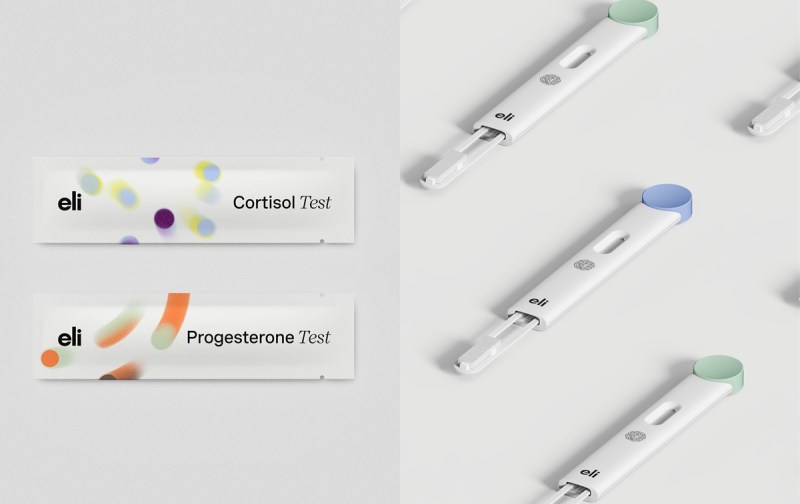

Eli Health, a pioneer in hormone monitoring technology, is launching the Hormometer at CES 2025, starting with cortisol and progesterone tests. Eli Health said that it has been working on it for five years and has 12 patent-pending innovations.

It’s the first solution to transform any smartphone into a portable, real-time hormone analyzer using saliva. Debuting at CES 2025 and a Best of Innovation winner in the CES Innovation Awards 2025 program for Digital Health, this groundbreaking solution redefines hormone tracking by offering real-time and actionable health insights directly through saliva, empowering users to monitor and optimize wellness on the go.

“At Eli Health, we are creating unprecedented access to hormone health insights, providing individuals with the tools they need to better understand and support their wellness—every day and across life,” said said Marina Pavlovic Rivas, CEO of Eli Health, in a statement. “The Hormometer is the result of years of dedicated R&D in our Canadian facility, supported by a multidisciplinary team of scientists, engineers, AI developers, doctors, and innovators. Combining cutting-edge innovation with user-friendly design, it delivers lab-grade precision in the palm of your hand. We are making hormone monitoring as simple and accessible as checking your heart rate, helping people proactively manage their health.”

Just as the glucometer transformed diabetes care, the Hormometer ushers in a new era of hormone health. Compact, non-invasive, and accessible, it provides immediate, actionable insights into critical hormones, beginning with cortisol and progesterone.

Leveraging a dozen patent-pending innovations, this FDA-registered system combines cutting-edge bioassay technology and microfluidics with advanced AI computer-vision analysis, delivering lab-grade precision and insights anytime, anywhere. It revolutionizes hormone monitoring by making it as simple as brushing teeth and as affordable as a cup of coffee.

Hormones produced by endocrine glands are vital chemical messengers that regulate nearly every aspect of health, including stress, sleep, mood, energy, reproduction, and overall health and longevity.

Imbalances in hormones can have wide-ranging effects, contributing to issues such as chronic stress, fatigue, male and female infertility, weakened immunity, weight fluctuations, disrupted sleep, poor heart and bone health, and accelerated aging.

Traditionally, hormone levels are measured through lab tests of blood, saliva, or urine, but these methods are costly and time-intensive, often taking weeks for results. In contrast, existing at-home hormone tests, while more convenient, primarily rely on somewhat messy urine tests and are predominantly focused on women’s fertility, offering no insights into broader hormonal health for all genders. These tests typically offer limited insights, with many providing binary results (e.g., confirming the presence of a hormone) without ongoing monitoring and insights.

Unlocking the science of saliva

While the correlation between hormone concentrations in blood and saliva has been recognized for years, Eli Health is the first to develop a portable and instant saliva-based solution with unparalleled precision across multiple hormones. This innovation is the result of five years of rigorous research and development, supported by a $9 million investment.

The Hormometer combines an innovative one-step process cartridge, advanced microfluidics, and a self-contained ultra-sensitive bioassay, paired with powerful software that transforms any smartphone into a sophisticated chemical analyzer thanks to computer-vision algorithms. This breakthrough delivers precise, convenient hormone monitoring in just three easy steps:

Saliva-Collection: The elegantly designed cartridge, slim as a finger, is used like a thermometer, placed in the mouth, and held for 60 seconds. At its tip, a collection pad made from proprietary materials efficiently captures the saliva sample and releases it onto the bioassay. The bioassay detects specific hormones by binding them to capturing reagents, producing visible test lines within 20 minutes. Offering up to 1,000,000 times greater sensitivity than most at-home market products, the Hormometer sets a new standard for precision in hormone monitoring.

Smartphone Biofluid Analysis: The Eli app transforms smartphones into powerful biofluid scanners. Harnessing the phone’s camera, the app precisely analyzes the test’s alignment, color intensity, and patterns to extract detailed and accurate hormone data with advanced AI algorithms. What once took days to process in a laboratory with trained personnel is now accomplished in seconds, providing anyone with instant, lab-quality insights at their fingertips.

Health Insights: The Eli Health app provides personalized trends and actionable recommendations for managing various hormones and their related health functions, including stress management, sleep optimization, athletic performance, fertility, and more. The company is creating the first longitudinal data set of its kind, enabling unparalleled insights and progress in precision medicine.

Hormone health starting with cortisol and progesterone testing

Eli Health’s platform begins with two key hormones—cortisol and progesterone—chosen for their critical roles in overall health:

● Cortisol, the “stress hormone,” has an influence on most bodily functions and regulates the body’s stress response, cognitive and physical performance, metabolism, immune function, and much more. Monitoring cortisol helps users understand how stressors impact their health, guiding them to adopt better routines. The Eli Cortisol Test, the world’s first instant test for this hormone, delivers 97% accuracy compared to FDA-approved traditional lab gold standard tests in third-party testing.

● Progesterone, essential for reproductive and overall health, influences menstrual cycles, fertility, perimenopause, and endocrine conditions. Eli’s progesterone test provides precise insights into hormonal balance, helping users optimize their health and manage hormonal changes. With 94% agreement to the FDA-approved traditional lab test in third-party testing, it offers unmatched everyday accuracy.

With testosterone and estradiol already in development, Eli Health remains dedicated to expanding its hormone health platform to many other biomarkers, advancing wellness through cutting-edge precision.

Availability and pricing

Launching January 2025 in the USA and Canada. Subscription plans start at $8/test for a 12-month commitment, with other flexible options available. For more information, visit https://eli.health or the Eli Health booth at CES 2024 [Venetian Expo, Hall G – 62066].

Daily insights on business use cases with VB Daily

If you want to impress your boss, VB Daily has you covered. We give you the inside scoop on what companies are doing with generative AI, from regulatory shifts to practical deployments, so you can share insights for maximum ROI.

Read our Privacy Policy

Thanks for subscribing. Check out more VB newsletters here.

An error occured.