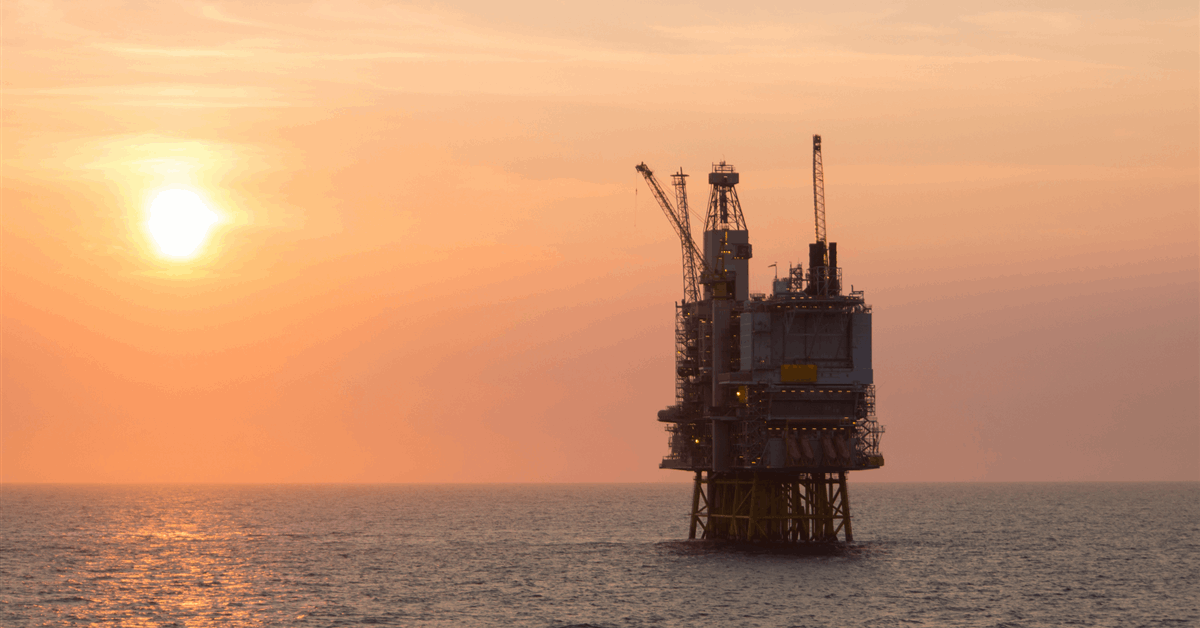

Enbridge Inc. has earmarked an investment of up to CAD 2 billion ($1.39 billion) until 2028 for a Canada-United States liquids pipeline with a capacity of about 3 million barrels a day of crude oil.

That will be spent on “further enhancing and sustaining reliability and efficiency aimed at ensuring the Mainline system continues to operate safely and at full capacity to support maximum throughput for years to come”, the Calgary, Canada-based energy transporter and gas utility said in an online statement.

Mainline, which started service seven decades ago and has grown to be Canada’s biggest crude conveyor, carries production from the Canadian province of Alberta to eastern Canada and the U.S. Midwest. Besides petroleum, it also transports refined products and natural gas liquids. Mainline stretches nearly 8,600 miles, according to Enbridge.

The optimization will “support the growing need for ratable egress out of Alberta”, said chief executive Greg Ebel.

Enbridge also announced additional investments in two pipelines: CAD 400 million for the BC Pipeline and CAD 100 million for the T15 project.

The investment for the BC Pipeline is for the Birch Grove project under the pipeline’s T-North section. Expected to raise the BC Pipeline’s capacity by 179 million cubic feet per day to about 3.7 billion cubic feet a day by 2028, the Birch Grove project will provide additional egress for gas producers in northeastern British Columbia to access markets for their growing production, driven by the Montney formation.

The investment for T15 phase 2 is meant for the installment of additional compression to double the original pipeline’s capacity. Expected to go onstream 2027, the expanded pipeline will deliver around 510 million cubic feet a day of natural gas to Duke Energy Corp.’s Roxboro plant in North Carolina as it transitions from coal to gas-fired generation.

The investments come despite President Donald Trump imposing tariffs on Canada, including for its energy exports. Most Canadian products, as well as Mexican products, entering the U.S. will bear a 25 percent tariff while Canadian energy will have a lower rate of 10 percent. The tariffs apply to goods that do not qualify for preference under the three countries’ trade agreement, according to information published online by the White House.

According to the presidential house, the move is in response to Canada- and Mexico-based trafficking of drugs into the U.S. and illegal migration from Mexico. The tariffs stay “until the crisis is alleviated”, the White House said in a statement February 1.

Ebel said, “In combination with the $8 billion [CAD] of projects we sanctioned in 2024, Enbridge’s secured growth now sits at $29 billion [CAD]”.

“We expect to place approximately $23 billion [CAD] of that secured backlog into service through 2027 and the remainder is slated to enter service through 2029”, Ebel added.

“Enbridge will continue to be disciplined as we continuously high-grade our $50 billion [CAD] opportunity set through the end of the decade. Rigorous investment criteria, including project-specific hurdle rates and low-risk commercial models, allow us to capture strong risk-adjusted returns and maximize value for our investors.

“Looking ahead, we’ll maintain our capital discipline and financial flexibility. Our long-held target debt-to-EBITDA range of 4.5x to 5.0x remains the sweet spot for Enbridge and our steadily growing business can equity self-fund $9-$10 billion [CAD] of annual growth capital”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR