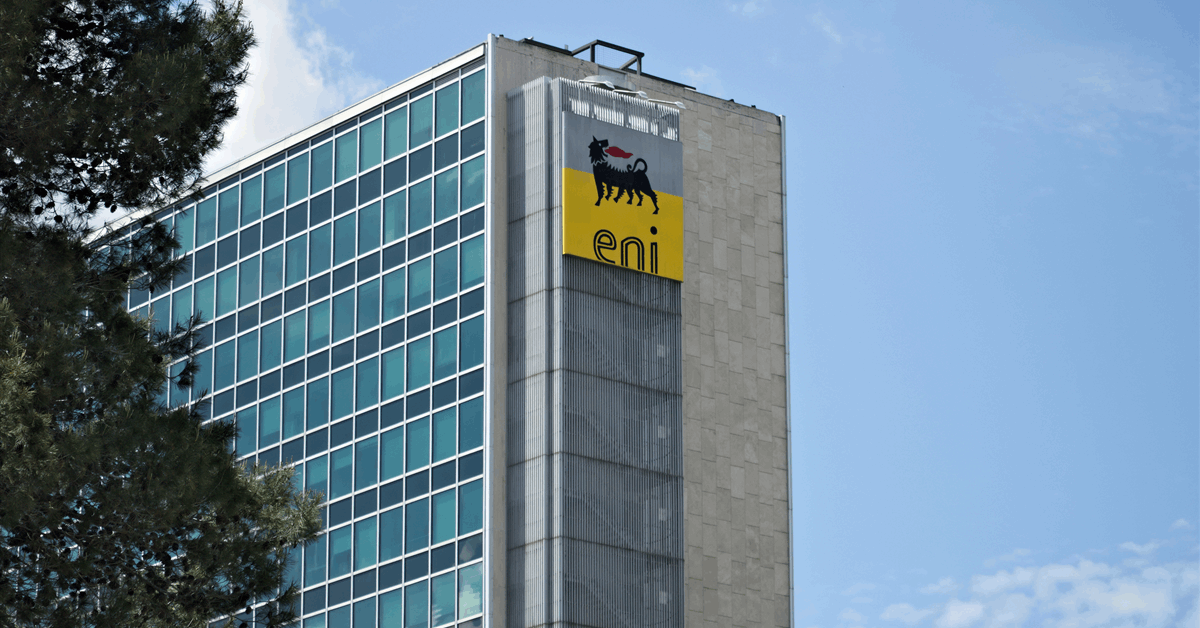

Eni SpA’s chemical arm, Versalis SpA, has transferred its oilfield chemicals assets to a new company called Versalis Oilfield Solutions SRL in an expansion bid, Eni said Tuesday.

“The operation aims to consolidate Versalis’ position in the oilfield services sector by bringing together key expertise and strategic activities in a single, focused and operationally efficient entity”, Italy’s state-controlled Eni said in an online statement.

“Versalis’ oilfield operations encompass research and development of advanced chemical formulations, outsourcing their production and marketing solvents and additives designed for the oil drilling industry. Products are tailored to meet specific client requirements, while services include sales and after-sales support, ensuring continuous and qualified technical assistance”.

Launched 2010, Eni’s oilfield chemicals business now operates in Africa, the Americas, Asia and Europe, according to the company.

Versalis Oilfield Solutions will expand “the scope of activities in terms of products and services, achieve higher revenue targets, and maintain strong profitability”, Eni said.

Last year Eni finalized a plan to transform Versalis, which makes basic chemicals, chemical products including plastics and biochemical products such as biolubricants.

With an investment of around EUR 2 billion ($2.36 billion), the plan “aims to reduce emissions by approximately 1 million tonnes of CO2, currently about 40 percent of Versalis’ emissions in Italy”, Eni said in a press release October 24, 2024.

“It includes the set-up of new industrial plants consistent with the energy transition and decarbonization of industrial sites across sustainable chemistry, as well as biorefining and energy storage”, Eni added. “To enable the construction of the new plants, activity at the cracking plants in Brindisi and Priolo, and the polyethylene plant in Ragusa, will be phased out”.

“Eni aims to significantly reduce Versalis’ exposure to basic chemicals, a sector that is facing structural and irreversible decline in Europe, and which has led to economic losses that have been close to 7 billion in cash terms over the last 15 years, 3 billion of which was in the last five years”, the company said.

Eni expects to complete the plan by 2029.

In its “Capital Markets Update” February 2025, Eni said, “We expect Versalis to achieve an EBIT break-even by 2027, an EBIT adjusted turnaround of around EUR 900 million by 2028 (vs 2024), a reduction in capital intensity of ~EUR 350 Mln versus the previous Plan leading to FCF break-even also by 2028, with a ROACE related to the new platforms of around 10 percent by 2030”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR