Eni SpA has signed a 10-year deal to supply Thailand’s Gulf Development Co 800,000 metric tons a year of liquefied natural gas (LNG).

“The LNG will be delivered at regasification terminals located in the country starting from 2027”, the Italian state-backed integrated energy company said in an online statement.

The new contract is on top of a two-year agreement signed 2024 under which Eni is to supply Gulf, a multi-sector company, about 500,000 metric tons per annum of LNG starting 2025.

“The agreement is Eni’s first long-term LNG supply to Thailand, in a move designed to strengthen its presence in Asia”, Eni said.

A day earlier Eni said it had won a deal to supply Turkiye’s state-owned Boru Hatlari ile Petrol Tasima AS (BOTAS) around 400,000 metric tons per year of LNG for 10 years.

The deal is on top of an earlier one signed September under which BOTAS committed to buying 400,0000 metric tons a year for three years from Eni, Eni said in a press release.

BOTAS said September 12 it had signed agreements with Eni, BP PLC, Cheniere Energy Inc, Equinor ASA, Hartree Partners LP, JERA Co Inc, SEFE Securing Energy for Europe GmbH and Shell PLC for around 15 billion cubic meters (529.72 billion cubic feet) of LNG. The volumes are to be delivered to Turkiye in 2025-28.

Eni said of the 10-year contract, “The agreement is Eni’s first long-term LNG sale to Turkiye, confirming the growing role of LNG in supporting the country’s energy needs, and is in line with Eni’s strategy to diversify its global LNG footprint, expanding its customer base in markets with high potential and growing its LNG portfolio to approximately 20 million metric tons per annum [MMtpa]”.

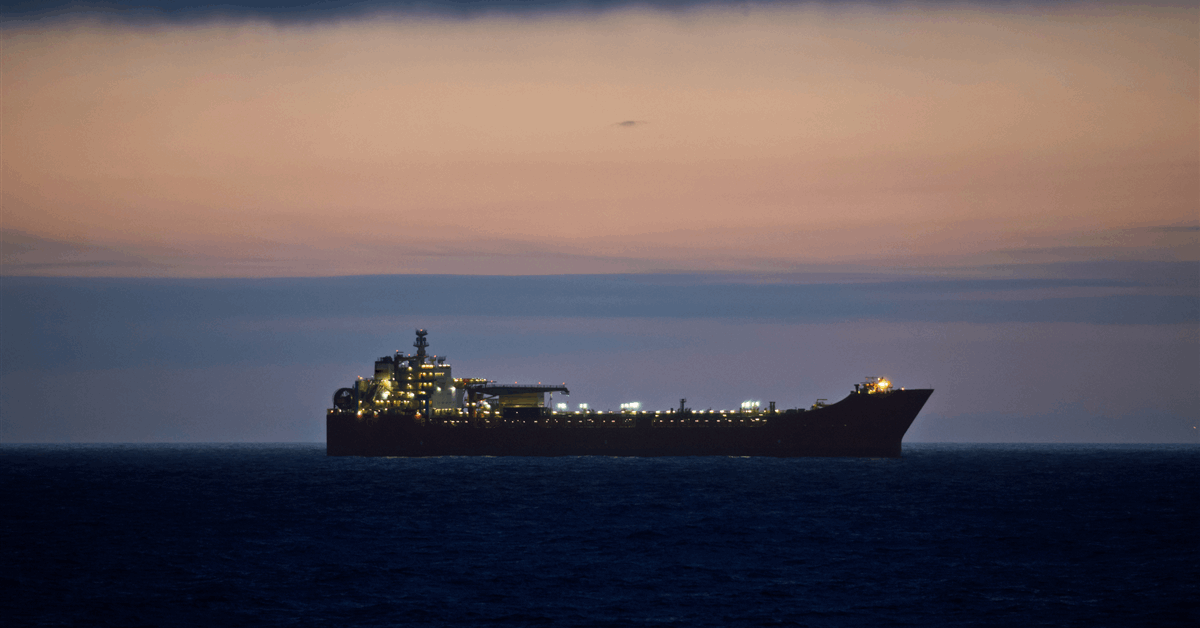

On December 2 Eni said the second phase of Congo LNG in the Republic of the Congo had started up. The project now has a capacity of three MMtpa or 4.5 billion cubic meters (158.92 billion cubic feet) a year of natural gas equivalent, according to Eni.

Eni expects to dispatch phase 2’s first LNG cargo “early 2026”, it said in a press release.

Congo LNG, the Central African country’s first LNG production facility, shipped its first cargo February 2024 through the Tango FLNG unit, which has a capacity of 600,000 metric tons a year, according to Eni. Congo LNG mainly exports to Europe, according to Eni.

Congo LNG and its source fields, Nene and Litchendjil, are part of the Marine 12 concession, where Eni is operator with a 65 percent stake. Russia’s Lukoil PJSC owns 25 percent. National oil and gas company SNPC holds 10 percent.

On October 2 Eni announced a positive final investment decision on Mozambique’s Coral North floating LNG project. Expected to start operations 2028, the project is designed to produce up to 3.6 MMtpa.

Eni owns 50 percent of the Coral North joint venture. China National Petroleum Corp holds 20 percent, South Korea’s state-owned Kogas 10 percent, Mozambique’s Empresa Nacional de Hidrocarbonetos 10 percent and Abu Dhabi National Oil Co 10 percent.

Eni already has an operational LNG facility in Mozambique. Coral South began service 2022. It has a declared capacity of around 3.4 MMtpa.

Also this year Eni and Argentina’s state-owned YPF SA signed a deal to build a liquefaction facility to enable the export of gas from the Vaca Muerta field in the South American country.

“The agreement defines the required steps to reach the final investment decision for the phase of the project that includes the production, treatment, transportation and liquefaction installations of gas through floating units, for a total capacity of 12 million tons of LNG per year”, Eni said in a statement June 6. The capacity is planned to grow to up to 30 MMtpa by 2030.

“Argentina LNG is a large-scale integrated, upstream and midstream gas development project designed to develop the resources of the onshore Vaca Muerta field and serve international markets”, Eni said.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR