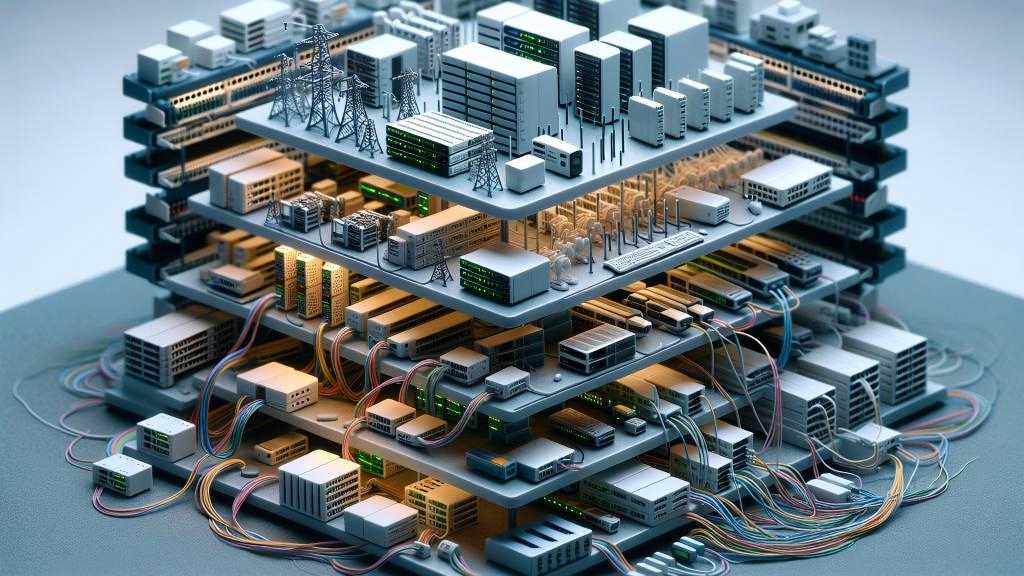

- Private data centers: 29.5%

- Traditional public cloud: 35.4%

- GPU as a service specialists: 18.5%

- Edge compute: 16.6%

“There is little variation from training to inference, but the general pattern is workloads are concentrated a bit in traditional public cloud and then hyperscalers have significant presence in private data centers,” McGillicuddy explained. “There is emerging interest around deploying AI workloads at the corporate edge and edge compute environments as well, which allows them to have workloads residing closer to edge data in the enterprise, which helps them combat latency issues and things like that. The big key takeaway here is that the typical enterprise is going to need to make sure that its data center network is ready to support AI workloads.”

AI networking challenges

The popularity of AI doesn’t remove some of the business and technical concerns that the technology brings to enterprise leaders.

According to the EMA survey, business concerns include security risk (39%), cost/budget (33%), rapid technology evolution (33%), and networking team skills gaps (29%). Respondents also indicated several concerns around both data center networking issues and WAN issues. Concerns related to data center networking included:

- Integration between AI network and legacy networks: 43%

- Bandwidth demand: 41%

- Coordinating traffic flows of synchronized AI workloads: 38%

- Latency: 36%

WAN issues respondents shared included:

- Complexity of workload distribution across sites: 42%

- Latency between workloads and data at WAN edge: 39%

- Complexity of traffic prioritization: 36%

- Network congestion: 33%

“It’s really not cheap to make your network AI ready,” McGillicuddy stated. “You might need to invest in a lot of new switches and you might need to upgrade your WAN or switch vendors. You might need to make some changes to your underlay around what kind of connectivity your AI traffic is going over.”

Enterprise leaders intend to invest in infrastructure to support their AI workloads and strategies. According to EMA, planned infrastructure investments include high-speed Ethernet (800 GbE) for 75% of respondents, hyperconverged infrastructure for 56% of those polled, and SmartNICs/DPUs for 45% of surveyed network professionals.