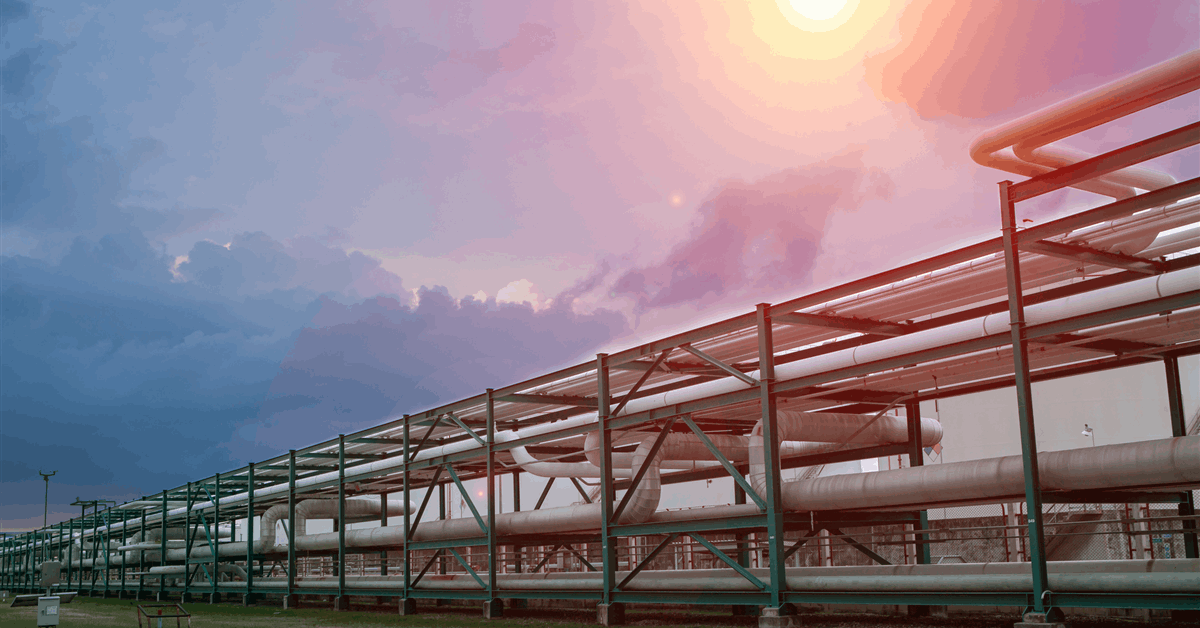

Howard Energy Partners (HEP) has completed the acquisition of a bidirectional ethylene pipeline in Texas from EPIC Midstream Holdings LP.

The 120-mile-long, 12-inch-wide pipeline links Exxon Mobil Corp. and Saudi Basic Industries Corp.’s (SABIC) ethane cracker in Gregory to storage in Markham. The cracker can produce up to 1.8 million metric tons a year of ethylene, according to ExxonMobil-SABIC joint venture Gulf Coast Growth Ventures.

The pipeline has an initial design capacity of 7.8 million pounds a day, which can be increased to meet growing ethylene demand in south Texas, according to Houston-based EPIC.

“In addition to increasing HEP’s overall footprint in the Gulf Coast region, the newly acquired ethylene pipeline offers unique synergies with HEP’s existing Javelina Plant, a treating and fractionation plant that extracts olefins, hydrogen, and natural gas liquids from the gas streams produced by local refineries”, HEP said in an online statement Wednesday.

The transaction was completed last month, EPIC said separately. Neither party disclosed the price.

Mike Howard, HEP chair and chief executive said, “This acquisition aligns with our long-term strategy of building a diversified midstream company through organic growth and acquisitions, anchored by long-term contracts”.

San Antonio, Texas-based HEP said 2024 was a record year for the company in terms of acquisition transactions, “with several material transactions totaling more than $1.1 billion”.

HEP now owns and operates over 1,500 miles of pipeline, nearly one billion cubic feet per day of cryogenic processing capacity and almost 2.5 billion barrels of tank storage capacity in the United States and Mexico, according to the company.

EPIC chief executive Brian Freed said, “The transaction completes the successful development, operation and divestiture of critical midstream infrastructure along the Texas Gulf Coast”.

Earlier Phillips 66 announced a deal to acquire from EPIC natural gas liquids (NGL) pipelines, fractionation facilities and distribution systems in the Permian basin for $2.2 billion.

“This transaction optimizes our Permian NGL value chain, allows Phillips 66 to provide producers with comprehensive flow assurance, reaching fractionation facilities near Corpus Christi, Sweeny, and Mont Belvieu, Texas, and is expected to deliver attractive returns in excess of our hurdle rates”, Phillips 66 chair and chief executive Mark Lashier said in an online statement Monday.

EPIC’s NGL operations comprise two fractionators with a capacity of170,000 barrels per day (bpd) near Corpus Christi, Texas; purity distribution pipelines stretching about 350 miles; and an NGL pipeline around 885 miles long and with a capacity of 175,000 bpd. The NGL pipeline links the Delaware, Midland and Eagle Ford basins to the fractionation complexes and Phillips 66’s Sweeny Hub.

“EPIC NGL is in the process of increasing its pipeline capacity to 225 MBD [thousand barrels per day] and has sanctioned a second expansion to increase capacity to 350 MBD”, Phillips 66 said.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR