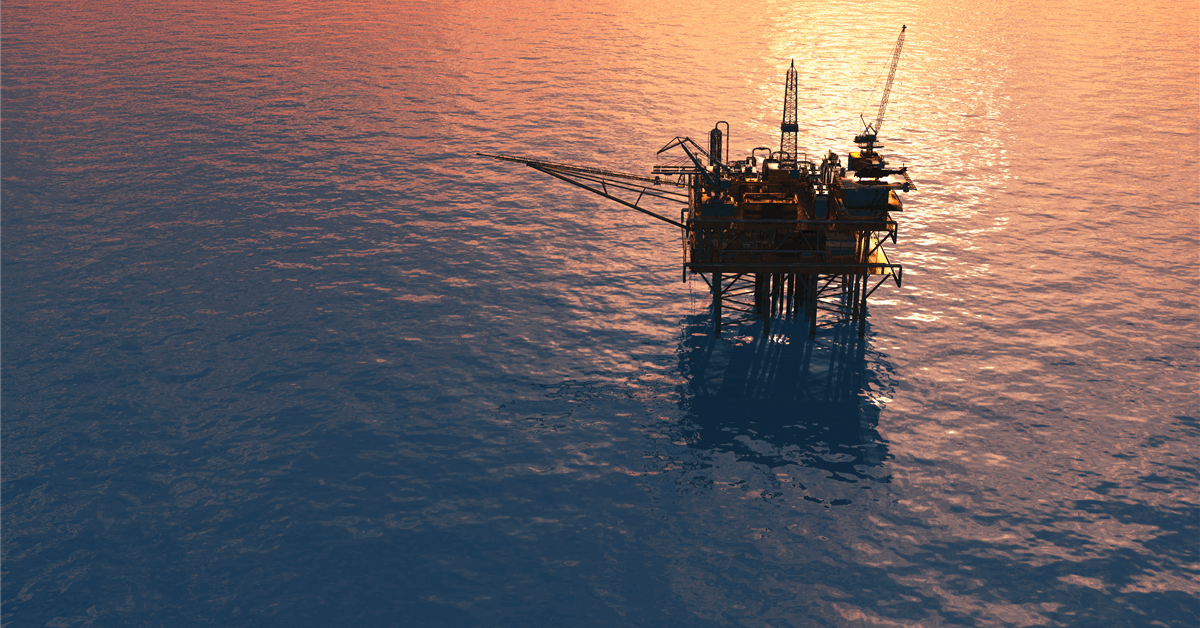

“Uncertainty” was highlighted several times by exploration and production companies in the ‘comments’ section of the first quarter 2025 Dallas Fed Energy Survey, which was released this week.

“The key word to describe 2025 so far is ‘uncertainty’, and, as a public company, our investors hate uncertainty,” one exploration and production company noted in an exploration and production firm segment of the comments section, which the survey outlined showed comments from respondents’ completed surveys that had been edited for publication.

“This has led to a marked increase in the implied cost of capital of our business, with public energy stocks down significantly more than oil prices over the last two months,” the company added.

“This uncertainty is being caused by the conflicting messages coming from the new administration,” it continued.

The company went on to state that “there cannot be ‘U.S. energy dominance’ and $50 per barrel oil”.

“Those two statements are contradictory. At $50 per barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (one million barrels per day plus within a couple quarters),” the company added.

“This is not ‘energy dominance’. The U.S. oil cost curve is in a different place than it was five years ago; $70 per barrel is the new $50 per barrel,” it went on to note.

Another exploration and production company stated in the comments section that “trade and tariff uncertainty are making planning difficult”.

A separate exploration and production firm noted that “the administration’s chaos is a disaster for the commodity markets”.

“‘Drill, baby, drill’ is nothing short of a myth and populist rallying cry. Tariff policy is impossible for us to predict and doesn’t have a clear goal. We want more stability,” that company added.

One more exploration and production company representative said, “I have never felt more uncertainty about our business in my entire 40-plus year career”.

Another exploration and production business noted in the comments section, “uncertainty around everything has sharply risen during the past quarter”.

“Oil prices feel incredibly unstable, and it’s hard to gauge whether prices will be in the $50s per barrel or $70s per barrel. Combined, our ability to plan operations for any meaningful amount of time in the future has been severely diminished,” that company added.

A separate business stated, “the only certainty right now is uncertainty”.

“With that in mind, we are approaching this economic cycle with heightened capital discipline and a focus on long-term resilience”, that company added.

Another exploration and production firm warned in the comments section that “the political climate caused by the new presidential administration appears to be creating instability”.

One more business said in the comments section that “global geopolitical unrest and the uncertain economic outcomes of the administration’s tariff policies suggest the need to hit the pause button on spending”.

Rigzone has contacted the White House, the Trump transition team, the U.S. Department of Energy (DOE), and the American Petroleum Institute (API) for comment on the exploration and production firm segment of the comments section in the first quarter 2025 Dallas Fed Energy Survey. At the time of writing, none of the above have responded to Rigzone.

In his inaugural address on January 20, which is transcribed on the White House website, U.S. President Donald J. Trump said, “we will drill, baby, drill”.

In an executive order issued on the same day, which was also posted on the White House website, Trump stated that “it is … in the national interest to unleash America’s affordable and reliable energy and natural resources”. That executive order issued directives focusing on “unleashing energy dominance through efficient permitting”.

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District, the Dallas Fed Energy Survey states.

The Federal Reserve Bank of Dallas is part of the Federal Reserve System, the central bank of the United States, the Dallas Fed site highlights.

To contact the author, email [email protected]