European natural gas jumped as traders assessed a range of bullish drivers — from a sharp rebound in oil prices to the region’s plans for a gradual phase-out of Russian supplies.

Benchmark futures rose as much as 6.7% after a retreat in the previous session.

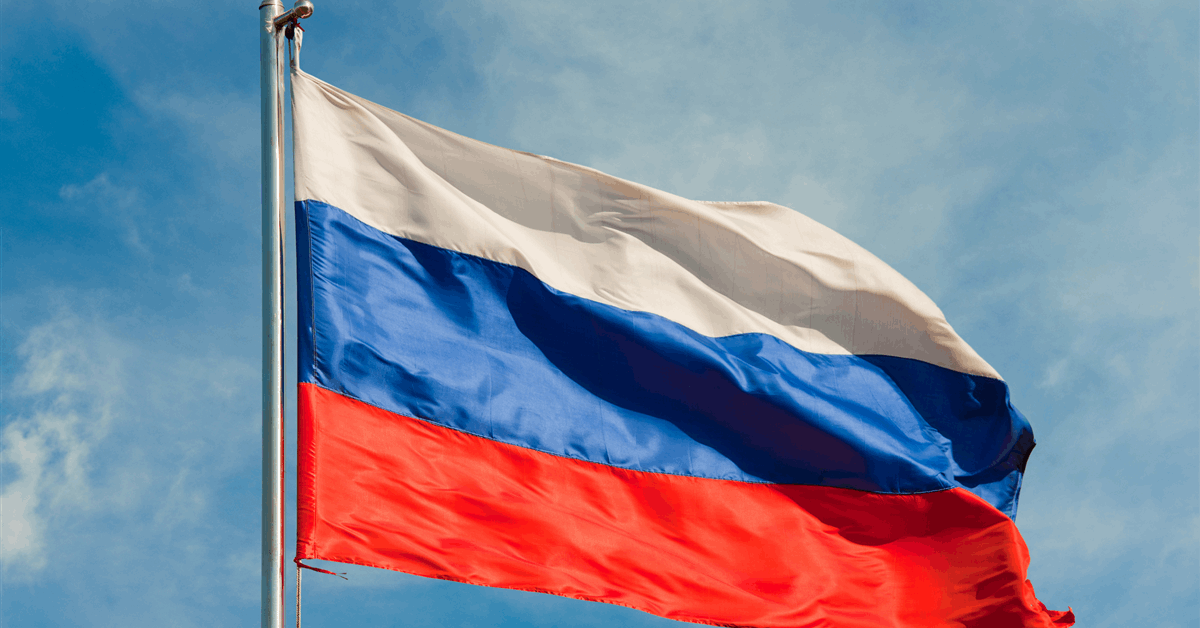

The European Commission unveiled a roadmap to switch off the remaining flows of Russian energy. Details will come next month, but Tuesday’s publication showed a phased approach. The plan envisages a ban on all new contracts and halt to existing deals on the spot market — a third of Russian gas flows to the bloc — by the end of 2025. Long-term contracts will be phased out by the end of 2027.

While the commission said its measures to terminate contracts won’t be sanctions, concerns about the future of those flows are adding volatility to an already nervous market.

Seasonal maintenance in Europe’s top supplier Norway is cutting pipeline flows to key consumers, while US data signal lower fuel flows to some export facilities. That’s in addition to a cold spell forecast in parts of Europe for the next two weeks, which could cause some heating demand, especially in the east.

Europe’s gas prices lost more than 20% in April, when the US-led trade war started to weigh on the global economic outlook and prospects for energy demand. The drop has made it less challenging for Europe to replenish its heavily depleted fuel stockpiles, but it also spurred opportunistic buying in other regions, with some Chinese importers resuming deals on the spot market after months of relative inactivity.

Hopes for trade talks between China and the US are also growing after Treasury Secretary Scott Bessent said Washington could see “substantial progress in the coming weeks.”

“The European gas market remains challenging for all market players due to geopolitical tensions and unclear developments in European energy supply,” Uniper SE’s Chief Financial Officer Jutta Donges said Tuesday.

Dutch front-month futures, Europe’s gas benchmark, traded 5.6% higher at €34.77 a megawatt-hour as of 4:39 p.m. in Amsterdam.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg