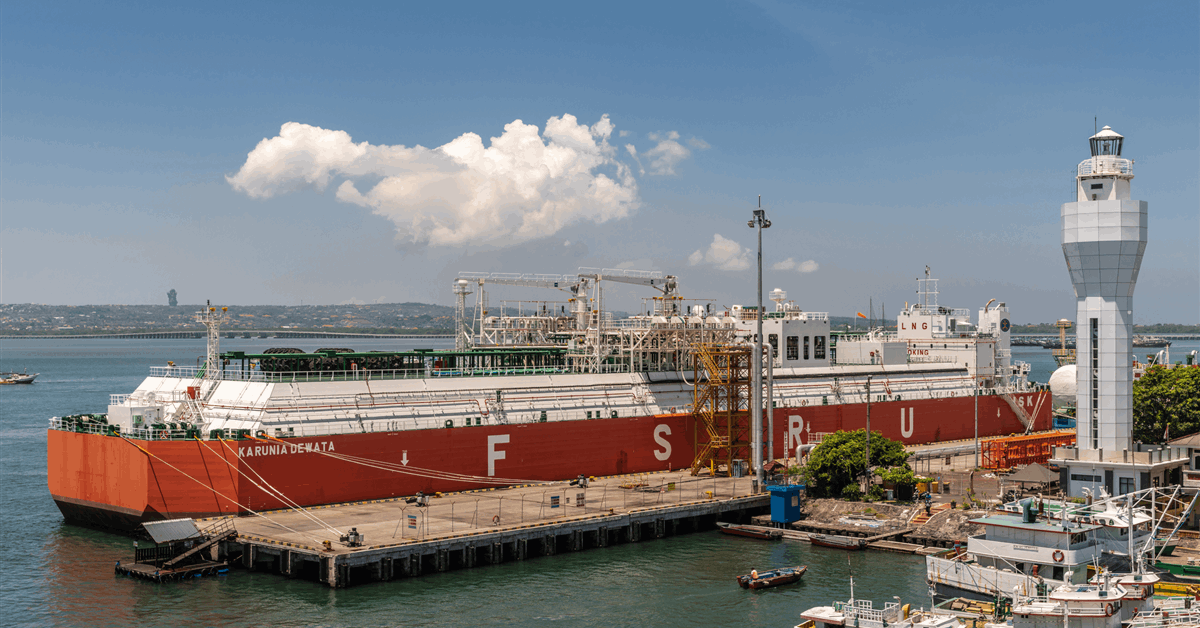

United States-based liquefied natural gas (LNG) company Excelerate Energy Inc. has reported a net income of $46.1 million for the fourth quarter of 2024, compared to $45.5 million for the previous quarter.

Excelerate Energy said its full-year net profit landed at $153 million, up from $126.8 million for 2023. The company attributed the increase to various charter rate increases and full-year earnings for the floating storage and regasification unit (FSRU) Excelsior, as well as lower depreciation expense driven by an update to the company’s FSRU useful life assumption in the fourth quarter of 2023. These were partially offset by high operating costs related to scheduled maintenance in the fourth.

“2024 was an exceptional year for Excelerate. We delivered record full-year financial results while maintaining our standard of operational excellence”, Steven Kobos, President and Chief Executive Officer, said. “Our continued success, driven largely by the performance of our core regasification business, has positioned us as the industry leader in FSRUs and downstream LNG infrastructure. As a U.S. LNG company with a global presence, we remain well positioned to connect growing global LNG supply to attractive demand centers around the world”.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for the fourth quarter was $91.6 million, slightly below the $92.3 million logged for the previous quarter. 2024 adjusted EBITDA came at $348.2 million, edging above the $346.8 million reported for the prior year.

Revenues reached $274.6 million and $851.4 million for the fourth quarter and full year 2024, respectively. Fourth-quarter revenue increased sequentially, while 2024 revenue was below that of 2023.

For 2025, the company expects its EBITDA to range between $340 and $360 million, with maintenance expenditure to range between $60 and $70 million.

“In 2025, we will continue to focus on expanding our fleet, optimizing our LNG supply portfolio, and pursuing strategic investments in both FSRU-based import terminals and downstream LNG infrastructure. We are committed to executing our growth strategy, and we look forward to announcing key initiatives that will drive value creation for our shareholders in the near and mid-term”, Kobos added.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR