Executives from oil and gas firms have revealed where they expect the West Texas Intermediate (WTI) crude oil price to be at various points in the future in the second quarter Dallas Fed Energy Survey, which was released recently.

The survey asked participants what they expect WTI prices to be in six months, one year, two years, and five years. Executives from 120 oil and gas firms answered this question and gave a mean response of $68 per barrel for the six month and year marks, $72 per barrel for the two year mark, and $77 per barrel for the five year mark, the survey showed.

Executives from 124 oil and gas firms answered this question in the first quarter Dallas Fed Energy Survey and gave a mean response of $68 per barrel for the six month mark, $70 per barrel for the year mark, $74 per barrel for the two year mark, and $82 per barrel for the five year mark, that survey showed.

The latest survey also asked participants what they expect the WTI crude oil price to be at the end of 2025. Executives from 135 oil and gas firms answered this question and gave an average response of $68.18 per barrel, the survey highlighted. The low forecast was $50 per barrel, the high forecast was $85 per barrel, and the average daily spot price during the survey was $69.81 per barrel, the survey pointed out.

Executives from 129 oil and gas firms answered this question in the first quarter Dallas Fed Energy Survey and gave an average response of $68.32 per barrel, that survey showed. The low forecast came in at $50 per barrel, the high forecast was $100 per barrel, and the average daily spot price during the survey was $67.60 per barrel, that survey highlighted.

Price and Production

In a “special questions” segment, the second quarter Dallas Fed Energy Survey asked exploration and production executives what they expect to happen to their firm’s oil production from June this year to June 2026 if WTI was to remain at $60 per barrel over the next 12 months.

Executives from 85 exploration and production firms answered this question, with zero percent responding that their oil production would “increase significantly”, six percent noting that it would “increase slightly”, 24 percent noting that it would “remain close to June 2025 levels”, 61 percent responding that it would “decrease slightly”, and nine percent noting that it would “decrease significantly”, the survey highlighted.

The survey also asked exploration and production executives what they expect to happen to their firm’s oil production from June this year to June 2026 if WTI was to be $50 per barrel over the next 12 months.

Executives from 85 exploration and production firms answered this question too, with zero percent responding that their oil production would “increase significantly”, two percent noting that it would “increase slightly”, nine percent noting that it would “remain close to June 2025 levels”, 42 percent responding that it would “decrease slightly”, and 46 noting that it would “decrease significantly”, the survey pointed out.

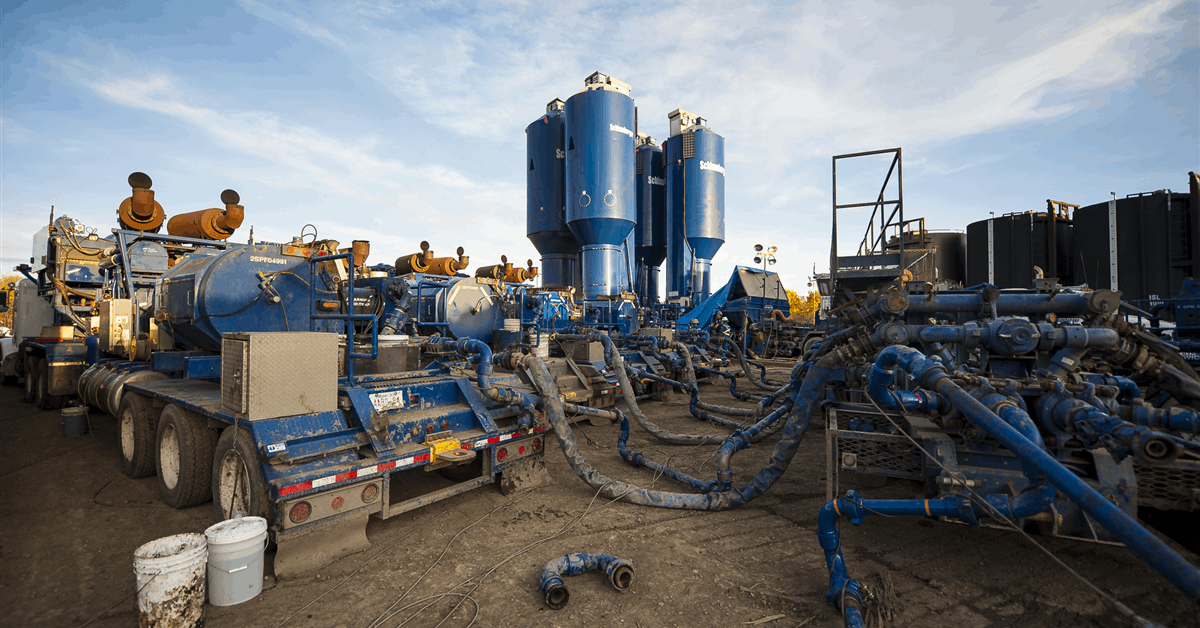

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District, the survey states, highlighting that the Eleventh District encompasses Texas, northern Louisiana, and southern New Mexico.

The third quarter Dallas Fed Energy Survey is set to be released on September 24, according to the Dallas Fed website.

The Federal Reserve Bank of Dallas is part of the Federal Reserve System, the central bank of the United States, the Dallas Fed notes on its site.

To contact the author, email [email protected]