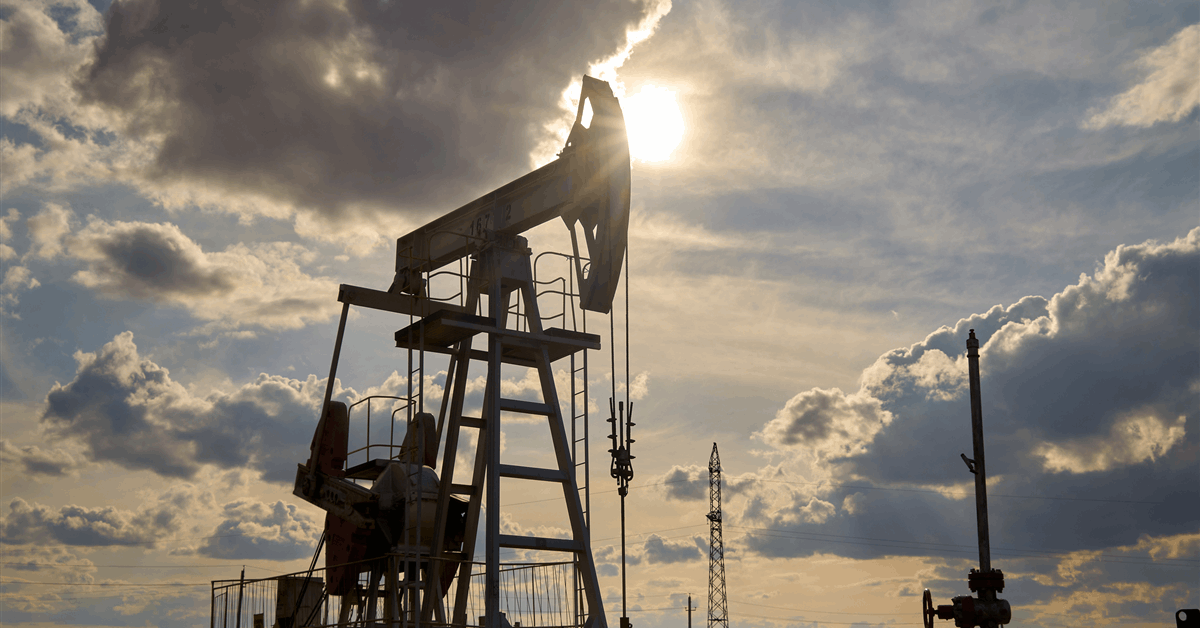

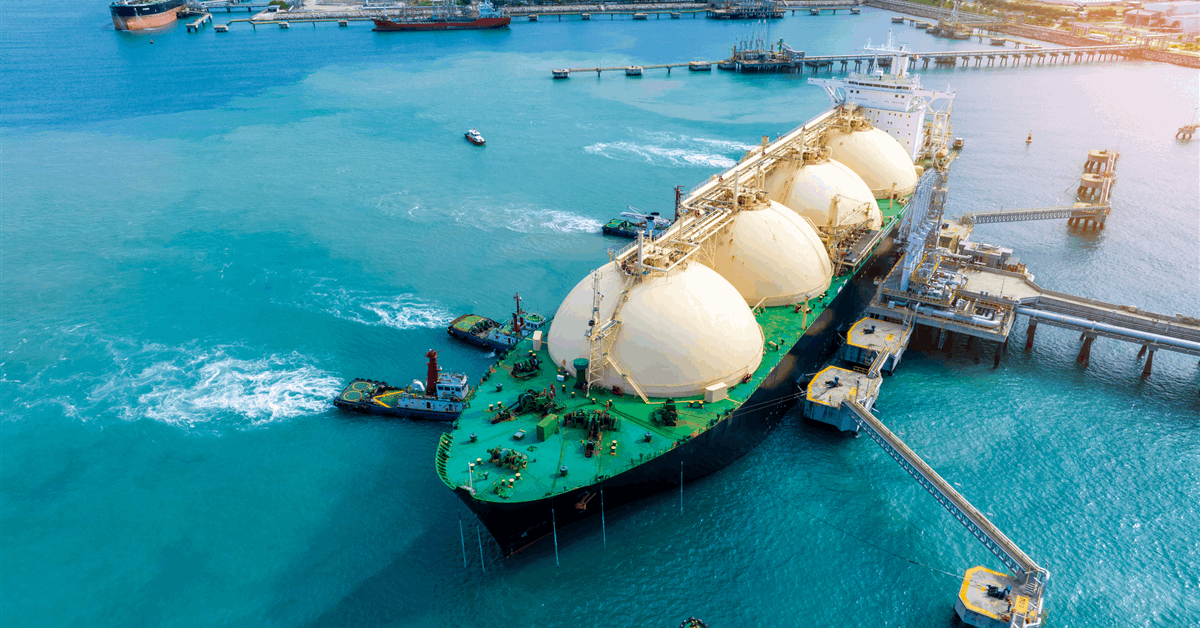

Cheniere Energy Inc. has produced the first liquefied natural gas (LNG) cargo from a project expanding the Corpus Christi LNG (CCL) terminal in the namesake Texan city.

CCL Stage 3 has seven midscale trains with an expected production capacity of over 10 million metric tons per annum (MMtpa), raising CCL’s output capacity to over 25 MMtpa from 10 trains.

“First LNG production from the first train of the CCL Stage 3 Project was achieved in December 2024, and the first cargo of LNG was produced in February 2025”, Houston, Texas-based Cheniere said in its quarterly report.

It plans to build two more mid-scale trains adjacent to the Stage 3 project for a further capacity addition of about 3 MMtpa. “In June 2024, we received a positive Environmental Assessment from the FERC and anticipate receiving all remaining necessary regulatory approvals for the project in 2025”, the report said.

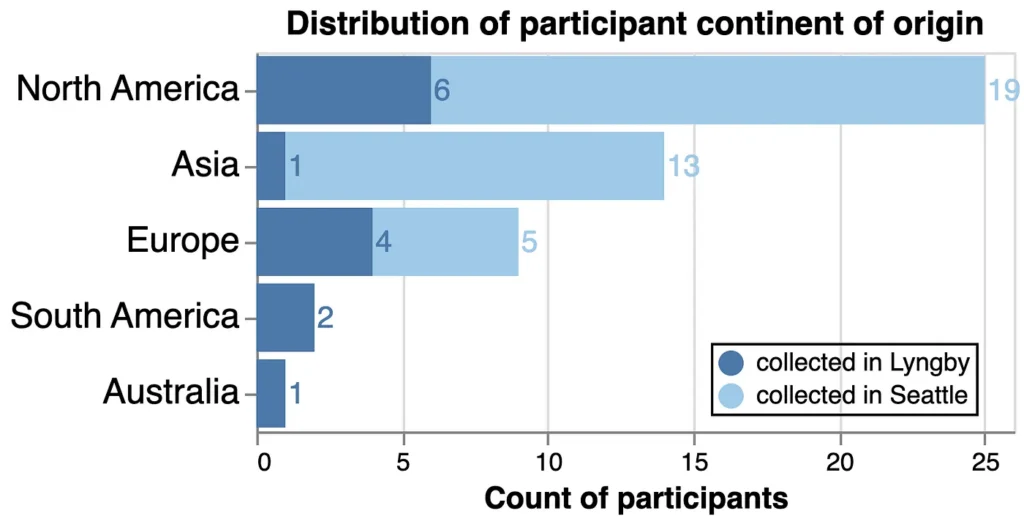

Citing new capacity unlocked from the expansion, Cheniere expects to surpass last year’s earnings. Consolidated adjusted EBITDA guidance for 2025 is $6.5 billion-$7 billion, compared to the actual 2024 figure of $6.2 billion. Distributable cash flow this year is expected to be $4.1 billion-$4.6 billion, compared to the actual 2024 figure of $3.7 billion.

“We expect 2025 to be another record year for LNG production as Stage 3 trains are completed, and we look forward to delivering financial results within these ranges and further enhancing the long-term value proposition of Cheniere”, commented president and chief executive Jack Fusco. Last year Cheniere exported a record 646 LNG cargoes, or 2.33 trillion British thermal units.

Cheniere posted $977 million in net profit for the fourth quarter (Q4) of 2024 and $3.25 billion for the full year. The figures were down 29 percent and 67 percent by year-ago comparisons, respectively.

On a diluted basis, Q4 earnings per share landed at $4.33, beating the Zacks Consensus Estimate of $2.69 per share.

“The decreases were primarily attributable to approximately $599 million and $6.7 billion of unfavorable variances related to changes in fair value of our derivative instruments (before tax and non-controlling interests) for the three and twelve months ended December 31, 2024, respectively, as compared to the corresponding 2023 periods”, Cheniere said.

“The decreases were partially offset by lower provisions for income tax, as well as lower net income attributable to non-controlling interests during both periods”.

Consolidated adjusted EBITDA dropped year-on-year by about $73 million for Q4 and $2.6 billion for 2024. “The decreases were primarily due to the moderation of international gas prices, resulting in lower total margins per MMBtu [million British thermal units] of LNG delivered, as well as a higher proportion of our LNG being sold under long-term contracts during both 2024 periods as compared to the corresponding 2023 periods”.

Revenue totaled $4.44 billion for Q4, down eight percent year-over-year, and $15.7 billion for 2024, down 23 percent against 2023.

Cheniere declared a dividend of $0.5 per share for Q4, maintaining the previous rate.

It ended the year with $2.64 billion in cash and cash equivalents, plus $552 million in restricted cash and cash equivalents. Current assets totaled $4.8 billion.

Cheniere owed $4.44 billion in current liabilities as of year-end, including $351 million in current debt.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR