A fall gas price drives has driven down the cost of household energy bills although they still remain high.

Energy regulator Ofgem has announced a 7% reduction of the energy price cap for the period covering July to September 2025, the first drop for a year.

The price cap, which is set every three months, sets a maximum limit suppliers can charge for energy.

For an average household paying by direct debit for dual fuel the fall equates to £1,720 per year. This is £660, or 28%, lower than the height of the energy crisis at the start of 2023 when the government implemented the energy price guarantee.

However, prices remain high, with the upcoming level of £152 still 10% higher than the same period last year.

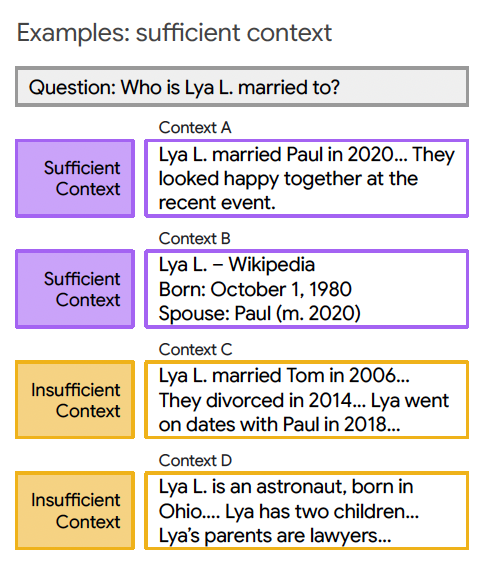

Ofgem said the recent fall in wholesale gas prices is the main driver of the overall reduction, accounting for around 90% of the fall. The remainder is primarily due to changes to the operating cost allowances energy suppliers can recover. Direct debit and prepayment customers will see standing charges fall by around £19 per year on average.

The price cap – which sets a maximum rate per unit and standing charge that can be billed to customers for their energy use – will fall by £129 for an average household per year, or around £11 a month, over the three-month period of the price cap.

Tim Jarvis, director of general markets at Ofgem urged consumers to “shop around” for deals on energy supply: “A fall in the price cap will be welcome news for consumers, and reflects a reduction in the international price of wholesale gas. However, we’re acutely aware that prices remain high, and some continue to struggle with the cost of energy.

“The first thing I want to remind people is that you don’t have to pay the price cap – there are better deals out there so it’s important to shop around, and talk to your existing supplier about the best deal they can offer you. And changing your payment method to direct debit or smart pay as you go can save you up to £136.”

He added that the UK government’s move to reduce the UK energy system’s reliance on gas would insulate consumer prices.

“In the longer term, we need an energy system where prices are insulated from the volatile international gas market, and which ensures more stable prices and energy security. And we’re working closely with government to get the investment we need to reach our clean power and net zero targets as quickly as possible,” he said in a statement.

“We’re also doing everything we can to support consumers today and pushing ahead with more changes to help consumers. This includes working on ways to support those trapped in energy debt and bringing in reforms to standing charge tariffs for this winter.”

However, Simon Virley, head of energy and natural resources at KPMG UK, argued falling gas prices mean the cost of developing clean energy would soon be the more expensive option.

“Today’s decrease in the energy price cap is the result of falling gas prices and will bring costs back to where they were at the end of last year. This is good news for households still struggling with the cost of living,” he said.

“With upward pressures on the cost of renewables, due to supply chain and other constraints, if gas prices continue to fall, it will be harder to argue that switching from gas to renewables will help bring energy bills down in the near term.”

Charities have estimated UK customers collectively owe energy companies £4 billion.

Unite general secretary Sharon Graham said: “Ofgem has lowered its cap, but our bills are still sky high and nobody has any faith left in this regulator, which allows multinational companies to extract obscene profits from our energy system. We urgently need to reverse the market madness and address the real causes of the lingering energy crisis.”