The One Big Beautiful Bill Act accelerated the phase-out of key tax credits for solar and wind projects but battery energy storage “retains a relatively stronger position,” Stout, a global advisory firm, said Tuesday in a first half energy update.

Battery storage projects will have tax credits available through 2033. However, they will still face headwinds including compliance with new Foreign Entities of Concern restrictions that pose “a significant challenge due to the sector’s heavy reliance on Chinese-dominated supply chains,” Stout noted.

“While U.S. energy storage capacity is still expected to grow, the administrative burden of demonstrating compliance with FEOC rules and sourcing non-restricted components could slow development and raise costs, hindering the sector’s long-term expansion,” the firm said.

The growth outlook for battery storage is evident in the most Short-Term Energy Outlook published by the U.S. Energy Information Administration on Aug. 7. The report estimates utility-scale domestic storage capacity will rise from about 29 GW at the end of Q1’25 to 65.7 GW at the end of 2026.

That’s slightly higher than the 64.9 GW at the end of 2026 that EIA estimated in its June STEO, before the budget bill phasing out renewable tax credits was signed.

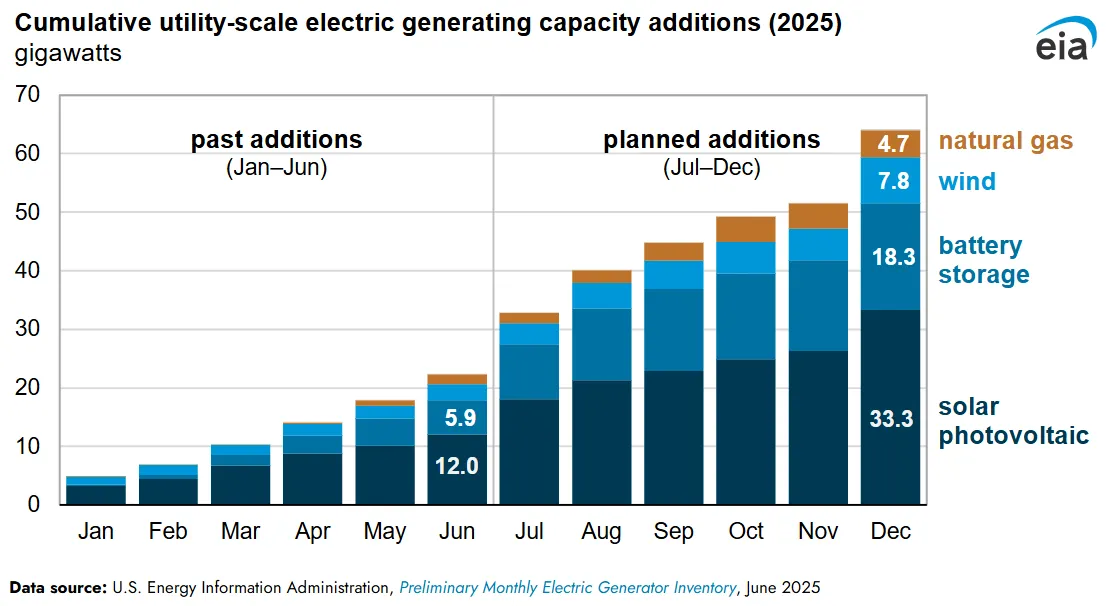

U.S. developers are planning to bring a total of 64 GW of generating capacity online this year, with more than 18 GW coming from battery storage, EIA said in an Aug. 20 note.

“Battery storage, wind, and natural gas power plants account for virtually all of the remaining capacity additions for 2025,” EIA said in an Aug. 20 note. “If planned capacity additions for solar photovoltaic and battery storage capacities are realized, both technologies will add more capacity than in any previous year. For both technologies, this growth is largely attributable to changes occurring in Texas.”