The Federal Energy Regulatory Commission faces a challenging year as it comes under pressure from the Trump administration to accelerate data center development amid rising concerns about energy affordability and grid reliability.

At the same time, FERC must also oversee compliance with fast-approaching deadlines for new rules on transmission planning and cost allocation.

“Between those two things, it’s going to eat up so much bandwidth at FERC,” said Devin Hartman, director of energy and environmental policy at the R Street Institute, a free market-oriented think tank.

“It’s going to be hard to do much else, especially on the policy front,” he said.

The keen focus on data center development by the Trump administration comes amid questions about FERC’s status as an independent agency. The two most recent additions to the five-person commission were nominated by President Donald Trump as he has also sought to impose new requirements on regulatory agencies via executive order.

Laura Swett, FERC’s new chairman, echoed the administration’s priorities when she said at her first open meeting in November that connecting data centers to the grid is her top priority — along with the agency’s mandate of ensuring grid reliability at fair rates.

“I would expect Chair Swett to track more closely with White House priorities than perhaps any chair has ever done,” Hartman said.

Former Chairman Willie Phillips, now a law partner at Holland & Knight, expressed faith in commissioners’ independence, however.

“If you value energy dominance, if you value reliability and having a FERC that is a referee that calls balls and strikes, then you have to value independence, and I believe that we have a FERC that does that,” he said.

In the end, for Swett and FERC, 2026 is about making sure that recent transmission and interconnection reforms instituted by the agency are working and that approved projects are getting built while also setting new rules of the road for large loads, Phillips said.

“In a lot of ways, this year will be more about implementation and execution rather than new policy reforms,” he said.

DOE colocation plan drives early agenda

In the near-term, FERC is focusing on the U.S. Department of Energy’s proposal for interconnecting colocated load to the transmission system. The proposal, which was issued in October and aimed at data centers, took many observers by surprise, with some describing it as an unusual move to expand federal authority.

President Donald Trump, joined by Energy Secretary Chris Wright, speaks during an event in the Oval Office at the White House on Oct. 6, 2025, in Washington, D.C. The Trump administration has made connecting data centers a priority, and Wright has proposed FERC adopt new rules for colocated large loads.

Anna Moneymaker via Getty Images

FERC responded swiftly by asking for comments four days later with a Nov. 14 deadline that was extended by two weeks. DOE asked FERC to issue a final rule by April 30 — a deadline the National Association of State Utility Consumer Advocates called “patently unreasonable.”

Public comments on DOE’s proposal reveal deep concerns from state legislators, regulators, grid operators and consumer advocates, particularly related to federal versus state regulatory powers.

The National Association of Regulatory Utility Commissioners said that under the Federal Power Act, states have jurisdiction over retail load interconnections, regardless of their size, as well as “end-use” electricity sales. FERC has never asserted jurisdiction over end-user load interconnections, it said.

“If FERC were to assert jurisdiction over a service to a limited class of retail customers, it would interfere with the balancing performed by state regulators in retail rate cases, a determination that is solely a state decision,” said the group, which represents state regulators.

Sorting through the federal-state jurisdictional issue will be a major part of the rulemaking process, according to Steven Shparber, a member of the Mintz, Levin, Cohn, Ferris, Glovsky and Popeo law firm.

“It’s going to be interesting to see how far FERC goes in terms of asserting jurisdiction over the interconnection of large loads,” Shparber said. “I think FERC is going to be very careful to make sure that any final rule is legally durable.”

Karen Bruni, a partner at the law firm Steptoe, said she is watching to see how detailed FERC’s response to DOE’s proposal will be.

“Will it be a very firm outline of directions to the [regional transmission organizations] and transmission providers across the country, or is it going to be something a little more high level, broader, asking for compliance filings, allowing for regional flexibility?” she said.

Josh Price, a director on research firm Capstone’s energy team, said he expects FERC to retain the same jurisdictional divide that exists today to avoid pushback from states and utilities by focusing on what’s squarely within federal jurisdiction, such as generation interconnection reforms, new demand response products and capacity markets.

New transmission plans come due

Meanwhile, FERC will also be responding to the compliance plans from RTOs and transmission providers to the agency’s Order 1920 on transmission planning and cost allocation.

The rule requires grid planners to develop transmission plans that look ahead at least 20 years using multiple scenarios and that consider grid-enhancing technologies, among other things. It also gives states a more robust role in the cost allocation process — a provision that is expected to be a major sticking point.

“We all know that cost allocation is where policy meets politics.”

Willie Phillips

Former FERC Chair

FERC Commissioner Judy Chang in January warned that without adequate transmission planning, efforts to bring generating supplies online quickly through improved interconnection processes may be ineffective.

“Just because we accelerate the processes upfront for generation and perhaps load interconnection, without sufficient amount of grid and reliability upgrades to the system, we can’t actually operate,” Chang said at a Jan. 22 FERC open meeting.

The Order 1920 compliance plans, most of which are due this year, may be key in addressing Chang’s concerns.

“How thoroughly FERC reviews those and requires any adjustments to set a high bar for 1920 compliance will be really important for the future of transmission planning,” said Hartman from R Street.

At the same time, the Fourth Circuit appeals court is considering appeals from state attorneys general, utility commissions, environmental groups and others challenging various aspects of Order 1920, which was issued in May, 2024, and revised by the agency in November that year.

A number of federal agencies under Trump have either stopped defending Biden-era rules or moved to revoke them entirely. But so far, FERC is standing by order 1920. It defended its rule in a Jan. 5 brief with the court.

The commission issued the Order 1920 “to correct an urgent, pervasive, and growing problem […] that existing transmission processes were failing to produce new transmission infrastructure to meet long-term transmission needs in a cost-effective manner,” the filing said. “The upshot was an aging electric grid that transmission providers have updated in a piecemeal, siloed fashion, resulting in inefficient and costly transmission investments and rates that fail to meet the Federal Power Act’s ‘just and reasonable’ standard.”

Bruni said it will be interesting to see how the current commission treats the compliance filings and whether the court orders any changes.

“It’ll certainly be something to watch really closely, because it will give Chairman Swett a bite at the apple,” she said.

Skyrocketing prices could prompt market reforms

The recent surge in electric demand forecasts and tight supply conditions in parts of the United States may also lead to changes in the wholesale power markets that FERC oversees.

The country’s largest grid operator, the PJM Interconnection, coordinates power sales for most of 13 states and 67 million people in the Mid-Atlantic region. Its last three base capacity auctions have seen prices spike to new highs even as the system fell short of its capacity targets.

PJM is “absolutely in a crisis stage, and it’s going to get worse,” said former FERC Chairman Mark Christie, who left the position last year and now works as director of the Center for Energy Law and Policy at William & Mary Law School.

Pennsylvania Gov. Josh Shapiro, a Democrat, delivers opening remarks at the Summit on the State of PJM Interconnection in Philadelphia on Sept. 22, 2025. Shapiro has been highly critical of the grid operator.

Courtesy of Pennsylvania governor’s office

The existing wholesale power markets were designed for a time when demand was relatively flat and the changing resource mix was more predictable, according to Phillips. System operators are trying to adapt, he said.

PJM’s board has called for a comprehensive review of its market structure, and ISO New England recently proposed an overhaul of its capacity market to move away from a forward market and towards a “prompt” auction.

At the direction of PJM’s board, its stakeholders have started considering holding a “reliability backstop” auction for power supplies to serve data center loads — perhaps the most controversial element of the board’s plan for interconnecting large loads in the grid operator’s footprint. PJM’s governors and the Trump administration also want a special auction in PJM for data center loads.

“We will continue to see opportunities … for FERC to tweak the markets across the country,” Phillips said.

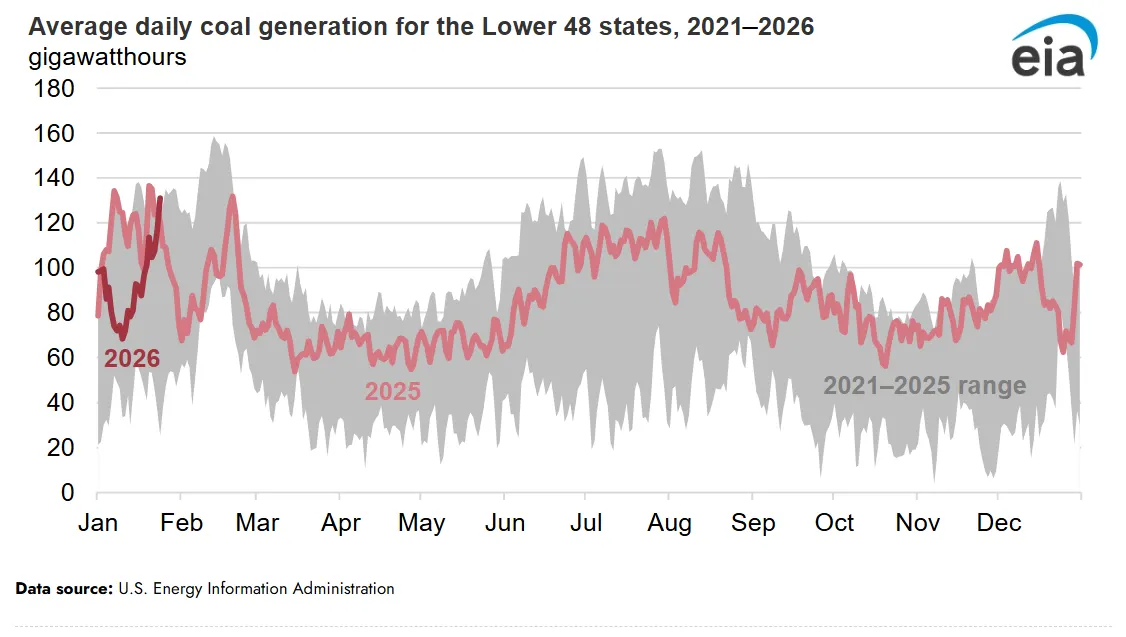

For example, there is a clear directive from the Trump administration — and FERC appears to be aligned with it — to find ways to increase capacity revenues for thermal generating resources, according to Hannah Rogers, an analyst with Capstone’s energy team.

“We could see either a move on behalf of FERC, or different RTOs such as PJM, to value certain attributes, such as fuel security, as a way of picking winners and losers or incentivizing more thermal generation, such as natural gas and coal,” she said.

Changes in capacity accreditation — a measure of how much a resource contributes to reliability in times of grid stress — could also be used to favor thermal resources, Rogers added. Grid operators’ capacity accreditation frameworks must be approved by FERC.

Under the banner of energy affordability, the Trump administration could also try to shift costs onto renewable energy resources through interconnection rules, market constructs and firming requirements, according to Capstone’s Price.

“I think that strategy is going to make its way into FERC policy,” he said.

Affordability looms over FERC decisions

FERC’s efforts to facilitate data center development — and questions on how to allocate the billions in costs in grid interconnections for new power plants and new transmission lines — comes amid an intense focus on electric affordability.

With the midterm elections approaching in November, affordability is going to be a talking point across the federal government, according to Bruni.

“I do think that message has been communicated to FERC,” she said.

At FERC, the issue will likely play out in cost allocation decisions for transmission projects and the cost of interconnecting large customers and the power projects needed to serve them, according to Bruni.

Former Chairman Christie warned that it would be a mistake for FERC to allow existing generation to be “cannibalized” to serve just one customer, like a data center, which he said would have a negative effect on the entire grid and other ratepayers.

“The most important issue that FERC is going to face this year is how to deal with the tremendous increases in load that is coming because of the data center development, and how they’re going to balance that with the need for sufficient new generation to keep the lights on,” he said. “FERC has to make sure that in any RTO regulation, and particularly on the issue of colocation, that the costs of interconnecting data centers … are not being shifted to all the other consumers, like residential and small business.”

Former Chairman Phillips offered a similar assessment.

“The challenge is making sure that [large loads] interconnect in a way that’s transparent, predictable and fair to existing customers,” said Phillips. “And of course, we all know that cost allocation is where policy meets politics — and FERC’s challenge, as always, is ensuring that who benefits pays, and to ensure that in a way that doesn’t harm or chill much needed infrastructure investment.”