The Federal Energy Regulatory Commission on Thursday launched a review of issues related to colocating large loads, such as data centers, at power plants in the PJM Interconnection.

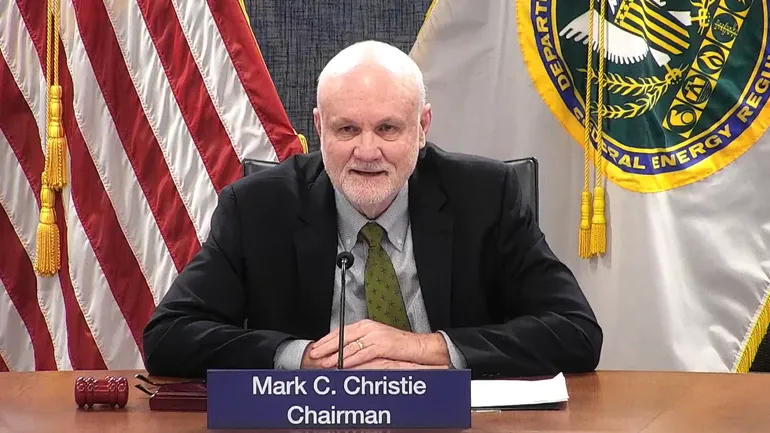

“There are tremendous implications for reliability and consumers, and we have to be fair,” FERC Chairman Mark Christie said during the agency’s monthly meeting. At the same time, utilities have an obligation to serve new customers, he said.

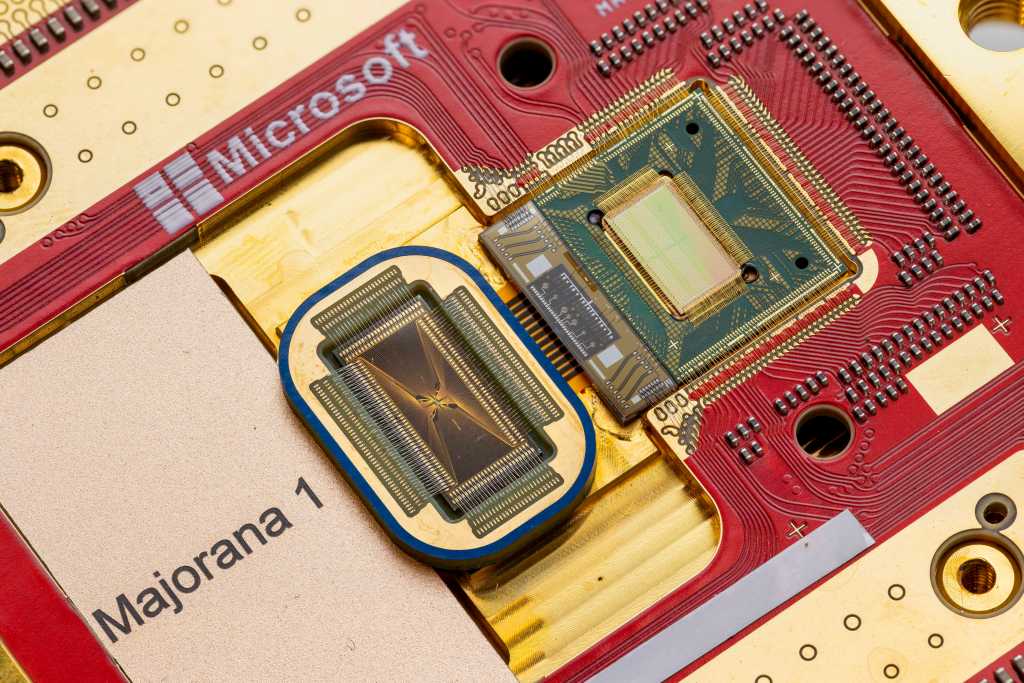

FERC’s effort to clarify rules for colocated load comes amid a surge in data center development across the United States, partly driven by the growth of artificial intelligence. Colocating data centers at existing power plants provides a potential pathway to bringing data centers online quickly and at lower cost compared with “front of meter” options.

However, new rules governing colocated resources in PJM likely won’t be approved by FERC until early next year, creating a period of uncertainty for independent power producers such as Talen Energy and Vistra by delaying deal announcements with data center operators, Capstone analysts said Thursday.

FERC aims to approve new colocation rules for PJM this year, said Ben Williams, FERC director of the office of external affairs. The agency expects it will vote on a PJM proposal within three months of one being filed at the commission, he noted.

The lack of near-term clarity on colocation is another negative development for IPPs and raises the potential that data center developers will prefer to work with regulated utilities instead of in competitive markets, Jeffries analysts said.

Issues surrounding siting data centers at large power plants in PJM came to a head late last year.

The agency in November rejected an amended interconnection service agreement that would have facilitated expanded power sales to a colocated Amazon data center from the Susquehanna nuclear power plant in Pennsylvania that is majority owned by Talen.

Also, FERC held a technical conference on colocated load, and Constellation Energy Generation filed a complaint over PJM’s colocation rules. The agency’s “show cause” order, issued Thursday, combines the records of the technical conference and the Constellation complaint.

FERC gave PJM and its transmission owners 30 days to explain whether the grid operator’s colocation rules are just and reasonable or what changes would make them just and reasonable. Other parties will then have 30 days to respond.

FERC asked PJM and its transmission owners to respond to a series of questions dealing with how colocation could affect transmission service, interconnection, cost allocation and PJM’s markets.

Separately, FERC rejected proposals by Exelon utilities regarding colocated load, saying the proposals exceeded their filing rights.

Here are six other takeaways from the meeting.

FERC to hold resource adequacy technical conference

The agency will hold a two-day technical conference starting June 4 to explore resource adequacy issues in regional transmission organization and independent system operator markets, Christie said.

The conference is driven by “astronomical” load forecasts and a failure to bring online enough generating capacity at an adequate pace, Christie said during a briefing with reporters. Further, there have been a flurry of recent complaints and reform proposals related to PJM’s capacity market, Christie said. PJM governors have become involved in the issue, he said, noting he had an extensive conversation with Pennsylvania Gov. Josh Shapiro, D, about PJM’s capacity market and consumer costs. “We’ve had a lot of controversy, a lot of complaints,” Christie said. “I want to get in front of it.”

In PJM, there’s “fermentation” about alternatives to the grid operator’s capacity market, according to Christie.

FERC approves PJM capacity market proposals

The agency on Thursday approved PJM’s proposal to extend its capacity must-offer requirement to intermittent resources, storage resources and hybrid resources and to update its market seller offer cap. In approving the proposal, FERC rejected concerns raised by PJM’s market monitor, trade groups for power plant owners and renewable energy companies and ratepayer advocates.

Citing the market monitor’s analysis, FERC said PJM’s must-offer exemption inflated revenues in the last base capacity auction by $4.1 billion. “Increasing the number of resources that participate in the capacity market will allow for more competition and, in turn, help ensure that the capacity market produces just and reasonable rates,” FERC said.

No cuts made to FERC’s probationary staff

Although the Trump administration is working to cut federal employees, in part by firing workers that are in probationary hiring periods, FERC has had zero probationary staff cuts, according to Christie. “No one has been terminated,” he said.

FERC has not been contacted by the Department of Government Efficiency, Christie said. DOGE is an advisory body in the Executive Office a temporary organization that aims to cut federal spending. Among the more than 200,000 federal workers who have lost their jobs in the last month, about 2,000 people at the Department of Energy have been fired, according to ABC News.

FERC’s funding comes from fees levied on the companies the agency regulates, not from taxpayers, Christie said. “We are deficit-neutral.”

FERC rejects LS Power project transmission incentives

Great Basin Transmission, an LS Power subsidiary, failed to show it was eligible for requested incentives for the Southwest Intertie Project–North transmission line connecting Nevada and Idaho as well as related upgrades to the One Nevada 500-kV transmission line, FERC said. The agency rejected Great Basin’s request that it be able to recover all its prudently incurred costs if the project is abandoned for reasons beyond its control and be able to defer recovery of prudent pre-commercial costs through the creation of a regulatory asset.

“Great Basin has not shown that its project ensures reliability or reduces the cost of delivered power by reducing transmission congestion,” FERC said.

FERC rejects Invenergy complaint against Xcel utility

The agency dismissed a complaint from Invenergy subsidiaries Salsa Solar Energy and Towner Wind Energy III that argued that the Public Service Company of Colorado is improperly reserving transmission capacity on its Power Pathway transmission project for the utility’s own unqueued generating resources ahead of Invenergy’s queued generation projects, which total 500 MW.

“PSCo may set aside transmission capacity on the Power Pathway under its native load priority, through its calculation of [available transfer capability,] to accommodate the acquisition of additional generation resources to meet its native load obligation,” FERC said.

The agency also rejected Invenergy’s argument that PSCo’s delay in providing complete and transparent study assumptions highlighted anticompetitive and unduly discriminatory conduct.

NERC extreme weather standard approved

FERC approved TPL-008-1, a North American Electric Reliability Corp. reliability standard on transmission system planning for extreme heat and cold weather. The standard requires periodic extreme temperature assessments and requires corrective action response plans to fix any identified grid problems. It is set to be phased in over five years.

“Although system planning measures alone will not eliminate the reliability risk associated with extreme heat and extreme cold events, we find that Reliability Standard TPL-008-1 will help prepare the bulk-power system for extreme weather events in the long term and, together with the requirements in the Cold Weather Reliability Standards, will work to mitigate the near-term reliability impacts of extreme weather events,” FERC said.

Editor’s note: This story was updated to include a comment from FERC on the timing of expected action on its colocation review.