Fluor Corp. plans to appeal against the Queensland Supreme Court’s decision favoring Santos Ltd. in a dispute on costs over the Gladstone LNG project, majority-owned by Santos.

“The court affirmed that Fluor must pay approximately AUD 692 million to Santos and its co-venturers, with further sums yet to be determined”, oil and gas explorer and developer Santos said in a statement on its website.

Adelaide-based Santos, which initiated the case in December 2016, and Irving, Texas-based Fluor had signed a contract for the construction of the coal bed methane-to-liquefied natural gas (LNG) project. Gladstone started producing LNG 2015 after going over time and over budget.

Santos’ case alleges overpayments totaling more than AUD 1.4 billion, about AUD 140 million for a purported breach of the Australian Consumer Law and liquidated damages of AUD 15 million for an alleged failure of Fluor to reach mechanical completion by the contractual dates, according to the court judgment.

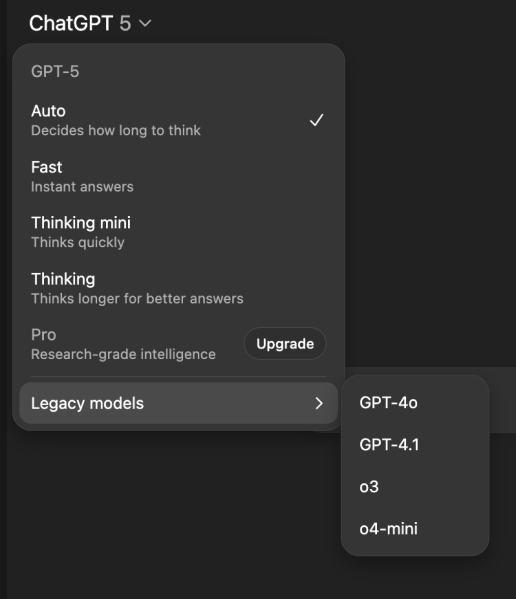

“[T]he court will hear the parties on the appropriate orders and directions and on the calculation of interest, and on costs”, read the ruling, published on the court’s online library. The case is Santos v Fluor [2025] QSC 184. Fluor the parent company is second defendant while Fluor Australia Pty. Ltd. is first defendant.

Fluor said in a statement on its website, “Further arguments and input from both parties will be heard by the court before a final judgment is delivered sometime later this year”.

“Fluor maintains the contracting principles addressed by the court have wide-sweeping consequences in the engineering and construction industry”, Fluor added. “The company is reviewing the court decision and exploring its response including the timing of its appeal.

“We are also working with our insurance carriers to address the obligations arising from the final judgment”.

Fluor said, “The court generally accepted the recommendations of a panel of referees that the court appointed to oversee the case despite Fluor’s objection”.

“The proceedings arose under an engineering and construction contract that Santos entered into with Fluor in 2011 for the development of production facilities that formed part of the Gladstone LNG project”, Santos said. “Construction took place between 2011 and 2014.

“Santos argued that Fluor was not entitled to all the costs it had claimed and received payment for under the contract. Santos sought to recover those amounts and also made claims to recover liquidated damages associated with the late completion of the project. Further, Santos sought to enforce against a parent company guarantee from Fluor Corp.”

Santos added, “In the referees’ opinion Santos was entitled to recover certain costs”.

Santos owns a 30 percent stake in Gladstone LNG and operates the project’s upstream component, which includes four onshore fields. France’s TotalEnergies SE and Malaysia’s Petroliam Nasional Bhd. each hold 27.5 percent. South Korea’s Korea Gas Corp. has 15 percent.

Gladstone LNG has two liquefaction trains, put into operation 2015 and 2016, with a combined capacity of 7.8 million metric tons per annum. The volume is about 10 percent of Australia’s LNG production capacity according to Santos. Most of the output is sold under long-term contracts with customers in South Korea and Malaysia.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR