Germany’s economy ministry is studying options for how to exit nationalized energy company Securing Energy for Europe GmbH, people with knowledge of the matter said.

Some officials have been holding early-stage deliberations as they evaluate a range of possible ways to exit SEFE, which could include a sale or breakup of the business, or a potential merger with fellow nationalized energy company Uniper SE, according to the people. The economy ministry department overseeing SEFE is tasked with drawing up a plan by mid-2025.

SEFE, a former Gazprom unit, has itself been speaking with Boston Consulting Group as it seeks to examine the economic rationale for various options including a potential merger with Uniper, the people said. It previously studied that possibility during the energy crisis in 2022.

A spokesperson for Germany’s economy ministry, which manages the SEFE holding, said it “cannot confirm” whether it is studying exit options, adding that it’s not currently considering a merger with Uniper. A SEFE spokesperson said it works with diverse consultancies including BCG, declining to comment on the nature of the work. The finance ministry, which oversees the Uniper stake, declined to comment. Uniper and BCG also declined to comment.

Combining the two nationalized energy companies would only be considered as a potential fallback option in case the government’s sale of Uniper fails to gain traction, some of the people said. While at least three suitors – including Equinor ASA, Czech billionaire Daniel Kretinsky’s EPH and Brookfield Asset Management Ltd. – are considering bids for Uniper, talks to sell the company in one piece are complicated by the utility’s diverse portfolio.

Some involved parties are skeptical of the merits of a potential merger between Uniper and SEFE, since any tie-up would have to pass rigorous antitrust hurdles and could delay the government’s exit, according to the people.

Any such move would also have to be cleared by both the economy and finance ministries – which are led by the two governing parties, the conservatives and Social Democrats respectively – and approved by Chancellor Friedrich Merz. Deliberations are at a preliminary stage and officials haven’t decided which path to pursue, the people said.

Uniper, once Germany’s top buyer of Russian gas, was bailed out by Berlin three years ago in one of the largest rescues in the country’s corporate history. The firm has assets ranging from gas trading to coal-fired power plants, and the only carbon-free assets in its portfolio are its hydro and Swedish nuclear plants.

The company has recently started building its first solar parks and acquired a wind farm under development, but lags behind rivals in the field of renewables, and also postponed plans to invest in hydrogen. For these reasons, an initial public offering – which has also been discussed and is the option preferred by staff – is considered difficult.

SEFE’s assets include a massive porous storage site in northern Germany, which has remained stubbornly empty as it hasn’t received enough attractive bids from traders, and a legacy contract with Russia’s Yamal LNG that the government concluded is too expensive to cancel. Its portfolio also includes a huge gas pipeline network, parts of which could be facing potential writedowns as the country aims to reach climate neutrality by 2045.

Germany took over both companies amid the height of the energy crisis in 2022. As part of the rescue deal, the European Commission asked Berlin to reduce its stake to not more than 25 percent plus one share by the end of 2028 at the latest, otherwise the government will have to notify the Commission of a restructuring plan.

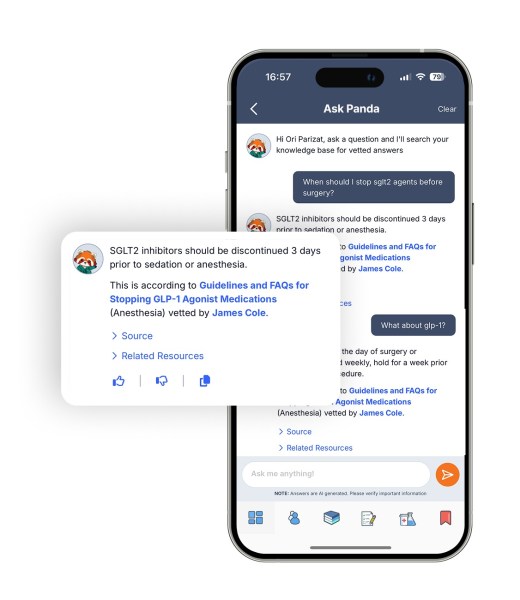

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.