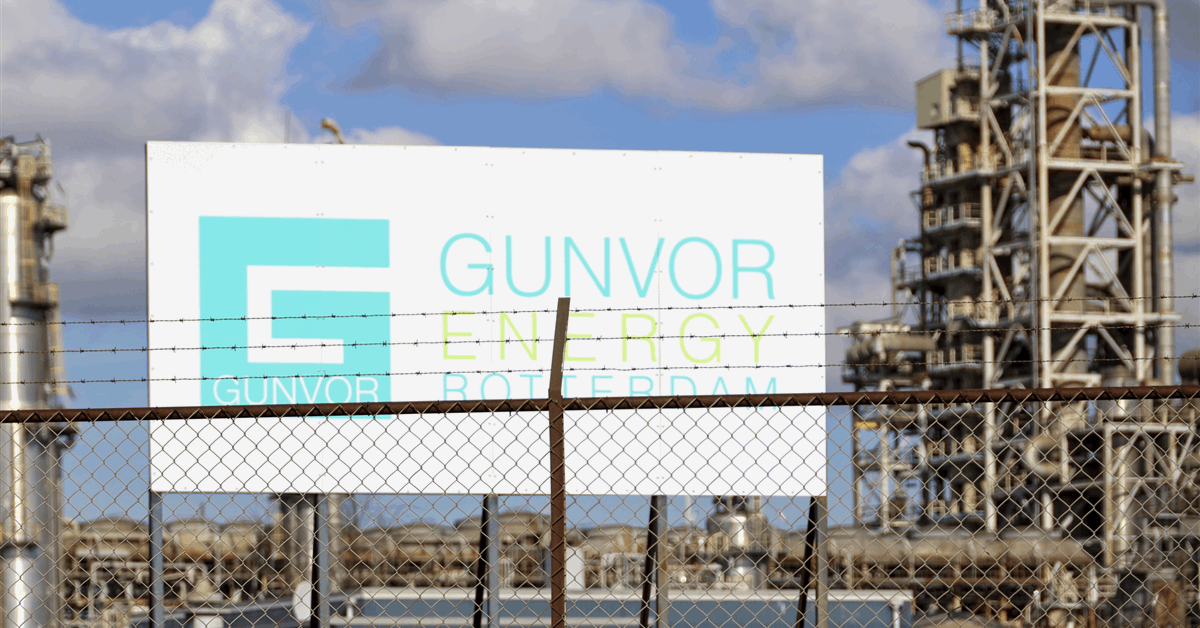

Commodity trader Gunvor Group has made another significant oil deal in Gabon, its second since the country sought more control of national assets following a coup d’etat in 2023.

State-owned Gabon Oil Company financed $220 million of a $300 million deal for Tullow Oil Plc’s assets in the country through an underwritten prepayment facility from Gunvor’s Middle East subsidiary, Tullow said in a filing Tuesday.

Gunvor last year provided around $800 million to help Gabon finance another nationalization deal, the acquisition of Carlyle Group’s Assala Energy. A spokesperson for Gunvor declined to comment on the deal.

Coming out of the most profitable period in their histories, trading firms are funneling cash into asset deals and prepayments to lock in more lucrative oil supply contracts as more competition from national oil companies and hedge funds lowers trading margins in oil markets.

The Tullow assets are set to produce around 10,000 barrels of oil a day this year, the company said, adding that it will use the funds to reduce its debt profile. The company has been setting up deals to sell assets and bring down debt ahead of $1.39 billion in maturities next year.

©2025 Bloomberg L.P.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR

Bloomberg