@import url(‘https://fonts.googleapis.com/css2?family=Inter:[email protected]&display=swap’);

a { color: var(–color-primary-main); }

.ebm-page__main h1, .ebm-page__main h2, .ebm-page__main h3, .ebm-page__main h4,

.ebm-page__main h5, .ebm-page__main h6 {

font-family: Inter;

}

body {

line-height: 150%;

letter-spacing: 0.025em;

font-family: Inter;

}

button, .ebm-button-wrapper { font-family: Inter; }

.label-style {

text-transform: uppercase;

color: var(–color-grey);

font-weight: 600;

font-size: 0.75rem;

}

.caption-style {

font-size: 0.75rem;

opacity: .6;

}

#onetrust-pc-sdk [id*=btn-handler], #onetrust-pc-sdk [class*=btn-handler] {

background-color: #c19a06 !important;

border-color: #c19a06 !important;

}

#onetrust-policy a, #onetrust-pc-sdk a, #ot-pc-content a {

color: #c19a06 !important;

}

#onetrust-consent-sdk #onetrust-pc-sdk .ot-active-menu {

border-color: #c19a06 !important;

}

#onetrust-consent-sdk #onetrust-accept-btn-handler,

#onetrust-banner-sdk #onetrust-reject-all-handler,

#onetrust-consent-sdk #onetrust-pc-btn-handler.cookie-setting-link {

background-color: #c19a06 !important;

border-color: #c19a06 !important;

}

#onetrust-consent-sdk

.onetrust-pc-btn-handler {

color: #c19a06 !important;

border-color: #c19a06 !important;

}

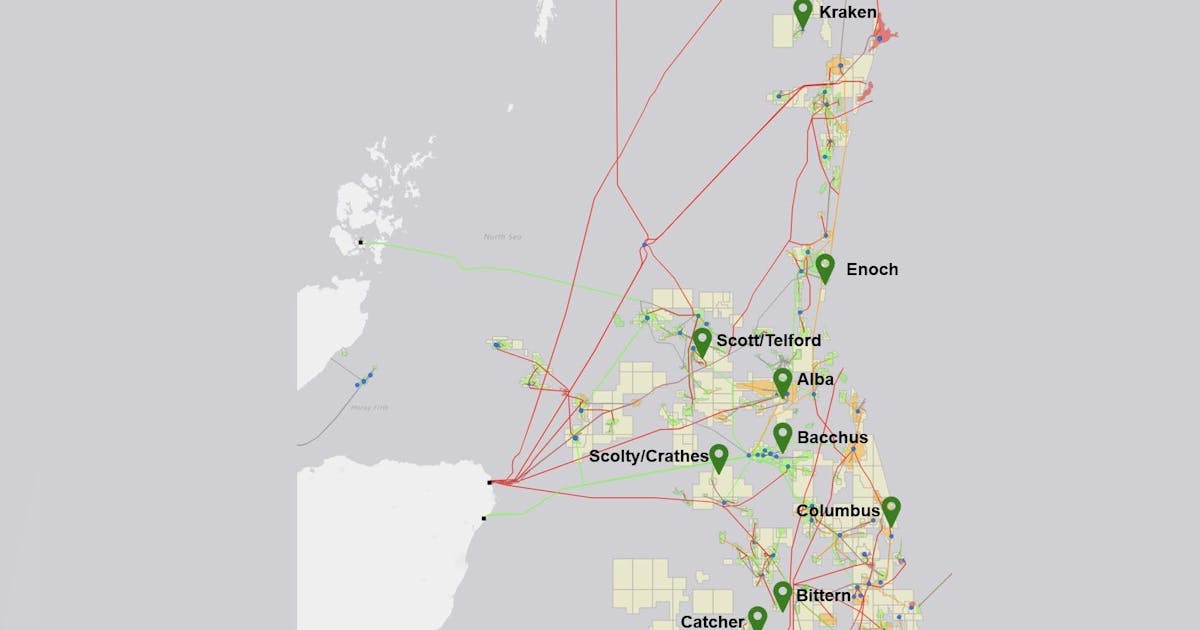

Harbour Energy plc has agreed to acquire substantially all the subsidiaries of Waldorf Energy Partners Ltd. and Waldorf Production Ltd., currently in administration, for $170 million.

The company, in a release Dec. 12, said the deal would add oil-weighted production of 20,000 boe/d and 2P reserves of 35 MMboe. In addition, the deal would increase Harbour’s interest in its operated Catcher oil and gas field to 90% from 50% and provide a new production base for Harbour in the northern North Sea with the addition of a 29.5% non-operated interest in the EnQuest plc-operated Kraken oil field.

The deal is expected to close in second-quarter 2026, subject to regulatory approvals and full and final settlement of all creditor claims against Waldorf’s subsidiaries.