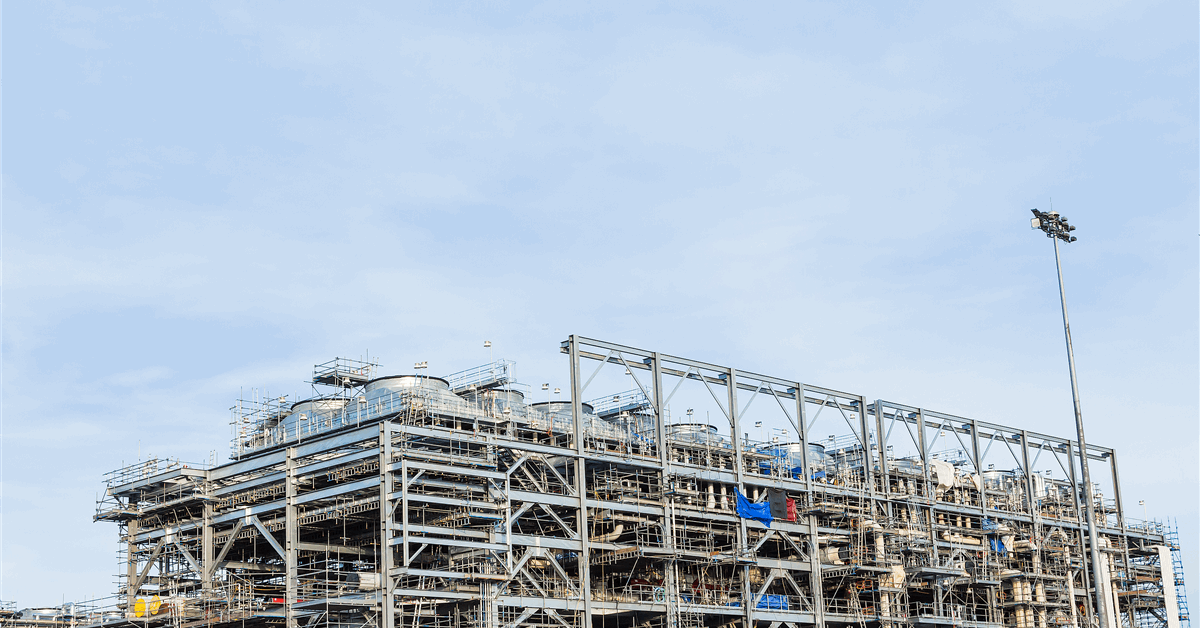

Hibiscus Petroleum Berhad announced in a statement posted on its website recently that it commenced drilling at the Teal West Development, which is situated in the North Sea.

The company noted in the statement that the Shelf Drilling Fortress jack-up rig prepared and mobilized from Invergordon, Scotland, on September 8, adding that it spudded a new well at the Teal West field on September 14. Hibiscus highlighted in the statement that the field is located 2.4 miles from the Anasuria Floating, Production, Storage and Offloading facility.

“Once completed, the new well will be tied back to the Anasuria FPSO,” Hibiscus said in the statement.

The company revealed in the release that subsea installation activities are scheduled to take place in early Q2 2026, “with first oil expected by mid-2026”. Fluids from the Teal West well will be processed and exported from the Anasuria FPSO, Hibiscus added.

Hibiscus highlighted in the statement that Anasuria Hibiscus UK Limited (AHUK), Hibiscus Petroleum’s wholly owned subsidiary, operates the Anasuria FPSO through its Anasuria Operating Company joint venture with Ping Petroleum UK PLC, a subsidiary of Dagang NeXchange Berhad (DNeX).

Hibiscus said in the release that AHUK “recognizes that the UK oil and gas sector is under significant pressure, with activity levels at historic lows and that Teal West is one of only three development wells being drilled across the entire UK Continental Shelf in 2025”.

“Our approach is about firstly delivering value to our shareholders,” AHUK General Manager, Tom Reeve, said in the statement, commenting on the Teal West development.

“We are continuing to invest in the UK North Sea as we believe that at some point, factors such as energy security, the environmental cost of importing LNG, and the preservation of local jobs will encourage the UK government to proactively and positively revise the current fiscal regime,” he added.

“In the meantime, we are focused on delivering a safe and top quartile performance for the drilling operation currently being undertaken,” he continued.

Rigzone has contacted the UK Department for Energy Security and Net Zero (DESNZ) and HM Treasury (HMT) for comment on Hibiscus’ statement. At the time of writing, neither have responded to Rigzone.

Industry body Offshore Energies UK (OEUK) said in a statement sent to Rigzone recently that a reform of the windfall tax on domestic energy producers in 2026 will mean more jobs, more tax revenue, and better UK energy security.

The statement noted that a new report from the organization “shows that reforming the windfall tax would add an extra GBP 137 billion ($183.9 billion) to the UK economy, support 23,000 jobs, and unlock much needed investment to reduce reliance on energy imports”.

A profit based mechanism is OEUK’s proposed replacement for the current Energy Profits Levy (EPL), the statement highlighted, noting that it’s designed to “trigger only during periods of unusually high prices, tax excess profits or revenues, [and] adjust fairly when prices fall, restoring investor confidence”.

OEUK warned in the statement that the levy “is already having a severe impact on the sector”.

Rigzone previously contacted HMT and DESNZ for comment on that OEUK statement.

In response, a HMT spokesperson previously told Rigzone, “we know that oil and gas will be with us for decades to come and are managing the transition to clean energy in a balanced way that supports communities”.

“This includes Great British Energy, which has already announced GBP 1 billion ($1.3 billion) in investment in British supply chains, unlocking significant investment and helping to create thousands of skilled jobs,” the spokesperson added.

“The Energy Profits Levy will end by 31 March 2030, and we are working with the sector to explore how firms can continue to invest and pay their fair share of tax,” the spokesperson continued.

The statutory end date of the levy is March 31, 2030, but if prices fall consistently below levels set by the Energy Security Investment Mechanism, the levy will be repealed earlier than its sunset, HMT highlighted in its response to Rigzone.

DESNZ did not respond to that Rigzone request for comment.

In a statement made on March 5, which was posted on the UK parliament website, James Murray, the Exchequer Secretary to the Treasury, noted that the EPL was introduced in 2022 “in response to extraordinary profits made by oil and gas companies driven by global events, including resurgent demand for energy post-Covid 19 and the invasion of Ukraine by Russia”.

Hibiscus highlights on its website that, on March 10, 2016, the company, through its wholly owned subsidiary AHUK, acquired its first producing asset, “a package of geographically focused producing fields and associated infrastructure located in the North Sea, United Kingdom (UK), collectively known as the Anasuria Cluster (Anasuria)”.

“Anasuria delivers production that generates positive cashflow with infield future development opportunities and exploration upside,” the company states on its site.

“The addition of the Teal West discovery, an award to Hibiscus Petroleum as part of the UK Continental Shelf (UKCS) 32nd Licensing Round is a positive development which should contribute to an increase in Anasuria’s production by CY2025,” it adds.

The company goes on to state on its site that Anasuria Hibiscus acquired the discovered Marigold West and Sunflower oilfields on October 16, 2018, adding that “this shallow-water development asset will deliver a step change to our production volumes and revenue generating capacity in the future”.

“Additionally, in line with our efforts to aggregate 2C oil resources at a competitive unit cost per barrel (as part of an area-wide development), we applied for (and were awarded), the Kildrummy discovery (as part of the UKCS 32nd and 33rd Licensing Rounds),” it continues.

“On 15 September 2023, Anasuria Hibiscus and Caldera Petroleum UK Limited executed a Unitisation and Unit Operating Agreement (UUOA) with Ithaca Energy Limited for their interest in a field called Marigold East. The combined unit is called ‘Marigold’,” it notes.

“We have now established two potential production hubs in the UK. The existing Anasuria Cluster, which includes the Fyne and Teal West fields, and the Greater Marigold Area Development (GMAD), which encompasses the Marigold, Sunflower, Kildrummy and Crown fields,” the site highlights.

To contact the author, email [email protected]