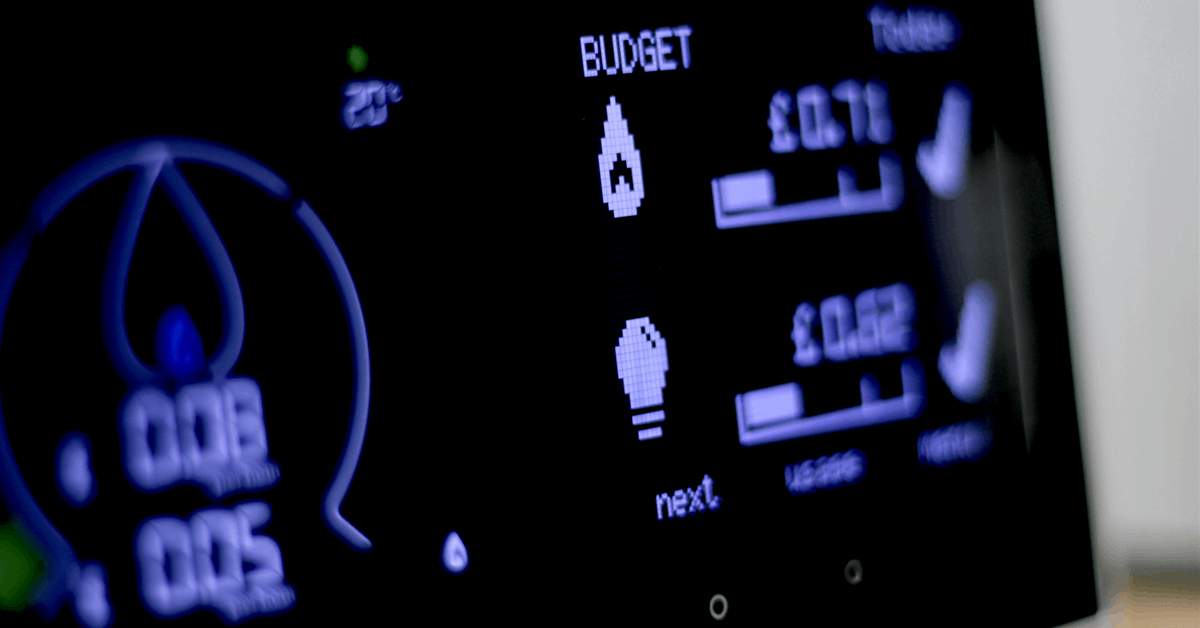

Iberdrola SA has inked a deal to divest SP Smart Meter Assets Ltd. (SPSMAL) to Macquarie Group Ltd. for about GBP 900 million ($1.2 billion).

SPSMAL manages 2.5 million meters in the United Kingdom. It would be taken over by Macquarie Specialized and Asset Finance, part of the Australian financial services provider’s Commodities and Global Markets business.

The parties expect to complete the transaction in the third quarter, subject to approval by the Competition and Markets Authority.

The acquisition would increase meters managed by Macquarie in the UK to over 13 million. Established 2003, its UK metering business currently manages 7.9 million smart meters and 2.5 million traditional meters across Great Britain, making Macquarie one of the biggest independent MAPs (meter asset providers) in the UK, according to Macquarie. “It has also provided over GBP 1.5 billion of funding to assist with Britain’s smart meter rollout”, Macquarie said in an online statement.

“Upon completion of the sale, Macquarie will enter a long-term meter rental agreement to provide Smart Meter Asset Provision (MAP) services to Scottish Power and support the business in the further roll-out of smart meters across Great Britain”, Macquarie said, referring to Iberdrola’s arm in the UK, Scottish Power Ltd.

“The replacement of traditional gas and electricity meters with smart meters represents an upgrade to energy infrastructure in the UK by providing consumers with near real-time information which they can use to manage their energy use and cut their bills”, Macquarie added. “Smart meters also support the transition to a low-carbon energy system by unlocking new approaches to managing demand”.

Iberdrola said separately, “The transaction is part of Iberdrola’s strategy of rotating non-strategic assets. In fact, in accordance with its Strategic Plan 2024/2026, Iberdrola already exceeds EUR 10,000 million in alliance and divestment operations. This transaction is the second largest divestment in Iberdrola’s history after the sale of the combined cycle plants in Mexico in 2024”.

“The alliance policy is Iberdrola’s strategy to accelerate its growth and promote the electrification of the economy while maintaining its financial strength”, added the press release on Iberdrola’s website.

In other news Iberdrola said ScottishPower has secured a GBP 600-million commitment from the National Wealth Fund (NWF) for grid upgrades. The commitment is part of a EUR 1.6-billion ($1.8 billion) financing package led by Bank of America as debt arranger.

“NWF’s financing will ensure the swift deployment of capital needed to deliver seven of ScottishPower’s priority transmission grid upgrade projects”, Iberdrola said in a separate statement Thursday. “These projects will help to facilitate more renewable energy onto the system, reduce congestion costs, lower the cost of electricity for businesses and consumers, and unlock growth across the UK”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR