Iberdrola SA has signed a long-term deal to supply Air Liquide with clean electricity for the French company’s operations in Spain and Portugal.

“It will allow Air Liquide to continue developing innovative and sustainable solutions for the supply of industrial gases and will enable its industrial and medical customers to meet their ambitions to reduce the carbon footprint associated with their final products”, Iberdrola, a Spanish power utility, said in a brief online statement. It did not disclose the duration or the financial details of the contract.

Air Liquide supplies gases to the industrial and healthcare sectors.

Iberdrola has long-term contracts to supply power in several countries including Australia, Brazil, Germany, Italy, Mexico, Poland, Portugal, Spain, the United Kingdom and the United States. The electricity comes from offshore and onshore wind projects, as well as solar projects, according to the company.

International firms that have committed to buying power from Iberdrola include ABInBev, Amazon, Apple, Bayer, Burger King, De Acero, Dillinger, Heineken, Holcim, Mercadona, Mercedes Benz, Meta, Renault, Salzgitter Group, Telefónica, TMD, Vodafone and VW-SEAT.

Under its current three-year strategic plan, Iberdrola eyes gross investments of EUR 41 billion ($44.7 billion) by 2026, focused on the electrification of economic sectors.

“The electrification of energy is unstoppable and will expand exponentially in the years ahead, supporting decarbonization, boosting energy security, and reducing the volatility caused by fossil fuels”, Iberdrola executive chair Ignacio Galán said March 21, 2024, in the company’s announcement of the 2024-26 plan.

“Our strategic pillars focus on networks, geographical diversification, and a balanced energy and customers mix.

“This plan will allow us to grow our asset base, grow our profitability and strengthen our finances, as well as increasing dividends and driving jobs and skills and economic growth”.

Iberdrola expects its renewables partners to contribute EUR 5 billion to the investment goal, resulting in a net investment of EUR 36 billion for Iberdrola.

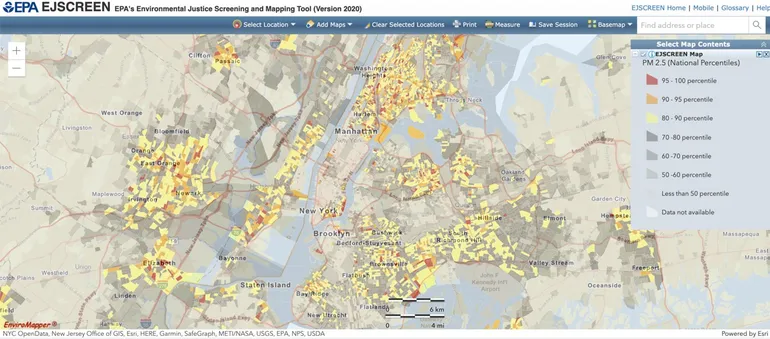

Eighty-five percent of the gross investment is allotted for Iberdrola’s A-rated markets. Of this allocation, 35 percent is for the U.S., 24 percent for the United Kingdom, 15 percent for Iberia, 15 percent for Latin America and 11 percent for Australia, France, Germany and others.

The three-year plan includes EUR 15.5 billion of gross “selective investment in renewables”, over half of which would go to the U.S., the UK, France and Germany.

Last Wednesday Iberdrola’s U.S. subsidiary, Avangrid Inc., announced plans to invest $20 billion in the country’s power grid infrastructure until the end of the decade. That would be spent on grid modernization and expansion and potentially new generation.

To contact the author, email [email protected]