Rising demand and new technologies are forcing utilities to coordinate distributed energy resources on an unprecedented scale, a trend likely to continue in 2026, analysts and stakeholders say.

But intimidating demand forecasts from power-hungry data centers, coupled with aggressive policy shifts away from renewables and efficiency standards, are turning power providers toward large-scale generation like nuclear, geothermal, gas and coal — possibly to the detriment of aggregation and demand response programs, they say.

“Utilities are shifting away from DER to focus on [utility-scale] wind and solar in the near term and then new natural gas, [extending the life of] aging coal, and [restarting] shuttered nuclear plants,” said Sally Jacquemin, vice president of power and utilities at AspenTech Digital Grid Management, Emerson.

Investment in distribution system modernization is also growing, but DER “is a lower priority,” she added.

But grid advocates and utility leaders say distributed resources could provide crucial benefits at a time of rising prices and accelerate the interconnection of large loads, which is a priority of the Trump administration.

In order to do that, virtual power plants must evolve and scale more rapidly or skyrocketing electricity demand and costs will force attention to traditional resources, industry sources say. The value of DER to the system will be determined by policies set by states, grid operators, federal regulators and officials in the Trump administration.

Allison Wannop, vice president of regulatory affairs and wholesale markets for Sparkfund, predicted that demand growth and affordability challenges will drive innovation to make the most of distribution system resources.

“20th century solutions will not build a 21st century grid,” she said.

‘Visibility will be key to VPP proliferation’

2025 was a good year for distributed energy resources and virtual power plants.

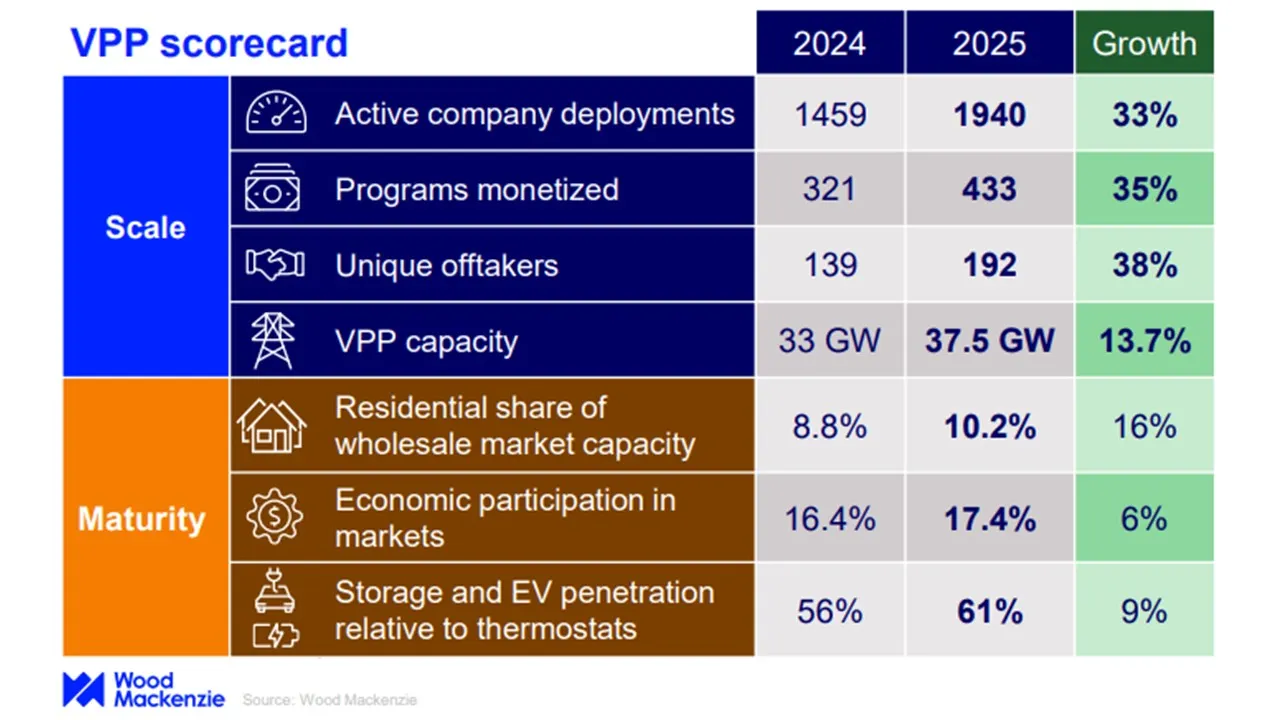

The numbers of active company deployments, unique offtakers for VPP capacity and monetized VPP programs all grew by at least one-third year over year, according to a September analysis by Wood Mackenzie.

But overall VPP capacity in North America grew only 13.7%, to 37.5 GW, a sign that the market is “broadening faster than it is deepening” due to persistent barriers to adoption, said Ben Hertz-Shargel, WoodMac’s Global Head of Grid Edge.

Many of these programs are still in pilot phase or otherwise limited in scope and effectiveness.

According to one recent analysis, VPPs are still a long way off from being considered an alternative to gas peaker plants.

The One Big Bueatiful Bill Act cut tax credits for residential rooftop solar.

Getty Images

The analysis from software provider EnergyHub proposed a Turing Test-inspired evaluation, called the “Huels Test” after one of the company’s data scientists, which compares a VPP’s performance against a peaker. On a scale of zero to four for “maturity” needed to pass the test by delivering “plant-like performance,” the most advanced VPPs only scored about a two.

2026 could be a decisive year for improving those scores.

Amid an unprecedented capital spending spree, utilities are poised to make foundational investments in distributed energy resource management systems, or DERMS, and data management systems to modernize their grids.

“Pressure on utilities to serve new loads will drive adoption of new system capabilities,” said Jen Downing, a former senior advisor in the Department of Energy and co-author of DOE’s VPP Lift-Off reports.

VPPs will not meet large baseload needs, but “for peak demand reductions of up to 20%, they are a proven cost-effective option,” she added. That could make them competitive against, for example, diesel generators deployed by hyperscalers to meet a daily two-hour peak, she said.

Of course, she noted that the total cost over time “is project-specific and depends on capital costs, fuel costs, the local grid and other variables.”

Prominent VPP technology providers expressed optimism about the sector’s outlook.

“Affordably meeting the new loads is the priority,” said Gisela Glandt, vice president of VPPs for grid edge software provider Uplight.

In 2026, utilities and their partners will develop “end-to-end distribution system management,” and “that visibility will be key to VPP proliferation,” she added.

Important federal policy shifts for distributed resources

At the federal level, regulatory, legislative and other policy decisions could have big impacts on VPPs and aggregated DER adoption.

The One Big Beautiful Bill Act signed by President Donald Trump on July 4 cut incentives for both utility-scale and residential solar systems, as well as tax credits aimed at weatherization, energy efficiency and appliance upgrades. The administration has also moved to weaken support for electric vehicles, roll back efficiency standards, ease pollution rules and cancel clean energy grants and loans.

Taken together, these actions could slow the pace of electrification and the proliferation of resources like solar panels, electric vehicles, batteries, heat pumps, smart appliances and thermostats that could be harnessed into virtual power plants.

“The macro trends for utilities in 2026 will be driven by the loss of tax incentives for renewables and customer-owned resources,” said AspenTech’s Jacquemin.

And with increasing costs for transmission and distribution infrastructure, “pricing to consumers is what is most on utility executives’ minds,” she added.

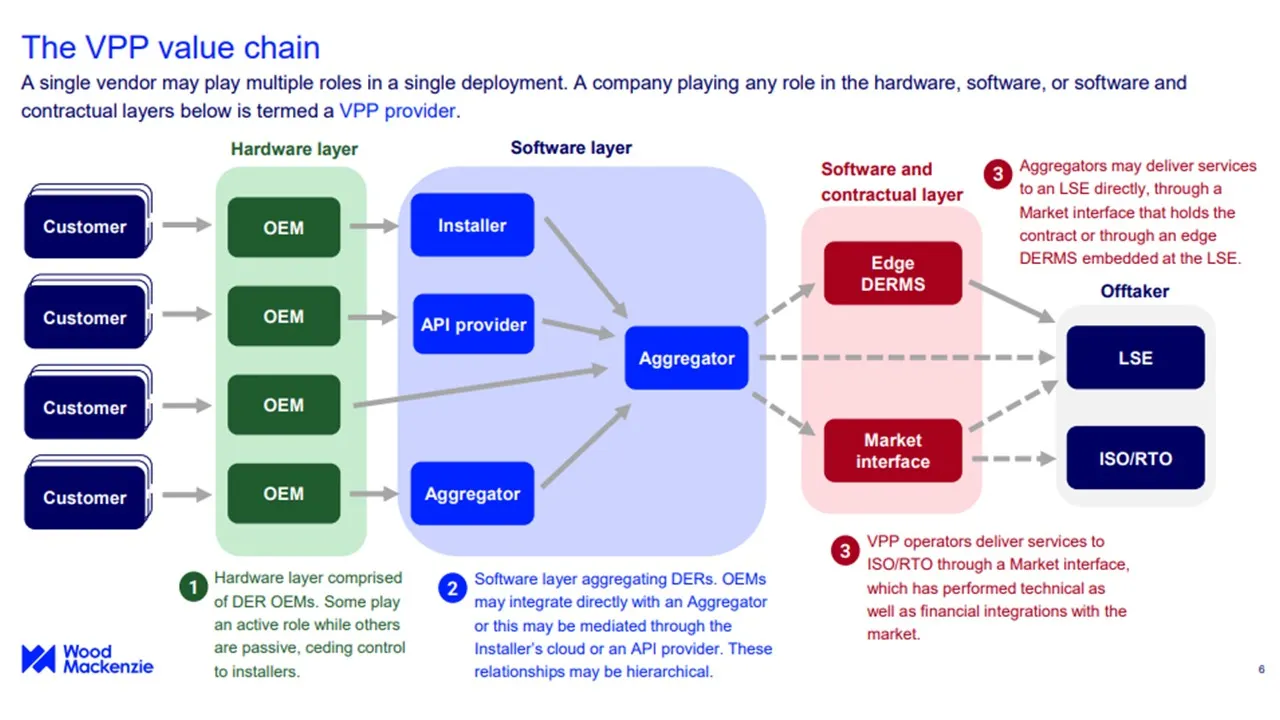

Optional Caption

Permission granted by WoodMac

At the same time, however, federal regulators – at the urging of the White House – are considering ways to accelerate the interconnection of data centers, which the administration considers critical to the economy and national security.

The Federal Energy Regulatory Commission has initiated a rulemaking process for connecting large loads after Energy Secretary Chris Wright called for it to take a more active role, including by prioritizing flexibility.

Any order resulting from that process is likely to include flexibility requirements, said Nancy Chafetz, vice president of regulatory and government affairs for DER aggregator CPower.

The question in 2026 will be whether VPP compensation for energy, capacity and ancillary services at the wholesale and retail levels will be adequate to incentivize participation, she said.

Emerald AI, one of the most advanced providers of software to manage data center load flexibility, is in the process of including distribution system resources, including aggregated customer-owned DER, into its platform, said Varun Sivaram, its CEO. That capability should be in place in 2026, he added.

FERC will also continue to review compliance filings for 2020’s Order 2222, which required system operators to include aggregated DER in their wholesale markets.

But Kay Aikin, CEO of software platform provider Dynamic Grid, said “the lack of coordination at the wholesale-local market overlap will lead to operational issues.”

MISO’s Joundi, CPower’s Chafetz, and the Wood Mackenzie report also said they expected little from Order 2222 compliance.

Market rules shape incentives

Some of 2026’s most influential policy will be determined by system and market operators.

In 2025, federally-regulated regional systems integrated more VPP capacity than investor-owned utilities, Wood Mackenzie reported. Markets facing the biggest proposed data center loads – the PJM Interconnection and the Electric Reliability Council of Texas – used VPPs the most, it added.

But an October announcement from PJM, the biggest U.S. system operator, could have less favorable impacts for DER than it might seem.

A SPAN Edge device attached to an electricity meter on the side of a house. The at-the-meter load control device is designed for utilities to better manage the distribution grid and was used in at least one VPP pilot last year.

Courtesy of Span

PJM increased the Effective Load Carrying Capability, or ELCC, value for demand side resources in its 2027-28 capacity auction from 69% to 92%. ELCC is used to evaluate reliability and seeks to quantify a resource’s availability to reduce demand spikes.

The higher valuation favors distributed demand-side resources by effectively assigning them a greater reliability score. But narrowed eligibility requirements shut out many residential and smaller commercial participants, Uplight’s Glandt said.

Existing PJM rules credit demand resources for reducing load more than they actually do, which means that their “actual performance has never been good,” said Joe Bowring, president of PJM independent market watchdog Monitoring Analytics.

And PJM’s proposed rule revisions will not improve their performance because they do not link compensation to availability, he said. The new rules “are equivalent to the status quo that has increased the costs to PJM customers by about $16.6 billion over the last two capacity auctions,” Monitoring Analytics reported in November.

The Midcontinent Independent System Operator, or MISO, capacity value methodology also significantly increased the value of flexible and demand resources in 2025, its 2025-26 Direct Loss of Load report showed.

Proposed MISO reforms would drive more flexibility in its load-modifying and demand response resources, said Zak Joundi, MISO’s head of market development. Under this system, new price signals will “support reliability by either reducing load or turning on distribution system generation,” he added.

Those reforms are still proposals that are expected to be reviewed for approval by MISO member states and FERC between 2026 and 2028, Zoundi said. And under the existing market incentives, use of demand resources could dip in 2026 if sudden demand peaks are less frequent, he added.

But, Zoundi stressed, “the business case for wholesale market resources that can come online faster and be more flexible will likely grow over time.”

Nicholas Papanastassiou, director of market development for software provider EnergyHub, agreed. But “targeted utility demand response programs” of aggregated DER “can more reliably shave demand peaks” and “deliver ratepayer savings without the complexities of wholesale market programs,” he added.

Use of DER has grown in the Texas Emergency Response Service program available through retail electric providers, Papanastassiou said. That shows the effectiveness of demand response for distribution system companies, he added.

Optional Caption

Permission granted by WoodMac

Already, the market for aggregation and flexibility services appears to be growing.

Piclo marketplace, which launched in Massachusetts last July, is a flexibility services market that allows utilities to connect with DER aggregators and bid for the flexible services offered. It has over 100 aggregators and asset owners to date and will continue to add market participants and move into more states in 2026, it reported.

States can move where federal government does not

While federal and regional market policies shake out, states could push for greater aggregation, policy advocates said. Public anger over rising power bills is already pushing some elected officials to take action.

On her first day in office Jan. 20, New Jersey Governor Mikie Sherrill declared an energy affordability crisis and issued executive orders that, among other things, directed state regulators to require utilities develop virtual power plant programs.

Her order came on the heels of Illinois Gov. JB Pritzker signing the Clean and Reliable Grid Act setting new storage targets and VPP requirements for that state.

A number of states are also weighing legislation to promote consumer access to small, plug-in “balcony” solar, heat pumps and other resources that could be aggregated. Others are proposing that large load data centers pay for customer-sited resources in return for the use of them during demand peaks.

“20th century solutions will not build a 21st century grid.”

Allison Wannop

Vice President of Regulatory Affairs and Wholesale Markets for Sparkfund

California, which advocates say boasts the largest virtual power plant in the country and possibly the world, has cut state funding for aggregation but continues to set new records for deployed capacity.

The growing role of states is the reason the Energy Policy Design Institute launched its VPP Convergence Project, a coalition of advocates attempting to standardize regulatory approaches to VPPs, said its Founder and Executive Director Ted Ko.

The variety of VPP business models, technologies, use cases and system services makes state regulators’ decision-making increasingly difficult, Ko said. The VPP Convergence Project, which is working with the National Association of Regulatory Utility Commissioners, intends to “bring clarity to those decisions,” he added.

Across the country, utilities, grid operators and other stakeholders are experimenting with different approaches to aggregated DER and VPPs, said Autumn Proudlove, managing director of policy and markets with the North Carolina Clean Energy Technology Center, or NCCETC.

She pointed to pilots from Dominion Virginia, Duke Energy, Pacific Power, Xcel Minnesota, DTE Michigan and Arizona Public Service as just a few examples. But Proudlove said many utilities still do not appreciate the full value of aggregated DER in long-term planning.

Programs for different resources are often very different, which has complicated the understanding of distribution system resources, Proudlove said. But there are a lot of ongoing regulatory proceedings, and “increasing interest in linking VPP programs to load growth,” she added.