Across the United States, states are rolling out a wave of new tax incentives aimed squarely at attracting data centers, one of the country’s fastest-growing industries. Once clustered in only a handful of industry-friendly regions, today’s data-center boom is rapidly spreading, pushed along by profound shifts in federal policy, surging demand for artificial intelligence, and the drive toward digital transformation across every sector of the economy.

Nowhere is this transformation more visible than in the intensifying state-by-state competition to land massive infrastructure investments, advanced technology jobs, and the alluring prospect of long-term economic growth. The past year alone has seen a record number of states introducing or expanding incentives for data centers, from tax credits to expedited permitting, reflecting a new era of proactive, tech-focused economic development policy.

Behind these moves, federal initiatives and funding packages underscore the essential role of digital infrastructure as a national priority, encouraging states to lower barriers for data center construction and operation. As states watch their neighbors reap direct investment and job creation benefits, a real “domino effect” emerges: one state’s success becomes another’s blueprint, heightening the pressure and urgency to compete. Yet, this wave of incentives also exposes deeper questions about the local impact, community costs, and the evolving relationship between public policy and the tech industry.

From federal levels to town halls, there are notable shifts in both opportunities and challenges shaping the landscape of digital infrastructure advancement.

Industry Drivers: the Federal Push and Growth of AI

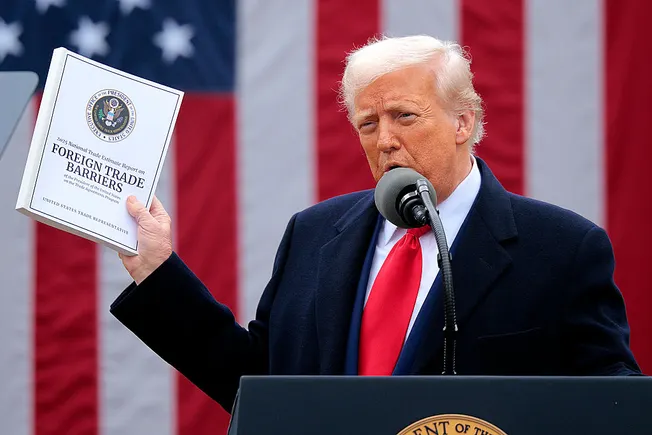

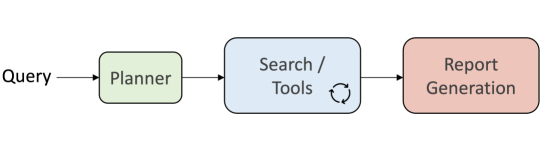

The past year has witnessed a profound federal policy shift aimed squarely at accelerating U.S. digital infrastructure, especially for data centers in direct response both to the explosive growth of artificial intelligence and to intensifying international competition. In July 2025, the administration unveiled “America’s AI Action Plan,” accompanied by multiple executive orders that collectively redefined the federal role in fostering data centers, semiconductor manufacturing, and the power grid that supports them.

A key turning point was President Trump’s July 23, 2025 Executive Order on “Accelerating Federal Permitting of Data Center Infrastructure,” which streamlines the approval process for large-scale data center projects, unlocks financial support (including grants, loans, and tax incentives), and makes federal land available for development. The order also eliminates many previous regulatory hurdles, empowering agencies like Commerce, Energy, and Defense to identify, prioritize, and expedite qualifying data center projects across the country. The new policies explicitly revoke Biden-era climate and DEI requirements for federally sited data centers, signaling a faster, industry-friendly buildout ethos.

These executive actions are part of a larger plan to establish the federal government’s comprehensive blueprint to maintain global technology leadership. Besides permitting reforms, the plan calls for investing in the electric grid, supporting semiconductor fabs, and ensuring national security by restricting adversarial tech in U.S. supply chains. The plan has catalyzed state-level action, as it sends a clear signal to the private sector and state governments that data center development is now a federal priority.

Proliferation of State Tax Incentives

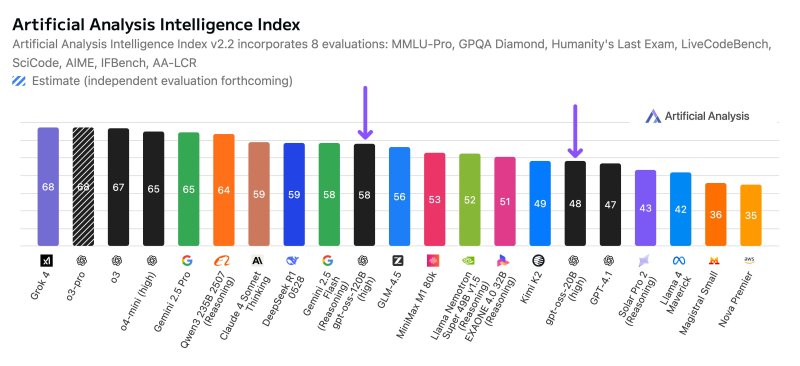

A dramatic proliferation of state tax incentives for data centers has swept across the U.S. in the past year, as states compete aggressively to attract investments from hyperscale and AI-driven operators. The landscape now includes an expanding variety of incentives: property tax abatements, long-term sales and use tax exemptions, and cash grants—often designed not only for data center owners but also for their tenants, in order to maximize site utilization and economic impact.

Currently, at least 42 states either offer sales tax exemptions for data centers or have no sales tax at all, with 37 states enacting legislation specifically targeting data centers in recent years. New and expanded programs have moved quickly: Michigan extended its sales and use tax exemption through 2050 (and to 2065 for brownfield sites), requiring major investments and job creation, while Kansas joined the race with a new 20-year sales tax exemption for projects investing $250 million or more and committing to create at least 20 jobs within five years. These moves reflect a notable cascade effect, as once-reluctant or late-adopting states are now rapidly enacting or updating incentives to compete with established leaders.

The competitive pressure is escalating incentive packages: Texas and Virginia led in total benefits, forgoing over $700 million each in exemptions in a single recent year, while Illinois, Georgia, and others have reported hundreds of millions in annual tax expenditures to lure data centers. In many states, exemptions cover not only construction and IT equipment but also electricity, cooling infrastructure, and sometimes even include dedicated benefits for individual tenants and operational partners.

A remarkable recent trend is the inclusion of expedited permitting and regulatory streamlining as part of incentive packages. The July 2025 federal executive order directed agencies to accelerate permitting for qualifying data centers, and states have responded by forming dedicated “action teams” or legislative task forces to synchronize state, local, and county approvals, ensuring that economic impact is realized without bureaucratic delays. This layering of incentives, streamlined approvals, and legislative collaboration illustrates the high strategic value many policymakers now place on winning new data center investments, especially as AI and digital infrastructure become central to state economic priorities.

While individual state strategies vary, and a handful of leading states such as Texas, Virginia, Michigan, and Kansas stand out for the size and duration of their programs, the general trend is unmistakable: U.S. states are engaged in an unprecedented race to the top, crafting ever-more robust incentive environments to capture the next wave of data center development.

Benefits and Challenges to Incentives

The incentives offered by states for data centers generate significant economic benefits, including direct investment, job creation, and broader community growth. Data centers contribute not only through construction and operations jobs, but also by supporting ancillary industries such as local utilities, maintenance services, and vendors.

According to recent reports, the average data center generates approximately $32.5 million annually in local economic activity, supports around 157 local jobs, and adds nearly $7.8 million in annual wages to local economies. The U.S. data center industry overall has grown to support about 4.7 million jobs nationwide and adds over $700 billion in tax contributions across federal, state, and local governments, with direct employment increasing over 50% in recent years.

The improvement of the power grid and broadband infrastructure is another crucial benefit. Many states use data center incentives as a catalyst to accelerate modernization of electric grids to meet the high energy demands of hyperscale and AI-driven facilities, as well as to expand broadband capacity for enhanced connectivity.

Policymakers argue that such incentives are critical for states to remain competitive nationally and globally, especially as hyperscale cloud providers and AI companies choose locations based on cost efficiencies driven by incentives and infrastructure availability. States like Michigan and Kansas have launched long-term, multi-decade incentive programs to attract these high-investment projects, creating economic development and technological leadership opportunities.

Opponents of incentives often cite the loss of local tax revenue and cost to taxpayers as primary objections. They argue that large abatements reduce funding for public services and question the proportion of permanent jobs created relative to public subsidies. However, this perspective can be short-sighted. When viewed holistically, data center investments stimulate indirect economic activity and job creation well beyond the facility site, powering new business growth, tax revenue from supporting services, and infrastructure improvements.

Financial analyses show that 90% of data center investments would likely not occur without tax incentives, indicating that these subsidies are essential to attract projects that might otherwise bypass a state entirely. Additionally, enhanced grid and broadband investment tied to these projects often benefit broader communities beyond the immediate data center area.

Thus, while concerns about lost tax revenue are valid in the short term, the long-term economic, infrastructural, and strategic benefits frequently outweigh these costs, making incentives a justified and necessary tool to foster digital economy growth and maintain competitive advantage.

The Domino Effect: State Competition and Best Practices

States that first embraced generous incentive packages, such as Virginia, Texas, and Arizona, set in motion a wave of policy revisions and expansions across the country. Their early successes in landing major infrastructure projects and economic windfalls have become models for others, triggering a cascade of new legislation and escalating competition. As states observe the rapid job creation, direct investment, and amplified tax bases achieved by these leaders, many have moved swiftly to match or exceed the incentives on offer.

This competitive atmosphere has led to a continual evolution of best practices, with states tailoring programs to attract both data center operators and their clients, refining eligibility requirements, and integrating streamlined permitting to secure their place in the exploding digital economy. The result is an environment where state-level innovation, propelled by high-profile wins, is not only accepted but actively emulated, fueling the next stage of U.S. data center growth.

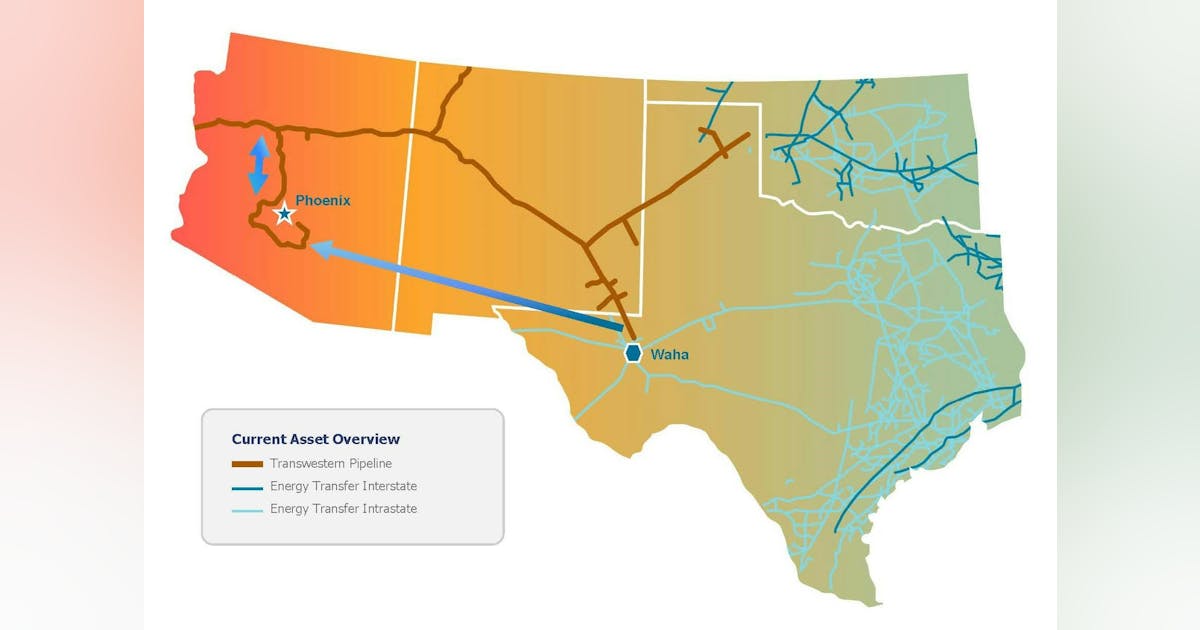

As data centers expand into new markets, certain states have taken the spotlight for power, connectivity, land costs, or other factors, but once word begins to spread and the state gets a reputation for being an emerging market, different states have had vastly different responses to finding themselves a hotbed of data center activity.

Georgia’s response when they found themselves in the limelight was to consider stripping incentives. The market got very heated in 2024 when their bill to suspend incentives passed both houses and was only vetoed at the last moment by Governor Kemp. On the flip side, Pennsylvania has found themselves the new focus of data center investment with abundant natural gas and energy resources and fiber connectivity.

The state not only has sustained tax incentives, but has announced such complete support for the industry that Governor Shapiro has rolled incentives to educational institutions that build a curriculum to feed the talent pipeline. New Mexico offers other tangential incentives such as to Biodiesel Blending Facilities, easing the path toward converting diesel to HVO for backup power fuel.

Some states have intentionally trimmed incentive plans to steer funds to develop larger scale facilities or to block out the larger facilities, an interesting study in and of itself. Florida this year eliminated exemptions for data centers under 100 MW of IT load, intentionally redirecting benefits towards larger-scale data centers to keep Florida competitive for AI and HPC workloads. This year, Kentucky similarly expanded incentives to attract the largest data center operators. As opposed to the NIMBYism we’ve seen reported so much over the years, who could have foreseen this show of support for the largest data center campuses?

Then there are states who are eliminating incentives. Ohio is right in the heat of budget reviews, expected to remove sales and use tax exemptions this year. Oklahoma technically cites a property tax exemption, but recently decided that the property tax exemptions had created a growing financial burden for the state, so while the exemption is still available, the funding mechanism from the state has changed.

Sustainability and Energy Usage as Incentive Conditions

As the data center industry continues its rapid expansion, sustainability, energy usage, and environmental concerns are increasingly integrated as conditions for tax incentive eligibility across U.S. states. This shift reflects growing recognition that the long-term viability of data center growth depends not only on economic impact but also on minimizing environmental footprints and aligning with localized climate goals.

Many states that once focused primarily on investment and job creation thresholds are now adding requirements for high energy efficiency, renewable energy integration, and environmental transparency. Some states like Arizona are enacting policies to require energy audits and certification, efficiency/performance benchmarks, and investments in on-site renewables as prerequisites for tax breaks. States such as Michigan and Illinois mandate data centers to source a significant percentage of their power from clean energy or certify green building standards to remain eligible for incentives.

This growing emphasis is driven by pressure from policymakers, advocacy groups, and community stakeholders concerned about the strain data centers place on power grids and natural resources, especially water. With states beginning to incorporate sustainability metrics into incentive qualification, balancing economic development with environmental stewardship will be critical.

Shifts in Incentive Design: Community Benefits, Equity Measures, and Renewable Energy

Beyond energy usage standards, incentive programs are evolving to reflect broader social and environmental criteria:

- Community Benefits Agreements: Some states increasingly insist on negotiated agreements ensuring that data center developments provide tangible benefits to local communities, including workforce development, improved infrastructure, and environmental safeguards.

- Renewable Energy Requirements: Tax incentives may be contingent on commitments to renewable power procurement, installation of clean microgrids, or investment in grid modernization projects that help reduce carbon emissions associated with data center operations.

- Equity Measures: Reflecting wider social equity goals, some jurisdictions link incentives to targeted hiring practices, local vendor engagement, or investment in disadvantaged areas, seeking to ensure that the economic gains of large data centers extend beyond corporate stakeholders.

These changes respond both to the increasing scrutiny over how public subsidies are delivered and to aligning data center growth with state climate and social priorities.

Federal-State Coordination and Emerging Tensions

While the federal government, notably through the 2025 Executive Order accelerating data center permitting and infrastructure investment, pushes for rapid deployment, some tensions between federal priorities and state/local sustainability concerns have surfaced.

Federal initiatives have rolled back certain climate and labor mandates to shorten timelines, whereas many states and communities demand stronger environmental conditions in exchange for their incentives. This dynamic is creating an evolving policy interplay where:

- States may develop more stringent environmental or community-focused criteria than federal guidelines.

- Coordination is needed to integrate federal permitting acceleration with state and local resource management.

- Future legislation may attempt to reconcile these potentially conflicting interests through clearer frameworks that balance speed, sustainability, and social impact.

Overall, the emerging landscape sees data center incentives shaped not only by economic competition but increasingly by environmental responsibility and community accountability. The most forward-looking states are leveraging this moment to craft programs that attract growth while ensuring the industry contributes to sustainable and equitable development.