Indian energy importers are switching from pricey liquefied natural gas to cheaper oil products, a move that will help ease tight global supplies of the super-chilled fuel.

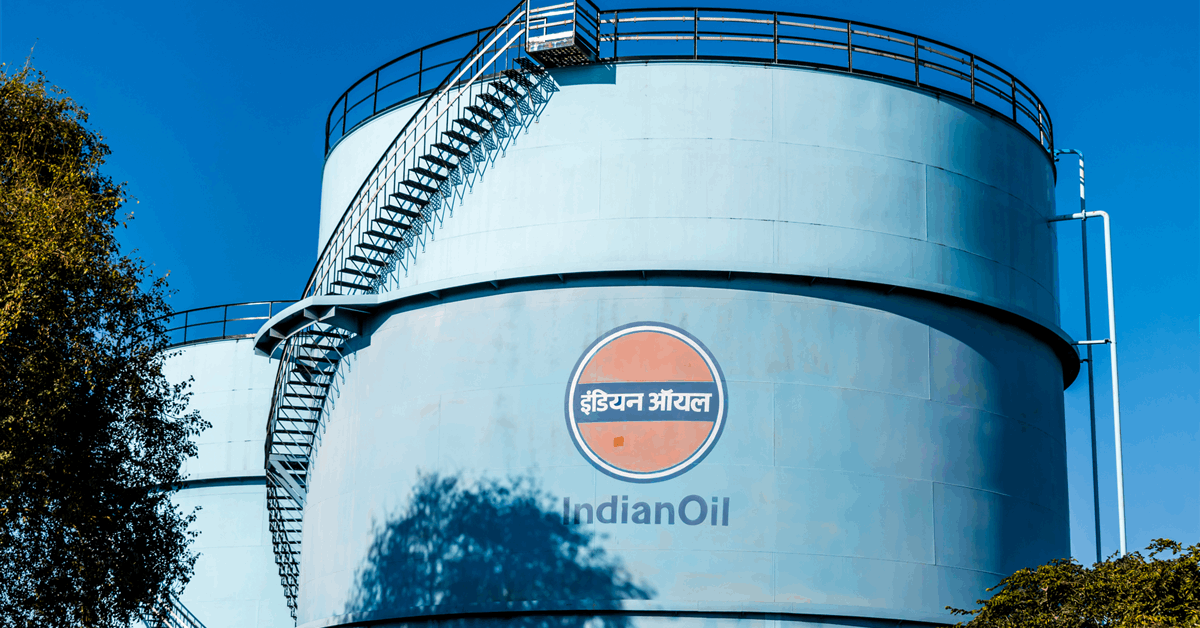

Buyers including Gail India Ltd. and Indian Oil Corp. canceled LNG purchase tenders due to high prices, according to people with knowledge of the matter who didn’t wish to be named due to the sensitivity of the trade. India’s LNG imports this month are estimated to average 1.9 million tons, down 5 percent from the same month last year and the lowest monthly volume since December 2023, according to data analytics firm Kpler.

Prices of LNG have been elevated due to a series of recent outages at export plants in Malaysia to Australia. That’s in spite of fears that the global trade war will cut gas demand. Any reduction in Indian purchases will help to free up supply for rival buyers in Asia and Europe.

Spot prices have been trading between $11 to $12 per million British thermal units over the last few weeks, while naphtha rates in India are closer to $8 to $9 per million Btu thanks to a slump in crude.

That’s pushing refiners, which account for 12 percent of India’s LNG consumption, to switch to naphtha, which is currently readily available due to shutdowns at petrochemical plants like Haldia Petrochemicals and Gail’s Uttar Pradesh facility, the people said.

Industries such as ceramic tile-makers have also shifted to cheaper propane, while local, less expensive gas is available on the market due to a shutdown at Reliance Industries Ltd.’s Jamnagar refinery and maintenance at some fertilizer plants, they said.

Still, India’s LNG demand could suddenly recover if hotter summer weather from next month prompts the government to mandate higher gas-fired power generation, the people added. Much of India’s gas power capacity is currently offline due to high LNG prices.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg