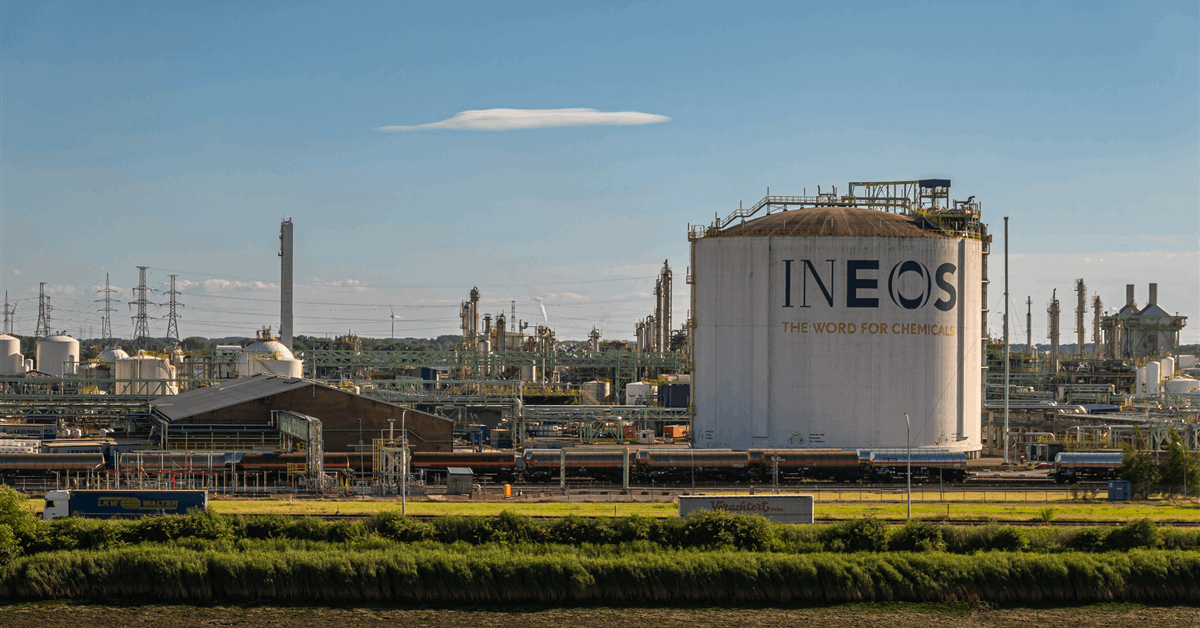

The INEOS Group has completed its purchase of China National Offshore Oil Corp.’s (CNOOC) stakes on the United States side of the Gulf of Mexico.

The acquisition consisted of non-operating stakes in deepwater early-production projects Appomattox and Stampede, as well as “several mature assets and supporting business”, according to INEOS. CNOOC held a 25 percent stake in Stampede, operated by Hess Corp., and 21 percent in Appomattox, operated by INEOS’ fellow British company Shell PLC.

The new assets raise the global production of INEOS’ energy arm to over 90,000 barrels of oil equivalent a day (boed), according to diversified company INEOS.

“The USA is a very attractive place for INEOS Energy to invest”, INEOS Energy chief executive David Bucknall said in a statement. “This is our third deal in three years following the 1.4 mtpa LNG deal with Sempra and the acquisition of Chesapeake Energy’s oil and gas assets in South Texas.

“Total capital spend on energy assets in the USA now exceeds $3 billion, providing a strong platform for future growth”.

INEOS Energy chair Brian Gilvary commented, “This is a major step for us into the deepwater US Gulf, which builds on our growing energy business”.

“INEOS Energy is all about competing in the energy transition to provide reliable, affordable energy to meet world demand as the population continues to grow – and progressing carbon storage projects”, Gilvary added.

For CNOOC, the divestments will help it “optimize” its global portfolio, CNOOC International Ltd. chair Liu Yongjie said in a statement December 14, 2024, announcing the transaction agreement.

Early last year Shell put into production a subsea tie-back to the Appomattox floating production hub, adding an estimated peak production of 16,000 boed.

Located in the Mississippi Canyon, the Rydberg project has estimated proven and probable reserves of 38 million boe, according to Shell.

“Rydberg will further boost production in the Norphlet Corridor at Appomattox, which is consistently one of our highest producing assets”, Rich Howe, deepwater executive vice president at Shell, said in a statement February 22, 2024.

Appomattox started up 2019, becoming the first commercial discovery brought into production in the deepwater Norphlet formation, according to Shell. It sits about 80 miles southeast of Louisiana’s Gulf Coast in around 7,400 feet of water, according to Shell.

In 2023 Appomattox contributed 19,000 boe to CNOOC’s net production, according to information on CNOOC’s website.

Stampede started production 2018. It has an average water depth of 3,500 feet, according to CNOOC.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR