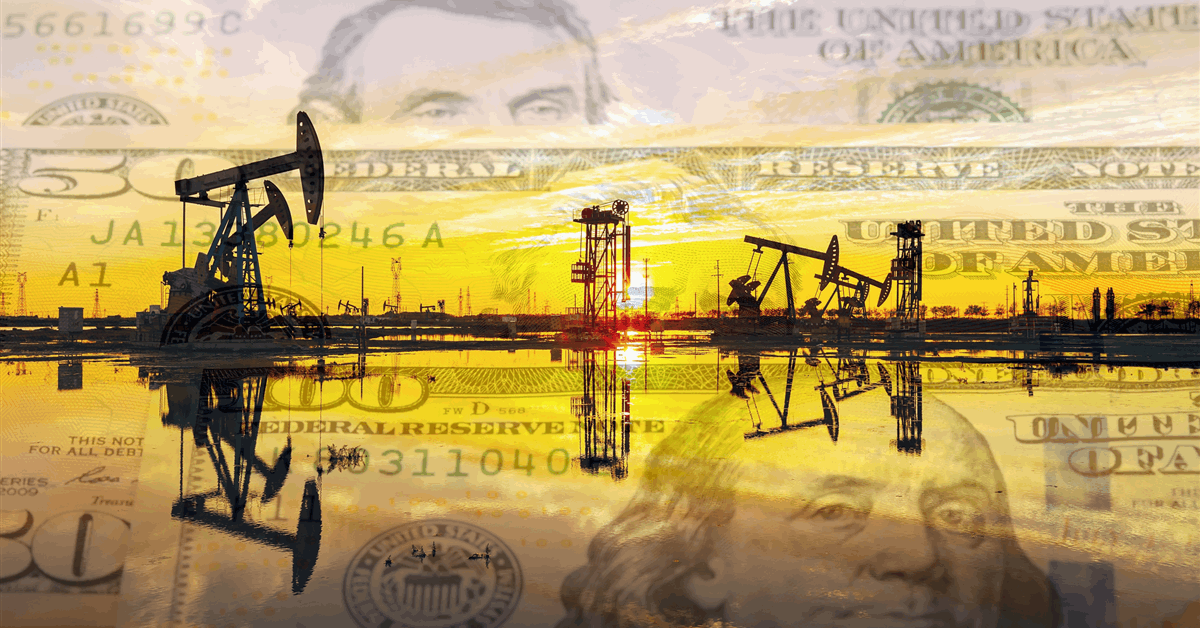

In a statement sent to Rigzone on Friday by the Independent Petroleum Association of America (IPAA), the organization’s president and CEO, Edith Naegele, highlighted that America’s independent producers are experiencing “a challenging price environment”.

“America’s independent oil and natural gas producers ushered in the shale revolution and have a proven record of delivering energy securely and competitively,” Naegele said in the statement.

“America’s independent producers are committed to producing the energy that powers American lives and competitiveness. IPAA’s member companies support American energy dominance and are the backbone of communities throughout the producing states, providing jobs and economic security in regions across the country,” Naegele added.

“This is a challenging price environment for America’s independent producers. America’s independents are known for taking risks, and no matter the basin they desire stability as they make capital allocation decisions,” the IPAA President continued.

“As global markets continue to develop and change, and as production opportunities present themselves around the world, IPAA’s member companies will continue to evaluate all prospects to produce oil and natural gas safely and securely,” Naegele went on to state.

Rigzone has contacted the U.S. Department of Energy (DOE) for comment on the IPAA statement. At the time of writing, the DOE has not responded to Rigzone.

In a J.P. Morgan research note sent to Rigzone by the JPM Commodities Research team on Friday, J.P. Morgan highlighted that the WTI crude price averaged $59 per barrel in the fourth quarter of last year and $65 per barrel overall in 2025. The company showed that the Brent crude price averaged $63 per barrel in the fourth quarter of last year and $68 per barrel overall in 2025.

J.P. Morgan projected in the report that the WTI crude price will average $56 per barrel in the first quarter of 2026 and $54 per barrel overall this year. The company forecast in the report that the Brent crude price will come in at $60 per barrel in the first quarter of 2026 and $58 per barrel overall in the year.

The U.S. Energy Information Administration’s (EIA) latest short term energy outlook at the time of writing, which was released on December 9, saw the fourth quarter 2025 WTI spot price averaging $59.31 per barrel, the overall 2025 WTI spot price averaging $65.32 per barrel, the fourth quarter 2025 Brent spot price averaging $63.10 per barrel, and the overall 2025 Brent spot price averaging $68.91 per barrel.

In that STEO, the EIA projected that the WTI spot price would average $50.93 per barrel in the first quarter of 2026 and $51.42 per barrel overall in 2026. The EIA also forecast in that STEO that the Brent spot price would come in at $54.93 per barrel in the first quarter of 2026 and $55.08 per barrel overall this year.

The EIA’s next STEO is scheduled to be released later on Tuesday.

In a commodities note sent to Rigzone by the Saxo Bank team on Friday, Ole S. Hansen, the head of commodity strategy at Saxo Bank A/S, highlighted that, “technically, resistance sits just below $59 in WTI and $63 in Brent, with a clear break above these levels potentially triggering momentum- and short‑covering‑led extensions”.

The IPAA describes itself in its statement as a national upstream trade association representing thousands of independent oil and natural gas producers and service companies across the United States.

“Independent producers operate 95 percent of the nation’s oil and natural gas wells and are responsible for 85 percent of U.S. oil production and 90 percent of natural gas production onshore,” the IPAA said in the statement.

On its website, the IPAA highlights that it “serves as an informed voice for the exploration and production segment of the industry and advocates its members’ views before the United States Congress, The White House, and federal agencies”.

To contact the author, email [email protected]