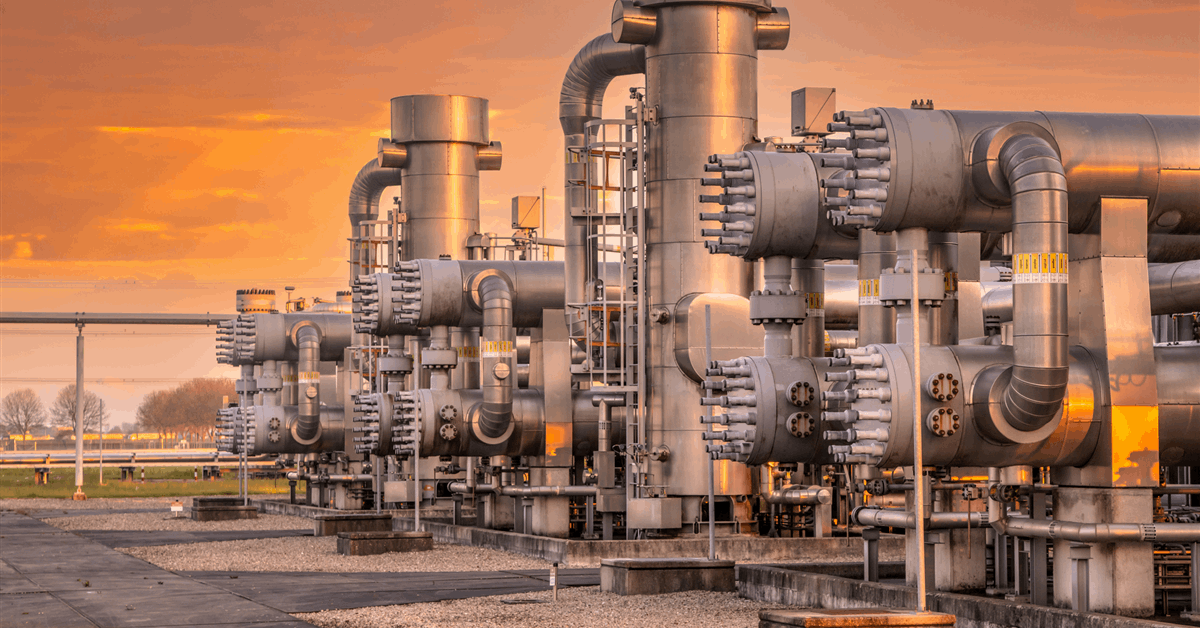

Global engineering specialist KBR Inc. has booked a contract to support a sustainable production of energy resources in Saudi Arabia. KBR said in a media release it will contribute to the delivery of Aramco’s Master Expansion Program and increase gas handling capacity at key regional locations.

The agreement will see KBR assist efforts to increase and maintain the maximum sustainable capacity across the Shaybah field’s four Gas-Oil Separation Plants (GOSPs) through 2028. It said it will also support the operation of power plant and well injection facilities.

The project prioritizes sustainability by integrating carbon-free energy alternatives, carbon capture, and gas reinjection to reduce emissions, optimizing existing equipment and GOSP plot space, and evaluating a greenfield facility to enhance resource efficiency while supporting Saudi Aramco’s 2060 net-zero goals, KBR said.

“We are pleased to continue partnering with Saudi Aramco and help shape a greener future for generations to come”, Jay Ibrahim, President of KBR Sustainable Technology Solutions, said.

Earlier KBR secured from BP International Ltd. an engineering, procurement, and construction management (EPCM) services agreement.

The BP deal includes the delivery of EPCM services for onshore, offshore, greenfield, and brownfield conventional energy projects and new energy sector projects worldwide for three years. The agreement includes a two-year extension option. KBR said it already provides BP with licensed technology solutions.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR